1. Introduction

LBS Bina Group Berhad (“LBGB” or “Company”) is committed to meeting its obligations towards ensuring compliance with the relevant provisions of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad and other relevant regulatory requirements.

In view thereof, the Company adopted the Directors’ Fit and Proper Policy (“Policy”) in assessing fitness and proprietary and take into account all relevant matters including competence and capability, honesty, integrity, fairness, ethical behaviour and financial soundness of the Directors of LBGB and its subsidiaries (collectively “LBGB Group” or “Group”).

2. Objective

This Policy serves as a guide to Nomination and Remuneration Committee (“NRC”) and Board of Director (“Board”) in review and assess of the candidates that are to be appointed as the Director as well as Directors who are seeking for re-election/reappointment. It is to ensure each Directors has the character, experience, integrity, competence and time to effectively discharge his/her role as Directors of the Group.

3. Scope

This Policy is applicable to the appointment and re-election/re-appointment of Directors of the Group.

4. Criteria

The NRC and Board shall take the following criteria into consideration when determine whether a candidate is fit and proper to held the directorship in the Group:

a) Character and integrity

b) Experience and competence

c) Time and commitment

4.1 Character and integrity

(i) Probity

- is compliant with legal obligations, regulatory requirements and professional standards.

- has not been obstructive, misleading or untruthful in dealings with regulatory bodies or a court.

(ii) Personal integrity

- has not perpetrated or participated in any business practices which are deceitful, oppressive improper (whether unlawful or not), or which otherwise reflect discredit on his professional conduct.

- service contract (i.e. in the capacity of management or director) had not been terminated in the past due to concerns on personal integrity.

- has not abused other positions (i.e. political appointment) to facilitate government relations for the company in a manner that contravenes the principles of good governance.

(iii) Financial integrity

- manages personal debts or financial affairs satisfactorily.

- demonstrates ability to fulfil personal financial obligations as and when they fall due.

(iv) Reputation

- is of good repute in the financial and business community.

- has not been the subject of civil or criminal proceedings or enforcement action, in managing or governing an entity for the past 10 years.

- has not been substantially involved in the management of a business or company which has failed, where that failure has been occasioned in part by deficiencies in that management.

4.2 Experience and competence

(i) Qualifications, training and skills

- possesses education qualification that is relevant to the skill set that the director is earmarked to bring to bear onto the boardroom (i.e. a match to the board skill set matrix).

- has a considerable understanding on the workings of a corporation.

- possesses general management skills as well as understanding of corporate governance and sustainability issues.

- keeps knowledge current based on continuous professional development.

- possesses leadership capabilities and a high level of emotional intelligence.

(ii) Relevant experience and expertise

- possesses relevant experience and expertise with due consideration given to past length of service, nature and size of business, responsibilities held, number of subordinates as well as reporting lines and delegated authorities.

(iii) Relevant past performance or track record

- had a career of occupying a high level position in a comparable organisation, and was accountable for driving or leading the organisation’s governance, business performance or operations.

- possesses commendable past performance record as gathered from the results of the board effectiveness evaluation.

4.3 Time and commitment

(i) Ability to discharge role having regard to other commitments

- able to devote time as a board member, having factored other outside obligations including concurrent board positions held by the director across listed issuers and non-listed entities (including not-for-profit organisations).

(ii) Participation and contribution in the board or track record

- demonstrates willingness to participate actively in board activities.

- demonstrates willingness to devote time and effort to understand the businesses and exemplifies readiness to participate in events outside the boardroom.

- manifests passion in the vocation of a director.

- exhibits ability to articulate views independently, objectively and constructively.

- exhibits open mindedness to the views of others and ability to make considered judgment after hearing the views of others.

5. Assessment

The fit and proper assessments on each person shall be conducted prior to the appointment or re-election/re-appointment of Directors in accordance with the factors set out in Clause 4 above before approval of the Board. The factors shall be assessed individually, as well as collectively, taking into account their relative importance.

The Declaration of Fit and Proper Form to be completed by a person who has been identified for appointment or re-election/re-appointment as a Director is set out in Annexure A or in such other form as the NRC may determine from time to time.

