LBS Unveils Ambitious 8 x 8 Strategy for 2025 – 2027 in Property Development

LBS Group has revealed its bold 8 x 8 Strategy during its Town Hall Meeting 2025. The strategy aims to elevate LBS’s position as a market leader, moving the company towards new heights of achievement and industry innovation. With a total gross development value (GDV) of approximately RM8 billion set to be rolled out across […]

Welcoming 2025: A Bright New Chapter with LBS

Hello, 2025! As we step into a fresh new year, we at LBS Bina Group can’t help but reflect on how incredible 2024 was. Winning the title of Malaysia’s Best Managed Companies for the third consecutive year was a proud moment, and it inspires us to aim even higher. Among our greatest achievements, we are […]

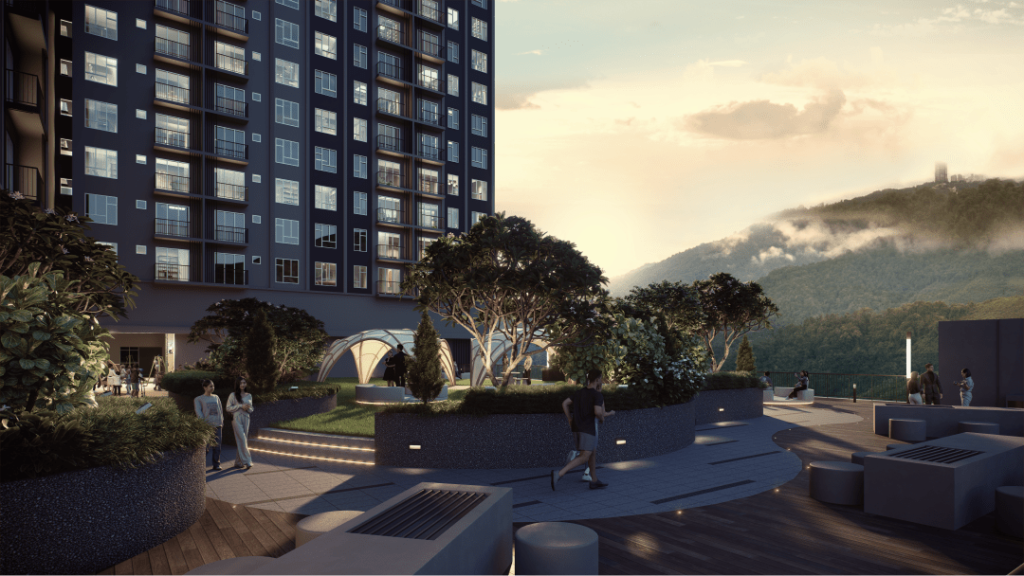

Investing In Bayu Hills For Long-Term Gains

Located in the serene, eco-conscious town of Rimbawan at Genting Highlands, Bayu Hills is a high-rise residential development by LBS that presents an investment opportunity. Here are several reasons why purchasing a property in Bayu Hills is a smart investment for both rental opportunities and future capital appreciation. 1. Cool, Fresh Weather Year-Round Rimbawan is […]

Embrace Sustainable Living: Join the Green Revolution at SkyRia @ D’Island Residence

In an exciting move towards a greener future, LBS Bina Group has teamed up with RHB Banking Group to launch innovative green financing solutions for the remarkable SkyRia @ D’Island Residence in Puchong. This strategic collaboration isn’t just about homes; it’s about creating a vibrant, eco-friendly community where sustainable living becomes a reality. SkyRia has […]

Perks And Plusses Turns One Celebrating a Year Of Exclusive Rewards and Epic Giveaways!

On 27th August 2024, we proudly celebrate the exciting first anniversary of Perks & Plusses, LBS Bina Group Berhad’s groundbreaking loyalty program! In just one year, Perks & Plusses has revolutionized the way our homeowners experience exclusive rewards and benefits, quickly becoming a favorite among LBS homebuyers. To celebrate this exciting milestone, we’ve lined up […]

Essential Considerations for Buying Your Dream Home in 2025

Are you a Gen Z born between 1997 and 2012, constantly on the lookout for your dream home in the upcoming year? As we all know, buying a house is a significant financial and personal decision. Here are several key factors to consider if you are planning to buy a house in 2025. Financial Readiness […]

Key Factors to Consider When Deciding on a House Renovation

A typical scene in one of P. Ramlee’s famous movies shows how a family always tries to compete with their neighbors when they see them getting a new sofa or starting to renovate their house. In reality, the urge to purchase new furniture or decide to renovate the house is heavily influenced by lifestyle and […]

Decoding Property Jargon: Why First-Time Homebuyers in Malaysia Need to Speak the Language

In communication, the terms “encoding” and “decoding” carry vital meaning. Encoding refers to the process of translating thoughts and ideas into a language or code that others can understand, while decoding involves interpreting that language or code to derive meaning. This fundamental concept applies not only to verbal communication but also to various aspects of […]

A Brief Overview Of The Advantages And Challenges Of Utilizing EPF Account 3 For Prospective Homebuyers In Malaysia

The recent government initiative to allow Employees Provident Fund (EPF) holders to have additional accounts has mixed reactions within the property community in Malaysia. While the intention is to alleviate the burden on some needy households, questions have been raised about whether this is a tactical effort and whether it is suitable only for the […]

Stamp duty and legal fees calculation for SPA when buying a house in Malaysia

Despite what many people think, the cost involved when buying a house is not limited to the 10% down payment. Find out the 7 other costs homebuyers need to consider when owning a house including stamp duty fees, legal fees for the SPA and loan agreement as well as property valuation fees. Hunting for a […]