Human Rights Policy

Mannju

on

September 8, 2023

1. INTRODUCTION

LBS Bina Group Berhad (“LBGB” or “Company”) and its subsidiaries (“LBGB Group”) endeavours to provide a conducive working environment that is characterised by mutual respect. LBGB Group is committed to respecting and abiding internationally recognised human rights standards and fair labour practices according to relevant international treaties and/or convention and local statutory laws within LBGB Group operations (“Human Rights Laws”). LBGB Group recognises the importance of fair labour practices and a good relationship with mutual respect between LBGB Group and its employees to foster high morale amongst employees and to improve employees’ engagement within LBGB Group. LBGB Group strictly do not condone any practices, events, and activities that are in violation of the abovementioned Human Rights Laws.

2. OBJECTIVE

The objectives of this Human Rights Policy are amongst others;

a) To ensure all employment in LBGB Group are in accordance with relevant employment laws and principles including but not limited to the Employment Act 1955 and International Labour Organization (ILO).

b) To identify any risks relating to current labour practices in LBGB Group and to determine an effective method to prevent and eliminate these risks.

c) To provide a fair, respectable and safe workplace for all employees in LBGB Group.

d) To foster a pleasant, cordial, and harmonious relationship between employer and employees for smooth operations, and to promote stability as well as prosperity.

3. SCOPE

This Policy applies to all Directors, employees (including employees on contract terms, temporary or short-term employees and employees on secondment) or third parties who have become aware of or are genuinely suspected on a reasonable belief to be an employee of LBGB Group that has engaged, is engaged, is preparing to engage as well as our external stakeholders such as consultants, contractors, distributors, independent contractors, licensees, manufacturers, primary producers and subcontractors to be committed for the conducts as stated below.

In accordance with our commitment to the best practices on Human Rights Policy, we also expect our external stakeholders to aspire to the same standards in their business operation included but not limited to our commitment.

4. COMMITMENTS

In the pursuit of the objective, LBGB Group undertakes the following:

a) Non-discrimination

LBGB Group has a zero-tolerance policy against discrimination in any form and employees of LGBG Group are provided with equal and merit-based career opportunities regardless of gender, race, caste, nationality, religion, age, physical condition, marital status, union membership/affiliation/activity, employment status or political affiliation.

b) Fair Employment Conditions

LBGB Group operates in full compliance to applicable wage, work hours, overtime and benefits laws. LBGB Group provides recognition based on performance and contribution of the employee towards LBGB Group’s success.

c) Health and Safety

LBGB Group provides a safe and healthy workplace environment for employees. LBGB Group complies with applicable health and safety laws, regulations and requirements. LBGB Group is dedicated in maintaining a safe, productive workplace and strive to take every measure to prevent job-related injuries and illnesses.

d) Workplace Security

We strive to provide a safe and mutually respectful workplace environment free from violence, harassment, humiliation and intimidation of any nature which includes but is not limited to physical, verbal, gesture and any other form.

e) Child Labour

LBGB Group does not recruit child labour and is committed to strictly comply with applicable child labour laws as legislated under the Children and Young Persons (Employment) Act 1966 in the event LBGB Group decides to incorporate young workers into LBGB Group via various internship programs or otherwise. LBGB Group condemns all forms of child exploitation and slavery.

f) Forced Labour

LBGB Group recognises that forced labour, modern slavery, debt bondage, and human trafficking may stem from coercive tactics and undue influence from people in position of higher authority towards people in lower positions of authority which may include violence or threats of violence, or more subtle means such as accumulated debt, retention of identity papers or threats of denunciation to authorities.

