20220321 LBS PARTICIPATES IN THE PROPOSED JOINT VENTURE OF A LIGHT RAIL TRANSPORT SYSTEM

Erfan Sakib

on

March 21, 2022

For Immediate Release

LBS PARTICIPATES IN THE PROPOSED JOINT VENTURE OF A LIGHT RAIL TRANSPORT SYSTEM WITH TRANSIT ORIENTED DEVELOPMENT IN JOHOR BAHRU

___________________________________________________________________________________________________________________________

Petaling Jaya, 21 March 2022 – LBS Bina Group Berhad (“LBS” or the “Group”) today announced that it has entered into a Heads of Agreement (“HOA”) with Nylex (Malaysia) Berhad (“Nylex”), Sinar Bina Infra Sdn. Bhd. (“SBI”), BTS Group Holdings Public Company Limited (BTS) and Ancom Berhad (“Ancom”) to build and operate a light rail transport system (“LRT Project”) with an integrated property development based on the “Transit-Oriented Development” concept in Johor Bahru’s metropolitan region. LBS and SBI have certain strategic land banks in Johor Bahru while BTS is a public listed company in Thailand and the majority shareholder of Bangkok Mass Transit System PCL, the operator of the BTS Skytrain and Bangkok BRT.

Pursuant to the HOA, LBS shall inject its lands at a consideration to be mutually agreed taking into account the valuation to be carried out by an independent valuer. In exchange, LBS will receive Nylex shares priced at RM0.15 per share and LBS or its affiliate shall be the preferred civil and construction contractor for the LRT Project as well as the preferred main contractor for the development of the LBS lands. The HOA is subject to the completion of a feasibility study to be conducted by BTS and professional consultants, the grant of the LRT Project concessions by the state government of Johor to SBI and signing of definitive agreements.

LBS Executive Chairman Tan Sri Lim Hock San said, “This potential collaboration provides us with an opportunity to monetise our lands in Johor and expand our property development and construction expertise beyond our usual housing projects. We expect to generate infrastructure construction income and steady recurring income from this project. The Johor Bahru metropolitan region is up and coming, connectivity is crucial for its growth. Our lands are strategically located. We foresee this project to be a viable development which will ease the transportation and connectivity concerns of the local community.

In addition, we are pleased to be able to work with experienced professionals who have appropriate technical skills and knowledge to see us through this project. We will work towards inking the definitive agreements and share any developments in addition to the final terms and conditions when available.”

-End-

LBS Participates In The Proposed Joint Venture Of A Light Rail Transport System

Erfan Sakib

on

March 21, 2022

21 March 2022

Untuk Siaran Segera

LBS SERTAI CADANGAN KERJASAMA PEMBANGUNAN

SISTEM TRANSIT ALIRAN RINGAN DI JOHOR BAHRU

Petaling Jaya, 21 Mac 2022 – LBS Bina Group Berhad (“LBS” atau “Kumpulan”) hari ini mengumumkan kerjasama melalui perjanjian utama (“HOA”) yang dimeterai dengan Nylex (Malaysia) Berhad (“Nylex”), pemegang saham Sinar Bina Infra Sdn. Bhd. (“SBI”) iaitu, BTS Group Holdings Public Company Limited (BTS) dan Ancom Berhad (“Ancom”) untuk membina dan mengendalikan sistem transit aliran ringan (“Projek LRT”) dengan pembangunan hartanah bersepadu berdasarkan konsep “Pembangunan Berorientasikan Transit” di wilayah metropolitan Johor Bahru. LBS dan SBI mempunyai bank tanah strategik di kawasan tertentu di Johor Bahru manakala BTS ialah syarikat tersenarai awam di Thailand dan pemegang saham majoriti bagi Bangkok Mass Transit System PCL, iaitu pengendali BTS Skytrain dan Bangkok BRT.

Menurut HOA, LBS akan menyediakan hartanah di kawasan tersebut berdasarkan pertimbangan yang dipersetujui bersama dengan mengambil kira penilaian yang bakal dilakukan oleh penilai bebas, bagi tujuan Projek LRT. Sebagai pertukaran, LBS akan menerima saham Nylex pada harga RM0.15 sesaham dan LBS atau mana-mana anak syarikatnya akan menjadi kontraktor utama bagi pembangunan berkaitan. HOA tertakluk kepada keputusan kajian yang akan dijalankan oleh BTS dan perunding profesional, pemberian konsesi Projek LRT oleh kerajaan negeri Johor kepada SBI serta menandatangani perjanjian muktamad bagi projek tersebut.

Pengerusi Eksekutif LBS Tan Sri Lim Hock San berkata, “Kerjasama yang berpotensi ini memberi peluang untuk kami memberi nilai tambah yang sewajarnya ke atas tanah-tanah kami di Johor di samping meningkatkan kepakaran pembangunan hartanah dan pembinaan sertai mengatasi projek perumahan yang biasa dibangunkan. Kami menjangka untuk menjana pendapatan melalui pembinaan infrastruktur dan pendapatan berulang yang stabil melalui projek ini. Wilayah metropolitan Johor Bahru semakin membangun dan, kesinambungan merupakan elemen yang penting bagi pertumbuhannya. Tambahan pula, tanah-tanah kami ini terletak di lokasi yang strategik. Kami menjangkakan projek ini akan menjadi pembangunan yang berdaya maju di samping melancarkan pengangkutan dan akses di kalangan masyarakat setempat.

Selain dari itu, kami gembira dapat bekerjasama dengan golongan profesional yang berpengalaman dan berkemahiran teknikal serta berpengetahuan luas untuk membantu kami di dalam projek ini. Kami akan berusaha untuk memuktamadkan perjanjian ini dan berkongsi sebarang maklumat sebagai tambahan kepada terma dan syarat perjanjian tersebut.”

-Tamat-

Untuk Siaran Segera

LBS SERTAI CADANGAN KERJASAMA PEMBANGUNAN

SISTEM TRANSIT ALIRAN RINGAN DI JOHOR BAHRU

Petaling Jaya, 21 Mac 2022 – LBS Bina Group Berhad (“LBS” atau “Kumpulan”) hari ini mengumumkan kerjasama melalui perjanjian utama (“HOA”) yang dimeterai dengan Nylex (Malaysia) Berhad (“Nylex”), pemegang saham Sinar Bina Infra Sdn. Bhd. (“SBI”) iaitu, BTS Group Holdings Public Company Limited (BTS) dan Ancom Berhad (“Ancom”) untuk membina dan mengendalikan sistem transit aliran ringan (“Projek LRT”) dengan pembangunan hartanah bersepadu berdasarkan konsep “Pembangunan Berorientasikan Transit” di wilayah metropolitan Johor Bahru. LBS dan SBI mempunyai bank tanah strategik di kawasan tertentu di Johor Bahru manakala BTS ialah syarikat tersenarai awam di Thailand dan pemegang saham majoriti bagi Bangkok Mass Transit System PCL, iaitu pengendali BTS Skytrain dan Bangkok BRT.

