LBS Delivers Impressive Earnings In Q2FYE22

Erfan Sakib

on

August 22, 2022

22 August 2022

Untuk Siaran Segera

LBS CATAT PENDAPATAN KUKUH PADA Q2FYE22

- Pendapatan meningkat 54% tahun ke tahun kepada RM410 juta daripada RM266 juta.

- Pelancaran 14 projek baharu bernilai RM1.77 bilion dengan tempahan dalam perancangan sebanyak RM317 juta.

- Nilai jualan tanpa bil sebanyak RM2.4 bilion.

- Jumlah jualan hartanah (21 Ogos 2022: RM1.31 bilion) – 82% daripada sasaran jualan bagi tahun 2022.

Petaling Jaya, 22 Ogos 2022 – LBS Bina Group Berhad hari ini mengumumkan keputusan suku kedua bagi tahun kewangan berakhir 31 Disember 2022 (“Q2FYE22”).

Bagi suku dalam tinjauan, LBS merekodkan hasil keuntungan RM410.4 juta dan keuntungan selepas cukai sebanyak RM33.2 juta, peningkatan tahun ke tahun masing-masing sebanyak 54% dan 71%. Keuntungan selepas cukai dan kepentingan bukan kawalan (“PATMI”) meningkat sebanyak 116%, tahun ke tahun, kepada RM35.1 juta. Syarikat melaporkan keputusan kewangan yang kukuh di sebalik cabaran industri pembinaan seperti kekurangan buruh dan tekanan inflasi yang meningkat.

Bagi enam bulan berakhir 30 Jun 2022 (“6MFYE22”), hasil dan PATMI masing-masing melonjak sebanyak 23% dan 58% kepada RM819.4 juta dan RM65.3 juta berbanding tempoh yang sama pada tahun 2021. Sebahagian besar peningkatan ini berikutan kadar pengambilan positif syarikat bagi projek di Bukit Jalil, LBS Alam Perdana, KITA @ Cybersouth dan Taman Perindustrian Alam Awana. Projek pembangunan di Lembah Klang dilaporkan menyumbang lebih 84% daripada hasil 6MFYE22. Nilai dan kesamaan tunai LBS, pada akhir Jun 2022, adalah sebanyak RM265.7 juta, meningkat 62% berbanding 6MFYE21.

Pada 21 Ogos 2022, LBS telah mengumumkan rekod jualan hartanah sebanyak RM1.31 bilion dan tempahan dalam perancangan sebanyak RM313 juta. Sehingga 31 Julai 2022, Syarikat mempunyai bank tanah untuk pembangunan masa hadapan seluas 2,674 ekar.

Mengulas mengenai keputusan itu, Pengerusi Eksekutif LBS Tan Sri Lim Hock San berkata, “LBS telah menghasilkan pendapatan yang luar biasa pada suku ini. Ini merupakan sebahagian daripada pelancaran yang dirancang teliti di samping usaha berterusan Syarikat untuk melaksanakan strategi pemasaran yang inovatif. Di dalam persekitaran yang penuh dengan ketidakpastian akibat kekurangan tenaga kerja, kenaikan kadar faedah serta kenaikan harga bahan mentah, saya gembira kerana kami berjaya mengekalkan pendapatan kami. Kami juga sedar bahawa semua ini memerlukan masa untuk pulih dan berharap momentum ini dapat dikekalkan menuju ke separuh kedua 2022.

Kejayaan memperolehi catatan RM1.31 bilion jualan, bersamaan dengan 82% daripada sasaran jualan tahun 2022. Kami gembira kerana kadar pengambilan kukuh bagi projek-projek kami pada suku kedua, khususnya di pembangunan LBS Alam Perdana dan KITA @ Cybersouth. Ini menunjukkan bahawa kami berada di landasan tepat dengan pembinaan di kawasan strategik sekaligus berupaya menyediakan rumah mampu milik yang memenuhi keperluan pembeli rumah. Kami akan terus kekal fokus pada rancangan pertumbuhan kami sambil mengutamakan pemegang saham kami dan tentunya kami berhasrat untuk membawa LBS ke tahap yang lebih tinggi.”

-Tamat-

Untuk Siaran Segera

LBS CATAT PENDAPATAN KUKUH PADA Q2FYE22

- Pendapatan meningkat 54% tahun ke tahun kepada RM410 juta daripada RM266 juta.

- Pelancaran 14 projek baharu bernilai RM1.77 bilion dengan tempahan dalam perancangan sebanyak RM317 juta.

- Nilai jualan tanpa bil sebanyak RM2.4 bilion.

- Jumlah jualan hartanah (21 Ogos 2022: RM1.31 bilion) – 82% daripada sasaran jualan bagi tahun 2022.

Petaling Jaya, 22 Ogos 2022 – LBS Bina Group Berhad hari ini mengumumkan keputusan suku kedua bagi tahun kewangan berakhir 31 Disember 2022 (“Q2FYE22”).

Bagi suku dalam tinjauan, LBS merekodkan hasil keuntungan RM410.4 juta dan keuntungan selepas cukai sebanyak RM33.2 juta, peningkatan tahun ke tahun masing-masing sebanyak 54% dan 71%. Keuntungan selepas cukai dan kepentingan bukan kawalan (“PATMI”) meningkat sebanyak 116%, tahun ke tahun, kepada RM35.1 juta. Syarikat melaporkan keputusan kewangan yang kukuh di sebalik cabaran industri pembinaan seperti kekurangan buruh dan tekanan inflasi yang meningkat.