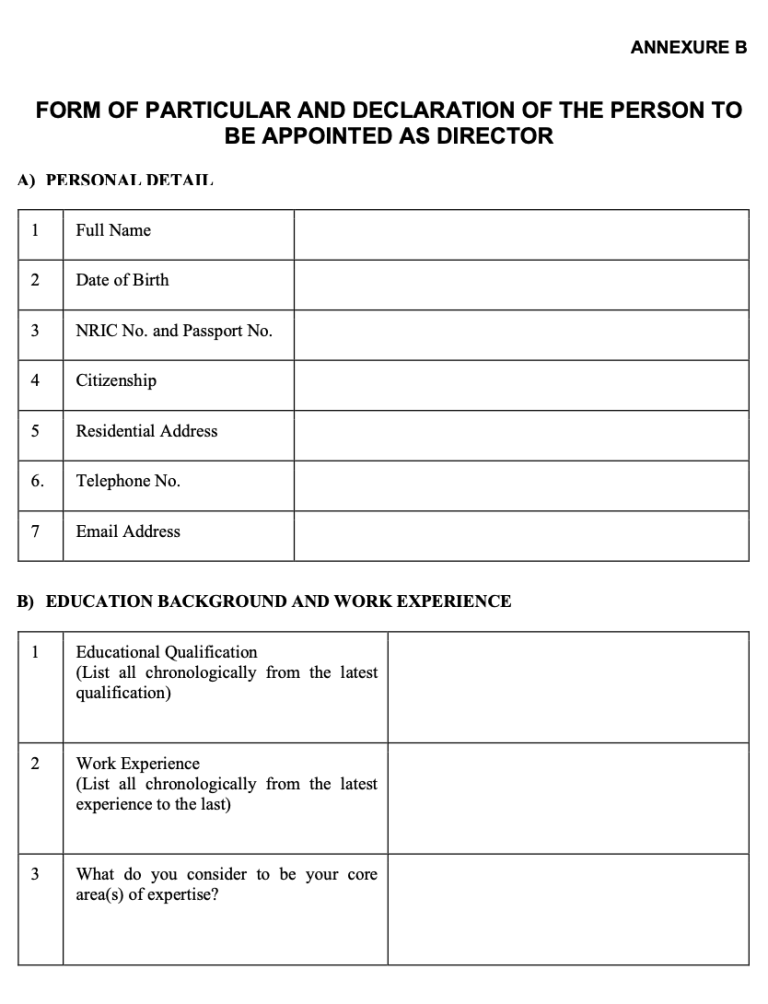

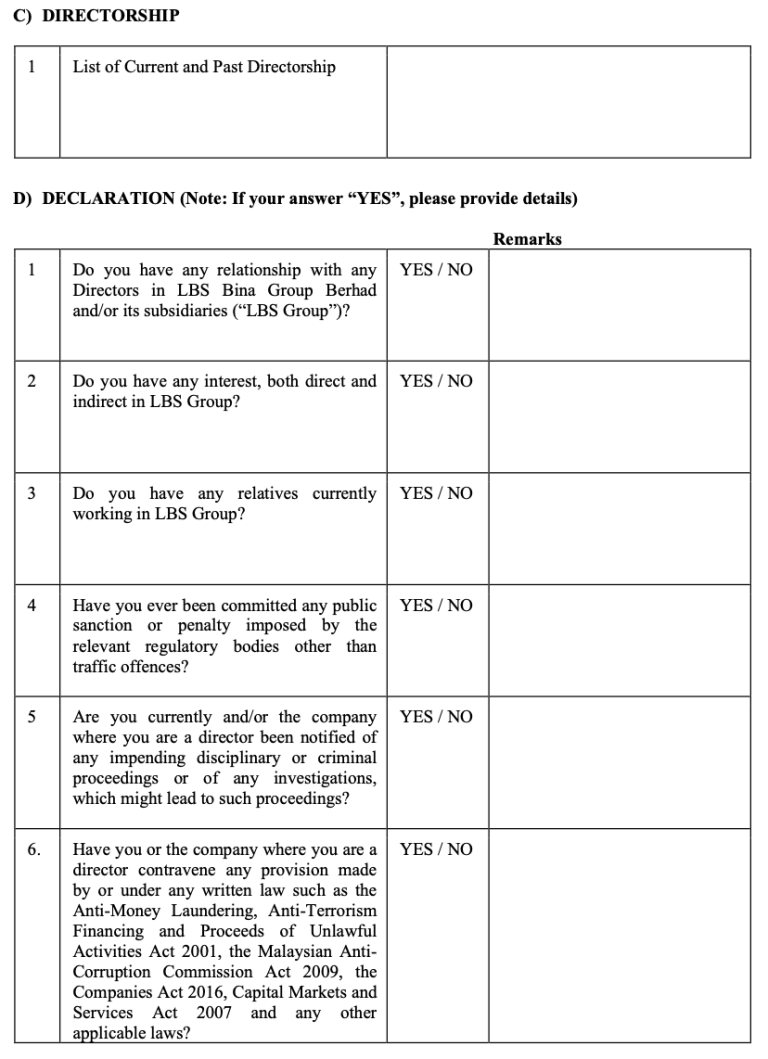

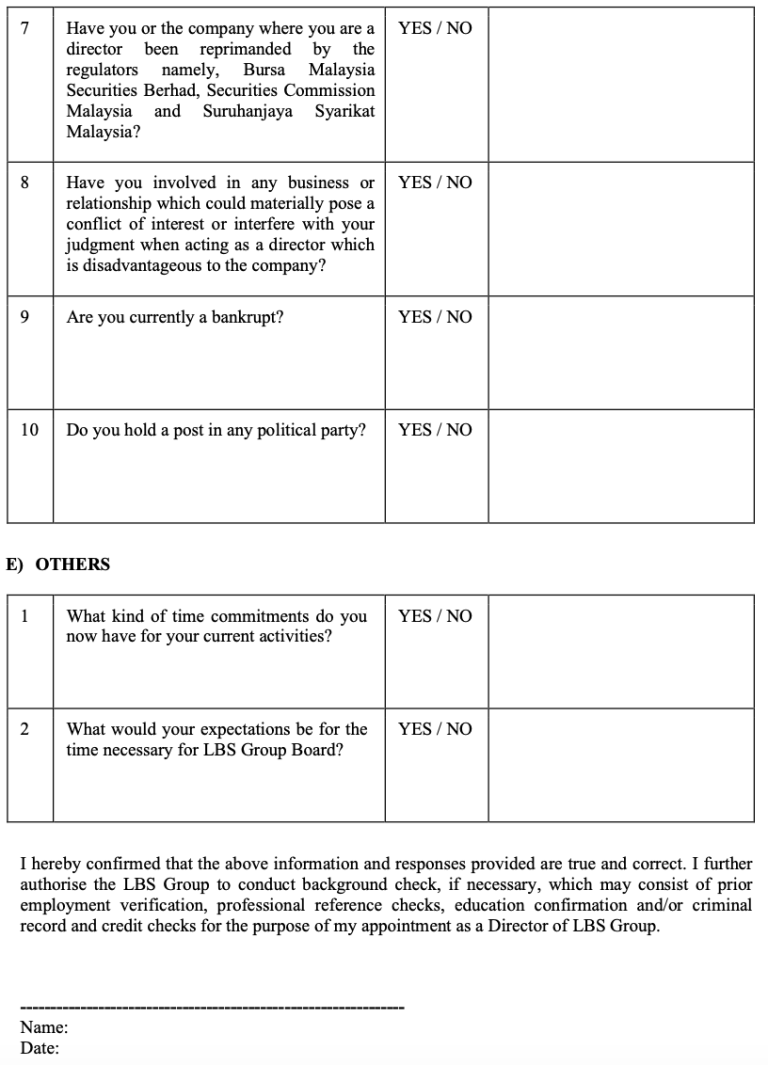

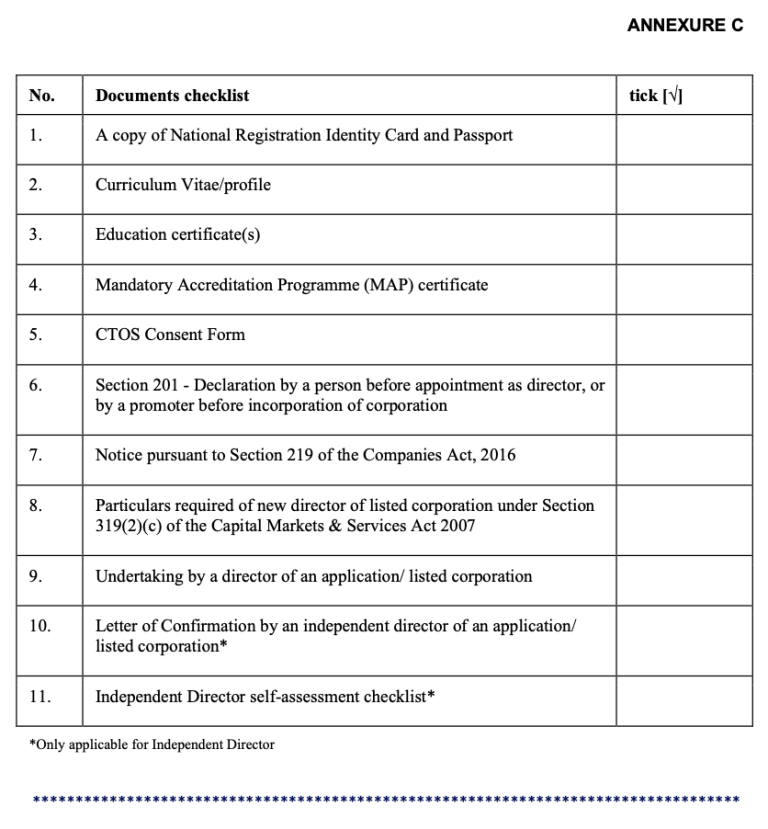

For the appointment of new Director, the person also required to complete the Form of Particular and Declaration of the person to be appointed as Director as set out in Annexure B and provide the necessary documents as mentioned in the Annexure C.

Failure to meet one factor on its own does not necessarily mean failure to meet the fit and proper criteria. The Group should consider the specific circumstances surrounding a person’s failure to meet specific factors, including the lapse of time since the occurrence of events, other contributing factors and the significance of the event from the perspective of potential risks posed to the Group.

The assessment process should be exercised objectively and always in the best interests of the Group and the sound conduct of the Group’s business.

6. Policy Review

This Policy has been approved by the Board and is made available for reference on the Company’s corporate website and internal computer networking system.

It shall be reviewed by the NRC and update whenever necessary to ensure its effective implementation. Any subsequent amendments to the Policy should be approved by the Board upon recommendation of the NRC.