Menurut HOA, LBS akan menyediakan hartanah di kawasan tersebut berdasarkan pertimbangan yang dipersetujui bersama dengan mengambil kira penilaian yang bakal dilakukan oleh penilai bebas, bagi tujuan Projek LRT. Sebagai pertukaran, LBS akan menerima saham Nylex pada harga RM0.15 sesaham dan LBS atau mana-mana anak syarikatnya akan menjadi kontraktor utama bagi pembangunan berkaitan. HOA tertakluk kepada keputusan kajian yang akan dijalankan oleh BTS dan perunding profesional, pemberian konsesi Projek LRT oleh kerajaan negeri Johor kepada SBI serta menandatangani perjanjian muktamad bagi projek tersebut.

Pengerusi Eksekutif LBS Tan Sri Lim Hock San berkata, “Kerjasama yang berpotensi ini memberi peluang untuk kami memberi nilai tambah yang sewajarnya ke atas tanah-tanah kami di Johor di samping meningkatkan kepakaran pembangunan hartanah dan pembinaan sertai mengatasi projek perumahan yang biasa dibangunkan. Kami menjangka untuk menjana pendapatan melalui pembinaan infrastruktur dan pendapatan berulang yang stabil melalui projek ini. Wilayah metropolitan Johor Bahru semakin membangun dan, kesinambungan merupakan elemen yang penting bagi pertumbuhannya. Tambahan pula, tanah-tanah kami ini terletak di lokasi yang strategik. Kami menjangkakan projek ini akan menjadi pembangunan yang berdaya maju di samping melancarkan pengangkutan dan akses di kalangan masyarakat setempat.

Selain dari itu, kami gembira dapat bekerjasama dengan golongan profesional yang berpengalaman dan berkemahiran teknikal serta berpengetahuan luas untuk membantu kami di dalam projek ini. Kami akan berusaha untuk memuktamadkan perjanjian ini dan berkongsi sebarang maklumat sebagai tambahan kepada terma dan syarat perjanjian tersebut.”

-Tamat-

For Immediate Release

LBS PARTICIPATES IN THE PROPOSED JOINT VENTURE OF A LIGHT RAIL TRANSPORT SYSTEM WITH TRANSIT ORIENTED DEVELOPMENT IN JOHOR BAHRU

Petaling Jaya, 21 March 2022 – LBS Bina Group Berhad (“LBS” or the “Group”) today announced that it has entered into a Heads of Agreement (“HOA”) with Nylex (Malaysia) Berhad (“Nylex”), Sinar Bina Infra Sdn. Bhd. (“SBI”), BTS Group Holdings Public Company Limited (BTS) and Ancom Berhad (“Ancom”) to build and operate a light rail transport system (“LRT Project”) with an integrated property development based on the “Transit-Oriented Development” concept in Johor Bahru’s metropolitan region. LBS and SBI have certain strategic land banks in Johor Bahru while BTS is a public listed company in Thailand and the majority shareholder of Bangkok Mass Transit System PCL, the operator of the BTS Skytrain and Bangkok BRT.

Pursuant to the HOA, LBS shall inject its lands at a consideration to be mutually agreed taking into account the valuation to be carried out by an independent valuer. In exchange, LBS will receive Nylex shares priced at RM0.15 per share and LBS or its affiliate shall be the preferred civil and construction contractor for the LRT Project as well as the preferred main contractor for the development of the LBS lands. The HOA is subject to the completion of a feasibility study to be conducted by BTS and professional consultants, the grant of the LRT Project concessions by the state government of Johor to SBI and signing of definitive agreements.

LBS Executive Chairman Tan Sri Lim Hock San said, “This potential collaboration provides us with an opportunity to monetise our lands in Johor and expand our property development and construction expertise beyond our usual housing projects. We expect to generate infrastructure construction income and steady recurring income from this project. The Johor Bahru metropolitan region is up and coming, connectivity is crucial for its growth. Our lands are strategically located. We foresee this project to be a viable development which will ease the transportation and connectivity concerns of the local community.

In addition, we are pleased to be able to work with experienced professionals who have appropriate technical skills and knowledge to see us through this project. We will work towards inking the definitive agreements and share any developments in addition to the final terms and conditions when available.”

-End-

For Immediate Release

LBS PARTICIPATES IN THE PROPOSED JOINT VENTURE OF A LIGHT RAIL TRANSPORT SYSTEM WITH TRANSIT ORIENTED DEVELOPMENT IN JOHOR BAHRU

Petaling Jaya, 21 March 2022 – LBS Bina Group Berhad (“LBS” or the “Group”) today announced that it has entered into a Heads of Agreement (“HOA”) with Nylex (Malaysia) Berhad (“Nylex”), Sinar Bina Infra Sdn. Bhd. (“SBI”), BTS Group Holdings Public Company Limited (BTS) and Ancom Berhad (“Ancom”) to build and operate a light rail transport system (“LRT Project”) with an integrated property development based on the “Transit-Oriented Development” concept in Johor Bahru’s metropolitan region. LBS and SBI have certain strategic land banks in Johor Bahru while BTS is a public listed company in Thailand and the majority shareholder of Bangkok Mass Transit System PCL, the operator of the BTS Skytrain and Bangkok BRT.

Pursuant to the HOA, LBS shall inject its lands at a consideration to be mutually agreed taking into account the valuation to be carried out by an independent valuer. In exchange, LBS will receive Nylex shares priced at RM0.15 per share and LBS or its affiliate shall be the preferred civil and construction contractor for the LRT Project as well as the preferred main contractor for the development of the LBS lands. The HOA is subject to the completion of a feasibility study to be conducted by BTS and professional consultants, the grant of the LRT Project concessions by the state government of Johor to SBI and signing of definitive agreements.

