Experience the Luxury of Emas Bling-Bling for Your Raya Celebration with LBS!

As the joyous season of Hari Raya Aidilfitri approaches, LBS BINA GROUP BERHAD welcomes you to indulge in luxury and festivities with our exclusive “Emas Bling-Bling Raya Bersama LBS” campaign. With the purchase of your dream home, seize the opportunity to claim a gold bar valued at RM600,000* (*terms and conditions apply), and step into a world of opulence and abundance.

This year, we have crafted a celebration that promises not only the warmth of tradition but also the sparkle of modernity.

Bling-Bling Raya 2024 Bersama LBS!

The Eligible Landed & High-Rise Properties For This Raya Campaign

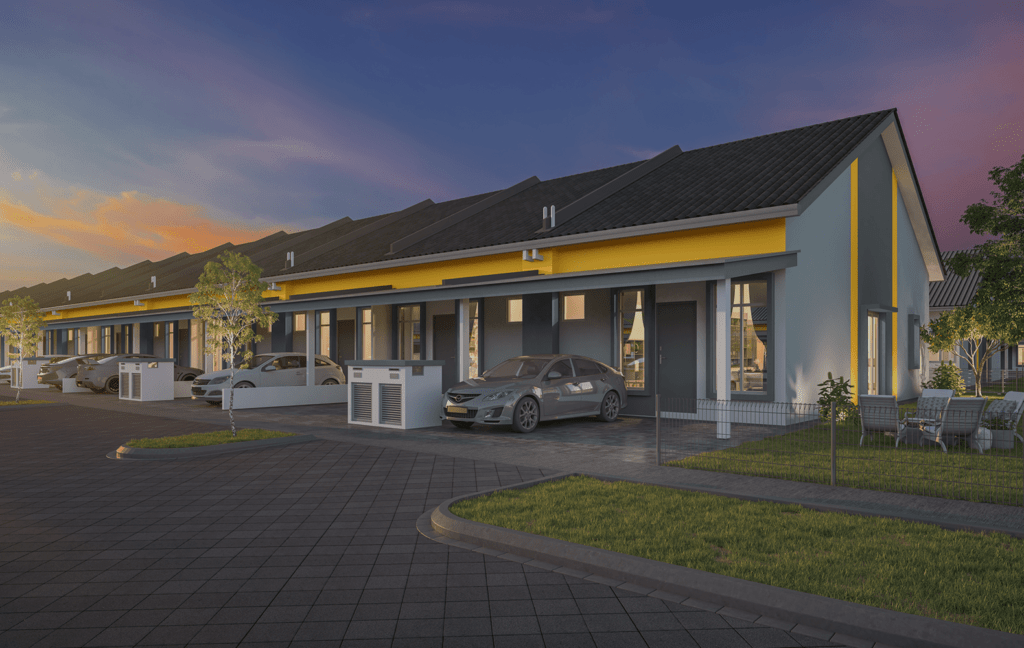

Discover a selection of participating projects for this campaign, starting from just RM1,100/month*, where you can seize the opportunity to claim a gold bar with your purchase:

- Price from: RM459,900*

- Price from: RM399,800*

- Price from: RM396,810*

- Price from: RM909,000*

- Price from: RM476,000*

- BSP Sutera (Townhouse), Puchong

- Price from: RM482,000*

Ready to get started? Simply register by providing your details, and we’ll be in touch with you soon!

How to be Eligible to Claim the Raya Gold Bar at LBS?

The journey of luxury with our Emas Bling-Bling Raya campaign starts by following these simple steps:

- Sign SPA before 31st May 2024

Secure your golden opportunity by signing the Sales and Purchase Agreement (SPA) before this deadline.

- Obtain Loan Approval

Within the timeframe given, make sure you obtain your loan approval, a crucial step towards owning your dream home.

- Claim Your Exclusive Gold Bar

Once the formalities are complete, it’s time to claim your exclusive gold bar at LBS!

Remember, the 999.9 Gold Bar of 2.50gm will be awarded to eligible purchasers who have completed the Sales and Purchase Agreement, obtained loan approval, and have not breached any terms and conditions as provided on our website.

Other Exciting Raya Campaigns by LBS Bina for More Raya Fun!

Not only do you have the opportunity to claim your Raya gold bar, but you are also welcome to participate in other Raya contests by LBS:

Express Your Raya Celebration on Social Media

Share Your Joy with #BersamaLBS!

Embrace the festive spirit and showcase your creativity with our “Sticker Your Raya Story #BersamaLBS” challenge! From April 1st to May 31st, embellish your Raya moments with our exclusive ‘RayaBersamaLBS’ GIFs on Instagram. Don’t forget to tag @lbsbinagroup and three friends of your choice to spread the joy!!

Golden Raya Challenge

Begin an exciting adventure with our Golden Raya Challenge! From April 1st to May 31st, test your skills by controlling a virtual snake to collect in-game elements such as “Raya Icons” and “Gold Icons.”

Submit your highest score for a chance to win fantastic prizes, including a Mini Fridge, Mi Smart Airfryer, Xiaomi Smart Speaker, and more! Visit this page to participate: https://campaign.lbs.com.my/goldenraya_challenge/.

This contest is open to the general public and will be officially announced by the Contest Organiser on or before June 14, 2024 on our social media platform.

For detailed participation guidelines and prize redemption information, check out the Golden Raya Challenge’s terms and conditions here.

Why Wait Longer? Secure Your Raya Gold Bar with LBS Today!

Join us as we celebrate the festive occasion of Hari Raya Aidilfitri, adorned with the brilliance of Emas Bling-Bling Raya Bersama LBS! Let’s celebrate togetherness, prosperity, and the boundless joys of homeownership.

Experience the fulfillment of owning your dream home while gleaming of your very own gold bar, symbolising not just an investment, but a cherished milestone in your life’s journey.

Don’t let this opportunity slip away – seize the chance to secure your Raya gold bar with LBS today. With LBS, your aspirations for a brighter future are within reach.