LBGB Group supports the elimination of forced labour, modern slavery, debt bondage and human trafficking. LBGB Group takes the stand that the foregoing constitutes a severe violation of human rights and restriction of human freedom.

g) Freedom of Association & Collective Bargaining

LBGB Group respects freedom of association as part of our commitment to support fair and equitable treatment of LBGB Group’s employees regardless of gender, race, caste, nationality, religion, age, physical condition, marital status, union membership/affiliation/activity, employment status or political affiliation. Any form of discrimination based on the aforementioned factors is prohibited, and any union membership/activity will not lead to disciplinary measures or punitive actions.

h) Equal Opportunities

LBGB Group is committed to inculcating diversity and equal opportunity in our workplace which allows us to gain a competitive edge through embracing workforce diversity as well as providing fair treatment to all our employees to promote improved morale and loyalty towards LBGB Group.

LBGB Group shall ensure that all employees receive equal and fair treatment based solely on merits and competency regardless of any form, whether based on gender, race, caste, nationality, religion, age, physical condition, marital status, union membership/affiliation/activity, employment status or political affiliation throughout the organisation.

i) Excessive Working Hours

LBGB Group’s working hours are regulated under the employment contract with the respective employee, Malaysia Employment Act 1955 and/or the Employment (Limitation of Overtime Work) Regulations 1980.

LBGB Group is committed to ensuring that all employees are accorded with proper rest days to recuperate for the operational efficiency of LBGB Group.

j) Minimum Living Wage

LBGB Group recognises that a minimum wage has been mandated by the Malaysian authorities with the aim to protect employees against exploitative low wages. LBGB Group is committed to comply with the local statutory laws on minimum wages and ensures that all wages are paid in a timely manner.

5. REPORTING OF VIOLATIONS OF THE POLICY

Any employee who knows of, or reasonably suspects, of a violation of this Policy, is encouraged to report via:

i) Grievance Mechanism: For further details, please refer the section of “Grievance Mechanism” in this policy.

ii) Whistle Blowing Policy: For further details, the Whistle Blowing Policy of LBGB Group is available on LBGB’s corporate website at www.lbs.com.my/

6. REVIEW OF POLICY

This Policy has been approved by the Board and is available for reference in the LBGB’s corporate website and internal computer networking system.

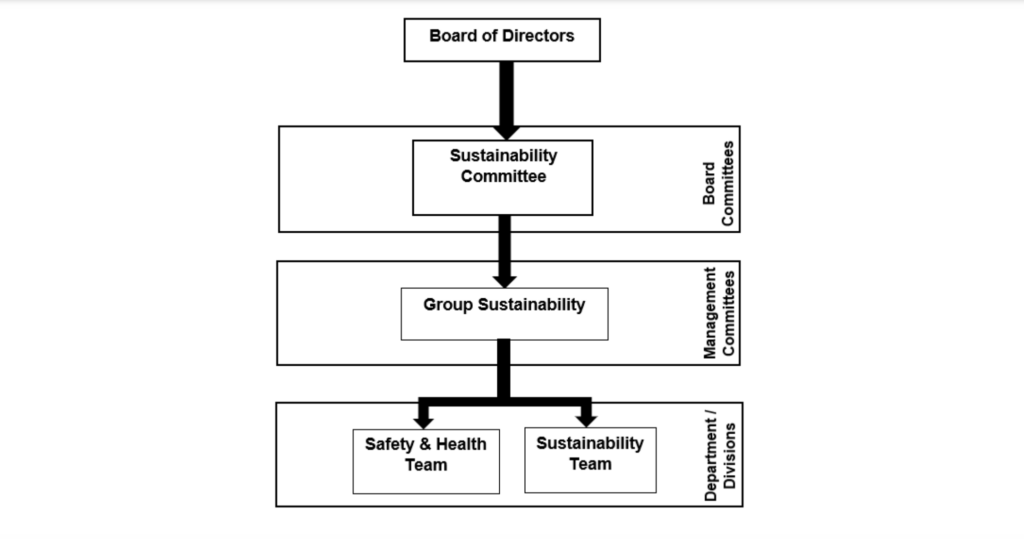

This Policy shall be reviewed by the Board once in every two years and updated whenever necessary to ensure its effective implementation. Any subsequent amendments to the Policy shall be approved by the Board upon recommendation of the Sustainability Committee.