LBS Executive Chairman Tan Sri Lim Hock San said, “This potential collaboration provides us with an opportunity to monetise our lands in Johor and expand our property development and construction expertise beyond our usual housing projects. We expect to generate infrastructure construction income and steady recurring income from this project. The Johor Bahru metropolitan region is up and coming, connectivity is crucial for its growth. Our lands are strategically located. We foresee this project to be a viable development which will ease the transportation and connectivity concerns of the local community.

In addition, we are pleased to be able to work with experienced professionals who have appropriate technical skills and knowledge to see us through this project. We will work towards inking the definitive agreements and share any developments in addition to the final terms and conditions when available.”

-End-

即时发布

林木生集团将参与新山轻快铁合资企業發展

(八打灵再也21日讯)林木生集团(LBS)今日宣布,与耐力斯(NYLEX,4944,主板工业产品服务股)、安康(ANCOM,4758,主板工业产品服务股)、以及Sinar Bina Infra私人有限公司(SBI),即BTS集团控股(BTS Group Holdings Public Company Limited)签署前期协议(HOA),在柔佛新山市区建设和营运轻快铁(LRT)系统。此轻快铁计划是一项“以公共交通为导向的发展”概念的综合房地产开发。

林木生集团与SBI皆在新山策略地点持有地库,而泰国上市公司BTS ,是曼谷铁路系统公司(Bangkok Mass Transit System PCL)的大股东;曼谷铁路系统公司是BTS轻轨和快捷公车BRT的运营商。

根据前期协议,在双方同意的情况下,以及考量由独立估价师针对轻快铁项目进行的估值,林木生集团将注入土地。作为交换,林木生集团将以每股15仙,获得耐力斯股;同时,林木生集团或其关联公司,将成为该轻快铁项目的首选土木和建筑承包商,以及林木生集团土地发展的主要承包商。前期协议将取决于BTS集团控股和专业顾问完成的可行性研究、柔佛州政府向SBI授予的轻快铁项目特许权,以及签署最终协议。

林木生集团执行主席丹斯里林福山指出:“这潜在的合作为我们提供机会,适当地资本化我们在柔佛的土地,并将我们的房地产发展与建筑专业知识,扩展到房屋项目之外。我们预计该项目将带来基础设施建设的收入,以及稳定的经常收入。新山大都市区正在崛起,链接与便利对其发展至关重要。我们的土地地理位置优越。相信这项目是个可行的发展,将改善当地社区的交通和连通问题。我们很高兴能与具有技术和知识,且经验丰富的专业人士合作。 我们将致力于前进,以签署最终协议,并分享最终条款与进展。”

~完~

即时发布

林木生集团将参与新山轻快铁合资企業發展

(八打灵再也21日讯)林木生集团(LBS)今日宣布,与耐力斯(NYLEX,4944,主板工业产品服务股)、安康(ANCOM,4758,主板工业产品服务股)、以及Sinar Bina Infra私人有限公司(SBI),即BTS集团控股(BTS Group Holdings Public Company Limited)签署前期协议(HOA),在柔佛新山市区建设和营运轻快铁(LRT)系统。此轻快铁计划是一项“以公共交通为导向的发展”概念的综合房地产开发。

林木生集团与SBI皆在新山策略地点持有地库,而泰国上市公司BTS ,是曼谷铁路系统公司(Bangkok Mass Transit System PCL)的大股东;曼谷铁路系统公司是BTS轻轨和快捷公车BRT的运营商。

根据前期协议,在双方同意的情况下,以及考量由独立估价师针对轻快铁项目进行的估值,林木生集团将注入土地。作为交换,林木生集团将以每股15仙,获得耐力斯股;同时,林木生集团或其关联公司,将成为该轻快铁项目的首选土木和建筑承包商,以及林木生集团土地发展的主要承包商。前期协议将取决于BTS集团控股和专业顾问完成的可行性研究、柔佛州政府向SBI授予的轻快铁项目特许权,以及签署最终协议。

林木生集团执行主席丹斯里林福山指出:“这潜在的合作为我们提供机会,适当地资本化我们在柔佛的土地,并将我们的房地产发展与建筑专业知识,扩展到房屋项目之外。我们预计该项目将带来基础设施建设的收入,以及稳定的经常收入。新山大都市区正在崛起,链接与便利对其发展至关重要。我们的土地地理位置优越。相信这项目是个可行的发展,将改善当地社区的交通和连通问题。我们很高兴能与具有技术和知识,且经验丰富的专业人士合作。 我们将致力于前进,以签署最终协议,并分享最终条款与进展。”

~完~

Build your own house or buy a ready-to-move-in house? Which one is better?

Erfan Sakib

on

March 16, 2022

Next, do you own land or not? If you already own one or want to build a house on your parents’ land, there is an assistance scheme that can be utilised, namely the SPNB Skim Rumah Mesra Rakyat (RMR). What is interesting regarding this programme is, successful applicants will get a construction subsidy of RM20,000. For those who are eligible, it is a relatively large amount and can be fully utilised. The Rumah Mesra Rakyat application can be made on the official website of Syarikat Perumahan Negara Berhad (SPNB), RMR Online System.

For those who are not eligible to apply for the SPNB RMR Scheme, you can hire contractors to build your house. Yet you need to be wary of irresponsible house contractors who may cause your home construction project abandoned and overdue for a long time. In fact, make sure that the house that has been completed has a warranty or guarantee to ensure that if there is any damage to the house due to unsatisfactory quality of work, you can still claim your rights.

To ensure that the process of building a house on your land runs smoothly, make sure you make a valid written agreement with the contractor. Make sure every item is clearly stated such as house price as well as construction period.

Many companies offer home building packages for landowners. You just need to do a compare and contrast, and research to determine which company is recognised and fits your budget.

Also, if you own a piece of land, this does not mean you can freely build a house on the site. This is because each land has its land status. For example, if you want to build a house on agricultural land, you may need to change the status of the ‘agricultural’ to ‘building’ first, subject to the approval of the District Council.

In fact, some bank policies require the status of agricultural land to be converted to building land for them to approve loans. Even if the District Council in your area has already approved a building plan on agricultural land, it does not mean that your loan will be approved by the bank. Therefore, make sure you know the status of the land on which you want to build a house, do not build it yet as you have to demolish it if you do not get the approval of the Local Authority.

- If you own a piece of land and you’re planning to build a house but it is very remote and isolated, you need to be willing to incur extra costs to get supplies such as electricity and water (additional costs will apply for electricity poles and pipes).

