When you purchase your first home, there are additional costs to consider on top of the property price. These extra costs often sneak up on home buyers, causing much stress and financial strain.

One of these additional costs includes stamp duty charges. These charges can rack up to tens of thousands of Ringgit, so it’s important to be aware and financially prepared for them.

Although this sounds daunting, we have good news for you first-time home buyers – you can enjoy stamp duty exemptions as part of the Malaysian Home Ownership Initiative!

What are Stamp Duty Exemption Acts and How Do They Affects Homebuyers?

Stamp duty is a fee charged on legal documents such as instruments of transfer and loan agreements.

For instruments of transfer, stamp duty is charged in tiers:

| Property price | Stamp duty (% of property price) |

|---|---|

| First RM 100,000 | 1% |

| From RM 100,001 – RM 500,000 | 2% |

| From RM 500,001 – RM 1,000,000 | 3% |

| Above RM 1,000,000 onwards | 4% |

For example, for a property with a price of RM 450,000, the stamp duty for the instrument of transfer would be calculated as follows:

1% of the first RM 100,000 = RM 1,000

2% of the next RM 350,000 = RM 7,000

Total stamp duty = RM 8,000

For loan agreements, on the other hand, the stamp duty charged is 0.5% of the loan amount. Let’s go back to the earlier example. Typically, you would pay a down payment of 10% and take a loan for about 90% of the property price.

Hence, for a property valued at RM450,000, you would normally apply for a 90% loan of RM 405,000. For a loan of this amount, the stamp duty charged on the loan agreement would be: 0.5% x RM 405,000 = RM 2,025.

In this example, the total stamp duty would add up to be: RM 8,000 + RM 2,025 = RM 10,025.

However, first-time home buyers can enjoy a 100% stamp duty exemption for property purchases up to RM 500,00 and a 75% exemption for property purchases between RM 500,001 and RM 1 million.

Stamp Duty Exemption on Housing Loans

In Malaysia, the provision of stamp duty exemptions on housing loan agreements serves as a significant financial relief for homebuyers. This exemption offers a valuable opportunity for individuals, especially first-time home buyers, to maximize savings. The funds saved through this exemption can subsequently be allocated towards enhancing the living space, whether through renovations or furnishing, thereby turning your dream home into a reality.

By taking advantage of this government-provided benefit, first-time home buyers not only ease their immediate financial obligations but also gain the means to enhance and personalize their new abode.

Who’s Eligible? Decoding the Stamp Duty Exemption Criteria in Malaysia

Malaysian citizens who have never owned any residential properties are eligible for the stamp duty exemptions. If you fit the bill, you can enjoy stamp duty exemptions, provided that:

- You purchase a residential property from a property developer,

- The sales and purchase agreement (SPA) is executed between 1 June 2022 and 31 December 2023, and

- The property purchased is under RM1 million for a 75% exemption and under RM500,000 for a 100% exemption.

This scheme offers a 100% stamp duty exemption on the instrument of transfer and loan agreement for your first home until the end of 2025, with a 75% stamp duty exemption applicable until 31st December 2023 for properties under RM1 million.

Stamp Duty Exemptions and Saving for Your First Home with LBS’ Projects

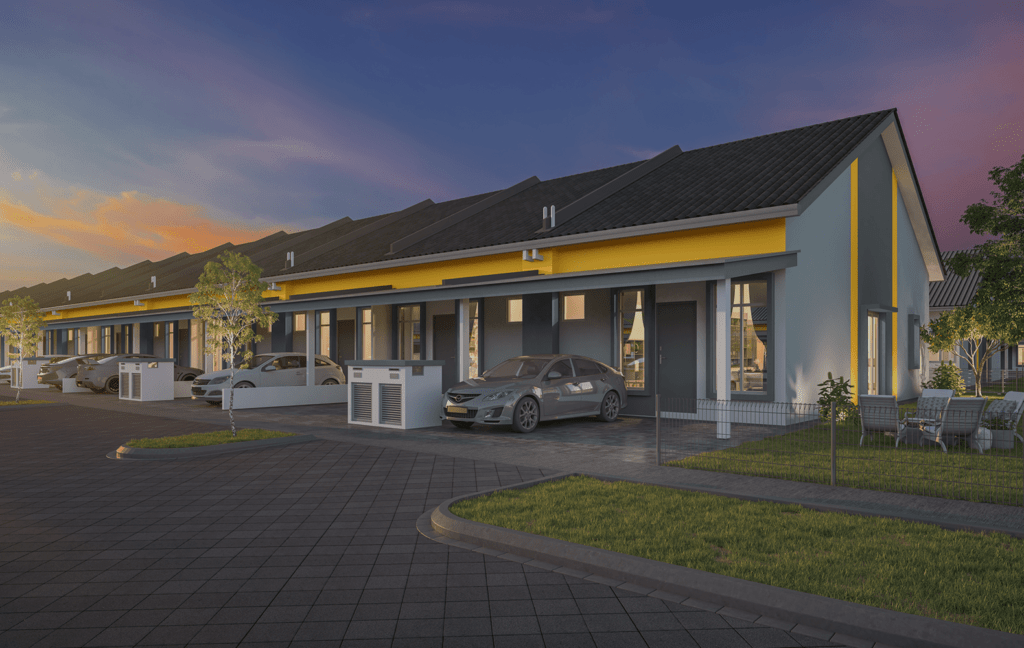

LBS Bina offers a wide range of residential properties for first-time home buyers who are excited to take advantage of these stamp duty exemptions.

For example, Kita @ Cybersouth by LBS Bina is a beautiful gated and guarded township with a variety of property options to choose from. Stand to enjoy 100% stamp duty exemptions with this affordable yet strategically located housing development in the up-and-coming southern corridor of Greater Klang Valley.

Begin Your Journey to Home Ownership with Stamp Duty Exemptions

Purchasing a property can be a costly affair, so being aware of any cost exemptions that you are eligible for is incredibly important. Take advantage of this amazing initiative and buy your first home at a cheaper price! Check out LBS Bina’s website to find your dream home today.