GRIEVANCE MECHANISM

1. INTRODUCTION

LBS Bina Group Berhad (“LBGB” or “Company”) and its subsidiaries (“LBGB Group”) tailored the grievance mechanism to provide employees an additional channel to address concerns and complaints related to workplace matters that do not fall under the purview of the Whistleblowing Policy. While the Whistleblowing Policy primarily deals with serious misconduct and unethical behavior, this grievance mechanism is intended to address broader workplace grievances, disputes, or concerns. It is also typically an internal procedure for complaints followed by consideration, management response and feedback. Grievance reporting enables LBGB Group to validate and monitor the policies construct.

2. OBJECTIVE

The objectives of this Grievance Mechanism are amongst others;

a) To help LBGB Group to identify any unacceptable or unlawful gaps in current approach to grievances.

b) To resolve any issues/concerns before they become serious issues or result in litigation

c) To protect LBGB Group’s brand or company image by avoiding the ‘bad press’ associated with a mishandled grievance

3. SCOPE

This grievance mechanism applies to all Directors, employees (including employees on contract terms, temporary or short-term employees and employees on secondment) or third parties who have become aware of or are genuinely suspected on a reasonable belief to be an employee of LBGB Group that has engaged, is engaged, is preparing to engage.

4. GRIEVANCES

a) Economic: Concerns from employee regarding wages or benefits.

b) Work Environment: Concerns from physical work conditions such as too much heat or cold, cramped or limited work space, low lighting, bad quality equipment, faulty appliances etc., all constitute work environment related grievances and are valid causes of it.

c) Supervisory: Workload, biased performance rating, berating, subtle insulting, harassment of any sort, all constitute supervision related grievances.

d) Employee Relations: Bullying, conflict with co-worker/team member in delivering a project/task assigned

5. PROCESS FLOW

Please view PDF for more info.

6. REPORTING

Any disclosure of grievances shall be made in writing via the few channels as follows:

1. File the grievance through E-Form submission Grievance raisers may file and lodge their grievances via this E-Form link: https://forms.office.com/r/jMwKfDKUeJ

2. File the grievance through E-mail / Mail

Grievance raisers may also obtain soft form / physical copy form (Appendix 1) from HR department and fill up the form. They can submit the form via the followings:

a. E-mail: [email protected]

b. Mail to: LBS Bina Group Berhad, Level 1-4, Plaza Seri Setia, No. 1, Jalan SS9/2, 47300 Petaling Jaya, Selangor. (Attention: Grievance Coordinator)

The grievance raiser will receive an acknowledgement of the receipt. In cases where more information is required to start the investigation, the Grievance Coordinator shall contact the complainant for additional information. Grievance Coordinator will be personnel from HR Department or GHR Department.

The Grievance Committee is a group of panels which consists of three (3) independent members from difference departments. The selection criteria of Grievance Committee as follows:

a) Grievance Committee’s designation must be higher than grievance raiser.

b) Grievance Committee must be free of partisanship that might hamper the independence of the committee

Each member of Grievance Committee is responsible for:

a) Review, assess and identify the grievance raised

b) Propose options to the grievance raiser or any other related parties to address the grievance c) Ensure comments, responses and grievances are handled in fair, transparent and timely manner in line with LBGB Group core values and best practices

7. TRANSPARENCY AND CONFIDENTIALITY

LBGB Group is committed to the transparency in handling of grievances. Grievance raisers can contact the Grievance Coordinator for inquiries regarding the status of the case (by email / in writing). All grievances reported under this mechanism will be treated with utmost confidentiality to protect the privacy of the parties involved and ensure a fair resolution process.

8. REVIEW OF MECHANISM

This grievance mechanism has been endorsed by Executive Director and is made available for reference in internal computer networking system.

It shall be reviewed and updated whenever necessary to ensure its effective implementation. Any subsequent amendments to this mechanism should be approved by Executive Director upon recommendation by the HR Department or GHR Department.