- If it is too far and isolated, do consider the safety aspect especially if you have a family in case there’s a medical emergency or crime. Travel distances between public facilities such as hospitals and police stations should also be taken into account. However, if the area itself is already within proximity to any of these public facilities, you can already start the project in peace.

- One of the undeniable advantages of buying a ready-to-move-in home is the strategic location. As a tactic to attract buyers, the housing developer will offer public facilities that are already available and close to the construction project.

- Some of the construction projects that have been built are within a short distance from job opportunities. Not just that, facilities such as public transport can also be one of the attractions to buying a ready-to-move-in house. So, as a homeowner, you just have to make a choice of which location you want.

Attractive young woman and her handsome husband looking at each other while calculating family expenses, interior of spacious living room on background

It is not a 100% complete decision if you don’t make a cost calculation. Here are some important things to consider before making calculations for each of these options.

To build a house, two parties will usually provide house building loans, namely government loans for civil servants and bank loans. For Government Housing Loans/ Lembaga Pembiayaan Perumahan Sektor Awam (LPPSA), the government offers two types of loans for the construction of houses on your land with several conditions:

- House construction can only begin after the loan is approved

- The building plan is approved by the local authority and the approval period is still in force

- The house must be built according to the plan during the loan approval

- Fees will be paid based on the development of the stage of the house being built.

For bank loans, the approval conditions and loan policy depend on the bank itself. For a home-building loan with a bank, you need to ask your bank officer about the conditions that have been set.

If you want to build your own house, here are the advantages:

- A home design can be set according to your taste

- You can build a house with a budget as low as RM100/per sq. ft up to as expensive as RM300/ sq.ft

- Those who plan to expand the size of the house in the future may plan from scratch. For example, in the future, you want to add a fish pond at home and you already have a budget. During the early stages of house construction, you can already allocate the land area for the desired fish pond.

At the same time, you must also take into account the disadvantages of building a house on your land.

- To save costs, you need to have your land

- You need to have a basic knowledge of the whole process of building a house to prevent you from being cheated by parties trying to manipulate you

- There may be additional costs from the original calculation. Construction prices may go up or you have to hire other construction workers

- Usually to build a house yourself need to make two loans, namely a loan to buy land (if you do not own a piece of land) and a loan to build a house

- Housing loan payments should start as soon as the money is received. Therefore, while the house is being completed, you may have to pay off the loan (and maybe rent too) while waiting for your house to be ready

- If you are not careful when choosing a home contractor services, you may face the risk of being scammed by the contractor.

Buying a ready-to-move-in house also has its advantages. You can choose to buy a house in the primary market or a sub-sale house.

- You do need to know about the technical aspects of construction and construction costs, you just need to know the process of buying a house

- The risk of going over a set budget is lower because most cost estimates will not exceed a set rate

- There is no risk of being cheated by the contractor

- Completed houses are usually complete with other facilities such as shops, schools, etc

- For those who need loans, more housing loan assistance schemes are being offered to buy ready-to-move-in houses.

Now, let’s see the downside of buying a house.

- An auction or sub-sale house can be at risk of being damaged and requiring additional repair costs

- For the undercon housing market, irresponsible developers can risk the project being abandoned

- There are no options for home design.

No matter whether you choose to build your own house or buy a ready-to-move-in house, each of these options has its advantages and disadvantages. What’s important, check your financial stability before making the choice that best suits you. Think wisely and consider all options before making a final decision. If you have experience in building your own house, share it with us. Whatever your choice is, good luck!

Presented by LBS Bina on 17 Mac 2022

Published at: https://www.iproperty.com.my/guides/build-house-vs-buy-house-which-one-is-better/

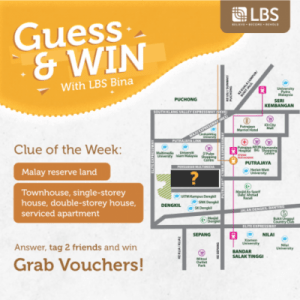

Guess & Win With LBS Contest

Erfan Sakib

on

March 4, 2022

The Contest is organised by LBS Bina Group Berhad (hereinafter known as “the Organiser”). By participating in the Contest, you agree to be bound by the terms and conditions contained herein (consisting of the General Terms and Conditions and the Specific Terms and Conditions) between you and the Organiser (“Contest Terms”). You agree that the Organiser may include additional terms to and/or vary the Contest Terms at our sole discretion at any point of time and any additional and/or variation of the terms shall be incorporated by reference immediately at the point of time in which it is implemented. You are advised to visit this page from time to time to be updated of the latest Contest Terms.

In the event of any inconsistency between any terms and conditions stipulated in any of our marketing brochures, leaflets, buntings, or otherwise any other platforms and the Contest Terms stipulated herein, the latest Contest Terms shall prevail.

MGB Interview with The Edge

Erfan Sakib

on

February 28, 2022

Tan Sri Lim Hock San joined an interview with The Edge. The interview comprised of insights about MGB Berhad profile and updates. Also discussed were the development of IBS as well as large-scale projects jointly cooperated by MGB and the Selangor State Government known as Rumah Selangorku Idaman MBI (Idaman).

The interview was published on the 16th and 17th of February 2022

Virtual Reality in Property Industry

Erfan Sakib

on

February 28, 2022

The property industry has been evolving and changing with the advancement of technology and the challenges of Covid-19. With the effects and restrictions of the pandemic, the property industry must learn to adapt and overcome the many obstacles in order to survive. A game-changer that has been transforming the way we buy and sell homes in Malaysia is virtual reality (VR).

Typically, homebuyers visit multiple properties before deciding on the one they want to buy. This can be very time-consuming and also expensive if the properties are far from where the buyer lives. VR helps solve this by allowing people to virtually visit and experience properties without leaving the comfort of their homes. One can put on a VR headset or simply view from one’s mobile device and view the property.

LBS Bina Group is one of the property developers which has adopted VR with the use of Matterport. By capturing many pictures, the program combines the pictures and creates a 3D replica of the unit. People can now enjoy virtual tours which allow users to view and move within a property unit with just a click of a button.

Part of the VR advancement that has changed how we design and present property to clients includes virtual home staging and architectural visualisation. Virtual home staging helps to virtually fill up an empty unit with furniture and interior design, enabling homebuyers to view fully furnished units. This can save the cost of actually sourcing and buying suitable furniture to furnish a unit. Architectural visualisation creates 3D models that help potential buyers visualise and imagine the architecture of an upcoming property that has yet to be built. These advancements help to create greater emotional connections when comparing the experience of 3D virtual tours and viewing 2D pictures.

VR allows anyone to view the property over long distances through the use of the internet. Clients are able to virtually visit the properties as and when they want, with no time limit to how long spent viewing the property. The customer experience can be further enhanced with add-ons like mortgage calculators and additional information on the property and neighbourhood. This will help clients get all the necessary information about the property before contacting a real estate agent and arranging a physical visit to the house they are interested in.

In conclusion, VR technology has already been transforming the property industry here in Malaysia. Realising the benefits and uses of VR, an increasing number of property developers, real estate property online portals, and others are adopting VR into their business models.

20220224 LBS FYE2021 NET PROFIT LEAPS BY 76%

Erfan Sakib

on

February 24, 2022

For Immediate Release

LBS FYE2021 NET PROFIT LEAPS BY 76%

- Q4FYE2021 revenue increased by 50%

- Outperformed 2021 sales target by 31% to RM1.58 billion

- 18 ongoing projects with an estimated GDV of RM5.30 billion

- Unbilled sales of RM2.30 billion

___________________________________________________________________________________________________________________________

Petaling Jaya, 24 February 2022 – LBS Bina Group Berhad (“LBS” or the “Group”) today announced its fourth-quarter results for the financial year ended 31 December 2021 (“Q4FYE2021”).

For the period under review, LBS reported a revenue of RM441.84 million. This translates to a year-on-year increase of 50%. To add on, the Group recorded a profit after tax (“PAT”) of RM46.38 million for Q4FYE2021, an impressive 41% increase as compared to Q4FYE2020.

For FYE2021, revenue increased by 24%, year-on-year, from RM1.10 billion to RM1.36 billion. The RM1.36 billion revenue is LBS’ highest ever achieved. The PAT increased by 76%, from RM67.29 million to RM118.70 million.

The strong FYE2021 performance was attributed to the innovative digitalisation efforts by the Group such as LBS’ Virtual Property Page, Raikan Rezeki Bersama LBS and Vacci-Nation Bonanza digital campaigns, as well as in-demand products which were well-received by the public.

On the property development front, which is the Group’s main earnings contributor, revenue increased to RM1.30 billion, resulting in a 26% increase year-on-year. The respective increase was the end result of good take up rates and steady construction progress at ongoing projects such as Residensi Bintang Bukit Jalil, Alam Awana Industrial Park, Cameron Centrum, KITA @ Cybersouth and LBS Alam Perdana.

LBS currently has 18 ongoing development projects with an estimated Gross Development Value (“GDV”) of RM5.3 billion. The landbank of 2,744 acres, as at 31 December 2021, will keep the Group busy for the next 10 years. Unbilled sales of RM2.30 billion will contribute positively to the Group’s revenue over the next two to three years.

Commenting on the results, LBS Executive Chairman Tan Sri Lim Hock San said, “FYE2021 has turned out to be an exceptional year for LBS. Our numbers reached an all-time high. Nevertheless, I hope that our financial results are a testament of the direction LBS is heading towards and that the general public and our shareholders keep their faith in us.

In 2021, we surpassed our property sales target by 31%, hitting RM1.58 billion as compared to our initial target of RM1.20 billion. This is a great start to 2022. Property development will continue to be our core business. Therefore, we have set ourselves a higher property sales target of RM1.60 billion for 2022 via 14 new project launches with a gross development value of RM1.77 billion. We are confident our launches will continue to receive strong responses, given the strategic locations. Further, with the roll-out of the vaccination booster shots, it appears that the days of lockdowns are out of sight.

In 2022, we will remain true to our three main pillars of Affordability, Connectivity and Community. The LBS team is motivated to rise to the challenge of delivering developments in strategic locations while maintaining affordable prices to meet homebuyers’ needs and to win their trust. We will continue to monitor the market and implement appropriate strategies to ensure our operations are not disrupted. We remain optimistic of our growth prospects for 2022.”

-End-

LBS FYE2021 Net Profit Leaps By 76%

Erfan Sakib

on

February 24, 2022

24 February 2022

Untuk Siaran Segera

LBS CATAT PENINGKATAN KEUNTUNGAN BERSIH 76%

BAGI FYE2021

- Hasil Q4FYE2021 meningkat sebanyak 50%

- Mencapai prestasi jualan 2021 sebanyak 31% kepada RM1.58 bilion

- 18 projek sedang berjalan dengan anggaran GDV sebanyak RM5.30 bilion

- Jualan belum dibil RM2.30 bilion

Petaling Jaya, 24 Februari 2022 – LBS Bina Group Berhad (“LBS” atau “Kumpulan”) hari ini mengumumkan keputusan suku keempatnya bagi tahun kewangan berakhir 31 Disember 2021 (“Q4FYE2021”).

Bagi tempoh dalam tinjauan, LBS melaporkan hasil keuntungan sebanyak RM441.84 juta yang diterjemahkan dari peningkatan tahun ke tahun sebanyak 50%. Syarikat turut mencatat keuntungan selepas cukai (“PAT”) sebanyak RM46.38 juta untuk Q4FYE2021, peningkatan yang amat memberangsangkan sebanyak 41 % berbanding Q4FYE2020.

Bagi FYE2021, keuntungan meningkat sebanyak 24.4%, tahun ke tahun, daripada RM1.10 bilion kepada RM1.36 bilion. Keuntungan RM1.36 bilion merupakan pencapaian tertinggi yang direkodkan oleh LBS dengan PAT meningkat 76% daripada RM67.29 juta kepada RM118.70 juta.

Prestasi FYE2021 yang kukuh ini didorong oleh usaha inovatif Syarikat di dalam inisiatif pendigitalan dan pelancaran Laman Hartanah Virtual LBS, Kempen Raikan Rezeki Bersama LBS dan Kempen Digital Vacci-Nation Bonanza yang menerima maklum balas dan diterima baik oleh orang ramai.

Dari segi pembangunan hartanah, yang merupakan penyumbang pendapatan utama LBS, pendapatan mencatatkan peningkatan kepada RM1.30 bilion, iaitu kenaikan 26% tahun ke tahun. Kenaikan ini didorong dari kadar pengambilan yang baik, dan kemajuan pembinaan yang stabil di projek yang sedang berjalan seperti Residensi Bintang Bukit Jalil, Taman Perindustrian Alam Awana, Cameron Centrum, KITA @ Cybersouth dan LBS Alam Perdana.

LBS mempunyai 18 projek pembangunan yang sedang berjalan dengan Nilai Pembangunan Kasar (“GDV”) sebanyak RM5.3 bilion, bank tanah seluas 2,744 ekar, setakat 31 Disember 2021, yang akan memastikan pengurusan syarikat aktif beroperasi untuk tempoh 10 tahun akan datang. Manakala jualan tidak dibil sebanyak RM2.30 bilion akan memberikan pulangan secara positif Syarikat untuk tempoh dua ke tiga tahun ke hadapan.

Mengulas mengenai keputusan itu, Pengerusi Eksekutif LBS, Tan Sri Lim Hock San berkata, “FYE2021 telah menjadi tahun yang luar biasa untuk LBS. Jumlah keuntungan kami mencapai paras yang tertinggi. Oleh itu, saya berharap keputusan kewangan LBS ini akan menjadi suatu kenyataan hala tuju LBS di dalam melangkah ke hadapan di samping mengekalkan kepercayaan para pemegang saham terhadap usaha LBS.

Pada tahun 2021, kami melepasi sasaran jualan hartanah kami sebanyak 31%, mencecah RM1.58 bilion berbanding sasaran awal kami sebanyak RM1.20 bilion. Ini merupakan permulaan yang baik untuk 2022. Pembangunan hartanah kekal menjadi perniagaan teras kami. Oleh itu, LBS telah menetapkan sasaran jualan yang lebih tinggi pada 2022 iaitu sebanyak RM1.60 bilion dengan menyasarkan 14 buah projek baru dengan nilai GDV sebanyak RM1.77 bilion. Kami yakin projek-projek ini bakal mendapat sambutan menggalakkan, berikutan lokasinya yang strategik. Ditambah dengan pelancaran suntikan penggalak vaksinasi, di mana kerajaan tidak lagi bercadang untuk mengenakan Perintah Kawalan Pergerakan di masa hadapan.

Untuk tahun 2022, kami akan terus berpegang teguh pada tiga tonggak utama kami iaitu Mampu Milik, Kesalinghubungan dan Komuniti. LBS turut berazam untuk menyediakan pembangunan di lokasi strategik dan mengekalkan harga yang berpatutan bagi memenuhi keperluan pembeli rumah di samping memenangi kepercayaan mereka. Kami akan terus memantau pasaran dan melaksanakan strategi sesuai bagi memastikan operasi kami berjalan lancer dan kekal optimis terhadap prospek pertumbuhan kami untuk 2022.”

-Tamat-

Untuk Siaran Segera

LBS CATAT PENINGKATAN KEUNTUNGAN BERSIH 76%

BAGI FYE2021

- Hasil Q4FYE2021 meningkat sebanyak 50%

- Mencapai prestasi jualan 2021 sebanyak 31% kepada RM1.58 bilion

- 18 projek sedang berjalan dengan anggaran GDV sebanyak RM5.30 bilion

- Jualan belum dibil RM2.30 bilion

Petaling Jaya, 24 Februari 2022 – LBS Bina Group Berhad (“LBS” atau “Kumpulan”) hari ini mengumumkan keputusan suku keempatnya bagi tahun kewangan berakhir 31 Disember 2021 (“Q4FYE2021”).

Bagi tempoh dalam tinjauan, LBS melaporkan hasil keuntungan sebanyak RM441.84 juta yang diterjemahkan dari peningkatan tahun ke tahun sebanyak 50%. Syarikat turut mencatat keuntungan selepas cukai (“PAT”) sebanyak RM46.38 juta untuk Q4FYE2021, peningkatan yang amat memberangsangkan sebanyak 41 % berbanding Q4FYE2020.

Bagi FYE2021, keuntungan meningkat sebanyak 24.4%, tahun ke tahun, daripada RM1.10 bilion kepada RM1.36 bilion. Keuntungan RM1.36 bilion merupakan pencapaian tertinggi yang direkodkan oleh LBS dengan PAT meningkat 76% daripada RM67.29 juta kepada RM118.70 juta.

Prestasi FYE2021 yang kukuh ini didorong oleh usaha inovatif Syarikat di dalam inisiatif pendigitalan dan pelancaran Laman Hartanah Virtual LBS, Kempen Raikan Rezeki Bersama LBS dan Kempen Digital Vacci-Nation Bonanza yang menerima maklum balas dan diterima baik oleh orang ramai.

Dari segi pembangunan hartanah, yang merupakan penyumbang pendapatan utama LBS, pendapatan mencatatkan peningkatan kepada RM1.30 bilion, iaitu kenaikan 26% tahun ke tahun. Kenaikan ini didorong dari kadar pengambilan yang baik, dan kemajuan pembinaan yang stabil di projek yang sedang berjalan seperti Residensi Bintang Bukit Jalil, Taman Perindustrian Alam Awana, Cameron Centrum, KITA @ Cybersouth dan LBS Alam Perdana.

LBS mempunyai 18 projek pembangunan yang sedang berjalan dengan Nilai Pembangunan Kasar (“GDV”) sebanyak RM5.3 bilion, bank tanah seluas 2,744 ekar, setakat 31 Disember 2021, yang akan memastikan pengurusan syarikat aktif beroperasi untuk tempoh 10 tahun akan datang. Manakala jualan tidak dibil sebanyak RM2.30 bilion akan memberikan pulangan secara positif Syarikat untuk tempoh dua ke tiga tahun ke hadapan.

Mengulas mengenai keputusan itu, Pengerusi Eksekutif LBS, Tan Sri Lim Hock San berkata, “FYE2021 telah menjadi tahun yang luar biasa untuk LBS. Jumlah keuntungan kami mencapai paras yang tertinggi. Oleh itu, saya berharap keputusan kewangan LBS ini akan menjadi suatu kenyataan hala tuju LBS di dalam melangkah ke hadapan di samping mengekalkan kepercayaan para pemegang saham terhadap usaha LBS.

Pada tahun 2021, kami melepasi sasaran jualan hartanah kami sebanyak 31%, mencecah RM1.58 bilion berbanding sasaran awal kami sebanyak RM1.20 bilion. Ini merupakan permulaan yang baik untuk 2022. Pembangunan hartanah kekal menjadi perniagaan teras kami. Oleh itu, LBS telah menetapkan sasaran jualan yang lebih tinggi pada 2022 iaitu sebanyak RM1.60 bilion dengan menyasarkan 14 buah projek baru dengan nilai GDV sebanyak RM1.77 bilion. Kami yakin projek-projek ini bakal mendapat sambutan menggalakkan, berikutan lokasinya yang strategik. Ditambah dengan pelancaran suntikan penggalak vaksinasi, di mana kerajaan tidak lagi bercadang untuk mengenakan Perintah Kawalan Pergerakan di masa hadapan.

Untuk tahun 2022, kami akan terus berpegang teguh pada tiga tonggak utama kami iaitu Mampu Milik, Kesalinghubungan dan Komuniti. LBS turut berazam untuk menyediakan pembangunan di lokasi strategik dan mengekalkan harga yang berpatutan bagi memenuhi keperluan pembeli rumah di samping memenangi kepercayaan mereka. Kami akan terus memantau pasaran dan melaksanakan strategi sesuai bagi memastikan operasi kami berjalan lancer dan kekal optimis terhadap prospek pertumbuhan kami untuk 2022.”

-Tamat-

For Immediate Release

LBS FYE2021 NET PROFIT LEAPS BY 76%

- Q4FYE2021 revenue increased by 50%

- Outperformed 2021 sales target by 31% to RM1.58 billion

- 18 ongoing projects with an estimated GDV of RM5.30 billion

- Unbilled sales of RM2.30 billion

Petaling Jaya, 24 February 2022 – LBS Bina Group Berhad (“LBS” or the “Group”) today announced its fourth-quarter results for the financial year ended 31 December 2021 (“Q4FYE2021”).

For the period under review, LBS reported a revenue of RM441.84 million. This translates to a year-on-year increase of 50%. To add on, the Group recorded a profit after tax (“PAT”) of RM46.38 million for Q4FYE2021, an impressive 41% increase as compared to Q4FYE2020.

For FYE2021, revenue increased by 24%, year-on-year, from RM1.10 billion to RM1.36 billion. The RM1.36 billion revenue is LBS’ highest ever achieved. The PAT increased by 76%, from RM67.29 million to RM118.70 million.

The strong FYE2021 performance was attributed to the innovative digitalisation efforts by the Group such as LBS’ Virtual Property Page, Raikan Rezeki Bersama LBS and Vacci-Nation Bonanza digital campaigns, as well as in-demand products which were well-received by the public.

On the property development front, which is the Group’s main earnings contributor, revenue increased to RM1.30 billion, resulting in a 26% increase year-on-year. The respective increase was the end result of good take up rates and steady construction progress at ongoing projects such as Residensi Bintang Bukit Jalil, Alam Awana Industrial Park, Cameron Centrum, KITA @ Cybersouth and LBS Alam Perdana.

LBS currently has 18 ongoing development projects with an estimated Gross Development Value (“GDV”) of RM5.3 billion. The landbank of 2,744 acres, as at 31 December 2021, will keep the Group busy for the next 10 years. Unbilled sales of RM2.30 billion will contribute positively to the Group’s revenue over the next two to three years.

Commenting on the results, LBS Executive Chairman Tan Sri Lim Hock San said, “FYE2021 has turned out to be an exceptional year for LBS. Our numbers reached an all-time high. Nevertheless, I hope that our financial results are a testament of the direction LBS is heading towards and that the general public and our shareholders keep their faith in us.

In 2021, we surpassed our property sales target by 31%, hitting RM1.58 billion as compared to our initial target of RM1.20 billion. This is a great start to 2022. Property development will continue to be our core business. Therefore, we have set ourselves a higher property sales target of RM1.60 billion for 2022 via 14 new project launches with a gross development value of RM1.77 billion. We are confident our launches will continue to receive strong responses, given the strategic locations. Further, with the roll-out of the vaccination booster shots, it appears that the days of lockdowns are out of sight.

In 2022, we will remain true to our three main pillars of Affordability, Connectivity and Community. The LBS team is motivated to rise to the challenge of delivering developments in strategic locations while maintaining affordable prices to meet homebuyers’ needs and to win their trust. We will continue to monitor the market and implement appropriate strategies to ensure our operations are not disrupted. We remain optimistic of our growth prospects for 2022.”

-End-

For Immediate Release

LBS FYE2021 NET PROFIT LEAPS BY 76%

- Q4FYE2021 revenue increased by 50%

- Outperformed 2021 sales target by 31% to RM1.58 billion

- 18 ongoing projects with an estimated GDV of RM5.30 billion

- Unbilled sales of RM2.30 billion

Petaling Jaya, 24 February 2022 – LBS Bina Group Berhad (“LBS” or the “Group”) today announced its fourth-quarter results for the financial year ended 31 December 2021 (“Q4FYE2021”).

For the period under review, LBS reported a revenue of RM441.84 million. This translates to a year-on-year increase of 50%. To add on, the Group recorded a profit after tax (“PAT”) of RM46.38 million for Q4FYE2021, an impressive 41% increase as compared to Q4FYE2020.

For FYE2021, revenue increased by 24%, year-on-year, from RM1.10 billion to RM1.36 billion. The RM1.36 billion revenue is LBS’ highest ever achieved. The PAT increased by 76%, from RM67.29 million to RM118.70 million.

The strong FYE2021 performance was attributed to the innovative digitalisation efforts by the Group such as LBS’ Virtual Property Page, Raikan Rezeki Bersama LBS and Vacci-Nation Bonanza digital campaigns, as well as in-demand products which were well-received by the public.

On the property development front, which is the Group’s main earnings contributor, revenue increased to RM1.30 billion, resulting in a 26% increase year-on-year. The respective increase was the end result of good take up rates and steady construction progress at ongoing projects such as Residensi Bintang Bukit Jalil, Alam Awana Industrial Park, Cameron Centrum, KITA @ Cybersouth and LBS Alam Perdana.

LBS currently has 18 ongoing development projects with an estimated Gross Development Value (“GDV”) of RM5.3 billion. The landbank of 2,744 acres, as at 31 December 2021, will keep the Group busy for the next 10 years. Unbilled sales of RM2.30 billion will contribute positively to the Group’s revenue over the next two to three years.

Commenting on the results, LBS Executive Chairman Tan Sri Lim Hock San said, “FYE2021 has turned out to be an exceptional year for LBS. Our numbers reached an all-time high. Nevertheless, I hope that our financial results are a testament of the direction LBS is heading towards and that the general public and our shareholders keep their faith in us.

In 2021, we surpassed our property sales target by 31%, hitting RM1.58 billion as compared to our initial target of RM1.20 billion. This is a great start to 2022. Property development will continue to be our core business. Therefore, we have set ourselves a higher property sales target of RM1.60 billion for 2022 via 14 new project launches with a gross development value of RM1.77 billion. We are confident our launches will continue to receive strong responses, given the strategic locations. Further, with the roll-out of the vaccination booster shots, it appears that the days of lockdowns are out of sight.

In 2022, we will remain true to our three main pillars of Affordability, Connectivity and Community. The LBS team is motivated to rise to the challenge of delivering developments in strategic locations while maintaining affordable prices to meet homebuyers’ needs and to win their trust. We will continue to monitor the market and implement appropriate strategies to ensure our operations are not disrupted. We remain optimistic of our growth prospects for 2022.”

-End-

即时发布

林木生集团2021财年净利涨76%

- 2021财年末季营业额上扬50%

- 房地产销售额达15.8亿令吉,超越目标31%

- 18个进行中项目,发展总值约53亿令吉

- 未进账销售23亿令吉

(八打灵再也24日讯)林木生集团(LBS)今日公布截至12月31日2021财年末季业绩。

林木生集团末季取得4亿4184万令吉营业额,按年升50%;净利为4638万令吉,比去年同期高41.2%。

2021财年,该集团营业额从11亿令吉,年增24%,创新高录得13亿6000万令吉。净利达1亿1870万令吉,升幅76%,去年同期为6729万令吉。

2021财年业绩表现归功于本集团的创新数码举措,如虚拟房地产网页、Raikan Rezeki Bersama LBS和Vacci-Nation Bonanza数码市场营销活动,以及发展项目深受公众欢迎。

作为该集团的盈利主要贡献,房地产发展业营业额达13亿令吉,成长26%。这主要基于房地产发展的可观认购率,武吉加里尔Residensi Bintang和Mercu Jalil、Alam Awana工业园、金马仑中环(Cameron Centrum)、以及KITA @ Cybersouth和LBS Alam Perdana两大城镇等发展项目的施工进度稳健。

该集团有 18 个正在进行的发展项目,发展总值(GDV)约53亿令吉。截至2021年12月31日,该集团持有2744英亩地库,预计可让集团繁忙10年。未进账销售23亿令吉,将为集团提供未来2至3年的盈利能见度。

林木生集团执行主席丹斯里林福山针对业绩表现指出:“2021财年对本集团来说,是不平凡的一年,业绩刷新记录。无论如何,希望我们的业绩表现能够证明本集团的发展方向凑效,,并希望公众和股东对我们保持信心。”

2021年,该集团录得15亿8000万令吉房地产销售额,比此前所设下的12亿令吉目标超出31%。

“这是开启2022年新篇章的良好开始。房地产发展仍然是我们的核心业务,加上通过推介14个合计发展总值17亿7000万令吉的新发展项目,我们为2022年设下更高16亿令吉的房地产销售额目标。鉴于战略位置,有信心我们所推介的项目将继续受到强劲的市场反应。 此外,随着疫苗加强剂持续进行,似乎不会再经历封锁的日子。”

2022年,我们将维持可负担、交通便捷和社区完善3大发展支柱理念。集团团队有动力迎接挑战,交付位于战略位置的发展项目,同时继续提供可负担房屋,满足购屋者的需求,并赢得他们的信任。我们将继续观察市况,并实施适当策略,以确保营运顺畅。我们对2022年的增长前景保持乐观。”

欲了解更多信息,请游览 https://lbs.com.my/ 。

~完~

即时发布

林木生集团2021财年净利涨76%

- 2021财年末季营业额上扬50%

- 房地产销售额达15.8亿令吉,超越目标31%

- 18个进行中项目,发展总值约53亿令吉

- 未进账销售23亿令吉

(八打灵再也24日讯)林木生集团(LBS)今日公布截至12月31日2021财年末季业绩。

林木生集团末季取得4亿4184万令吉营业额,按年升50%;净利为4638万令吉,比去年同期高41.2%。

2021财年,该集团营业额从11亿令吉,年增24%,创新高录得13亿6000万令吉。净利达1亿1870万令吉,升幅76%,去年同期为6729万令吉。

2021财年业绩表现归功于本集团的创新数码举措,如虚拟房地产网页、Raikan Rezeki Bersama LBS和Vacci-Nation Bonanza数码市场营销活动,以及发展项目深受公众欢迎。

作为该集团的盈利主要贡献,房地产发展业营业额达13亿令吉,成长26%。这主要基于房地产发展的可观认购率,武吉加里尔Residensi Bintang和Mercu Jalil、Alam Awana工业园、金马仑中环(Cameron Centrum)、以及KITA @ Cybersouth和LBS Alam Perdana两大城镇等发展项目的施工进度稳健。

该集团有 18 个正在进行的发展项目,发展总值(GDV)约53亿令吉。截至2021年12月31日,该集团持有2744英亩地库,预计可让集团繁忙10年。未进账销售23亿令吉,将为集团提供未来2至3年的盈利能见度。

林木生集团执行主席丹斯里林福山针对业绩表现指出:“2021财年对本集团来说,是不平凡的一年,业绩刷新记录。无论如何,希望我们的业绩表现能够证明本集团的发展方向凑效,,并希望公众和股东对我们保持信心。”

2021年,该集团录得15亿8000万令吉房地产销售额,比此前所设下的12亿令吉目标超出31%。

“这是开启2022年新篇章的良好开始。房地产发展仍然是我们的核心业务,加上通过推介14个合计发展总值17亿7000万令吉的新发展项目,我们为2022年设下更高16亿令吉的房地产销售额目标。鉴于战略位置,有信心我们所推介的项目将继续受到强劲的市场反应。 此外,随着疫苗加强剂持续进行,似乎不会再经历封锁的日子。”

2022年,我们将维持可负担、交通便捷和社区完善3大发展支柱理念。集团团队有动力迎接挑战,交付位于战略位置的发展项目,同时继续提供可负担房屋,满足购屋者的需求,并赢得他们的信任。我们将继续观察市况,并实施适当策略,以确保营运顺畅。我们对2022年的增长前景保持乐观。”

欲了解更多信息,请游览 https://lbs.com.my/ 。

~完~