Bagi enam bulan berakhir 30 Jun 2022 (“6MFYE22”), hasil dan PATMI masing-masing melonjak sebanyak 23% dan 58% kepada RM819.4 juta dan RM65.3 juta berbanding tempoh yang sama pada tahun 2021. Sebahagian besar peningkatan ini berikutan kadar pengambilan positif syarikat bagi projek di Bukit Jalil, LBS Alam Perdana, KITA @ Cybersouth dan Taman Perindustrian Alam Awana. Projek pembangunan di Lembah Klang dilaporkan menyumbang lebih 84% daripada hasil 6MFYE22. Nilai dan kesamaan tunai LBS, pada akhir Jun 2022, adalah sebanyak RM265.7 juta, meningkat 62% berbanding 6MFYE21.

Pada 21 Ogos 2022, LBS telah mengumumkan rekod jualan hartanah sebanyak RM1.31 bilion dan tempahan dalam perancangan sebanyak RM313 juta. Sehingga 31 Julai 2022, Syarikat mempunyai bank tanah untuk pembangunan masa hadapan seluas 2,674 ekar.

Mengulas mengenai keputusan itu, Pengerusi Eksekutif LBS Tan Sri Lim Hock San berkata, “LBS telah menghasilkan pendapatan yang luar biasa pada suku ini. Ini merupakan sebahagian daripada pelancaran yang dirancang teliti di samping usaha berterusan Syarikat untuk melaksanakan strategi pemasaran yang inovatif. Di dalam persekitaran yang penuh dengan ketidakpastian akibat kekurangan tenaga kerja, kenaikan kadar faedah serta kenaikan harga bahan mentah, saya gembira kerana kami berjaya mengekalkan pendapatan kami. Kami juga sedar bahawa semua ini memerlukan masa untuk pulih dan berharap momentum ini dapat dikekalkan menuju ke separuh kedua 2022.

Kejayaan memperolehi catatan RM1.31 bilion jualan, bersamaan dengan 82% daripada sasaran jualan tahun 2022. Kami gembira kerana kadar pengambilan kukuh bagi projek-projek kami pada suku kedua, khususnya di pembangunan LBS Alam Perdana dan KITA @ Cybersouth. Ini menunjukkan bahawa kami berada di landasan tepat dengan pembinaan di kawasan strategik sekaligus berupaya menyediakan rumah mampu milik yang memenuhi keperluan pembeli rumah. Kami akan terus kekal fokus pada rancangan pertumbuhan kami sambil mengutamakan pemegang saham kami dan tentunya kami berhasrat untuk membawa LBS ke tahap yang lebih tinggi.”

-Tamat-

Mengenai LBS Bina Group Berhad

LBS Bina Group Berhad (LBS), pemaju perbandaran terkemuka di peringkat antarabangsa dengan visi untuk membina ruang inspirasi sempurna merupakan penyandang pelbagai anugerah menerusi projek pembangunannya. Dengan mengutamakan pembeli rumah, LBS telah membina dan membentuk landskap negara selama 30 tahun dan terus memenuhi permintaan pasaran bagi rumah berkualiti dan mampu milik.

Kini, dengan bank tanah di seluruh Malaysia, LBS terus meraih kejayaan dan kekal kukuh dengan kejayaan perbandaran seperti Bandar Saujana Putra, KITA @ Cybersouth di Dengkil, LBS Alam Perdana di Bandar Puncak Alam dan lain-lain lagi. Selain daripada pembangunan hartanah, LBS turut terlibat di dalam pengurusan runcit, perhotelan dan pelancongan.

Kejayaan berterusan yang dilakar oleh LBS adalah hasil kepimpinan Pengerusi Eksekutif Kumpulan LBS, Tan Sri Lim Hock San yang turut dianugerahkan dengan pingat emas sebagai Property Man of the year by Malaysia Property Award (FIABCI) pada tahun 2018 yang merupakan Anugerah ‘Oscar’ dalam industri hartanah. Ketabahan dan kegigihan Tan Sri Lim di dalam mengatasi cabaran industri, serta kepimpinan yang cemerlang dengan pengetahuan ilmu industri hartanah yang unggul di samping nilai integriti dan tanggungjawab menjadi tonggak kepada penerimaan anugerah ini.

Disediakan Oleh:

Jabatan Komunikasi Korporat, Media & Digital, LBS

Untuk pertanyaan media, sila hubungi:

1. Ng Shu Wain

Emel: [email protected]

2. Jabatan Komunikasi Korporat, Media & Digital, LBS

Emel: [email protected]

For Immediate Release

LBS DELIVERS IMPRESSIVE EARNINGS IN Q2FYE22

- Revenue increased 54% year-on-year to RM410 million from RM266 million.

- 14 new project launches worth of RM1.77 billion with bookings in the pipeline of RM317 million.

- Strong unbilled sales of RM2.4 billion.

- Total property sales (21 August 2022: RM1.31 billion) – 82% of 2022 sales target.

Petaling Jaya, 22 August 2022 – LBS Bina Group Berhad (“LBS” or the “Group”) today announced its second quarter results for the financial year ending 31 December 2022 (“Q2FYE22”).

For the quarter under review, LBS delivered revenue of RM410.4 million and profit after tax of RM33.2 million, a year-on-year increase of 54% and 71% respectively. Profit after tax and non-controlling interests (“PATMI”) increased by 116%, year-on-year, to RM35.1 million. The Group reported a strong set of financial results despite encountering industry-wide challenges such as labour shortages and rising inflationary pressure.

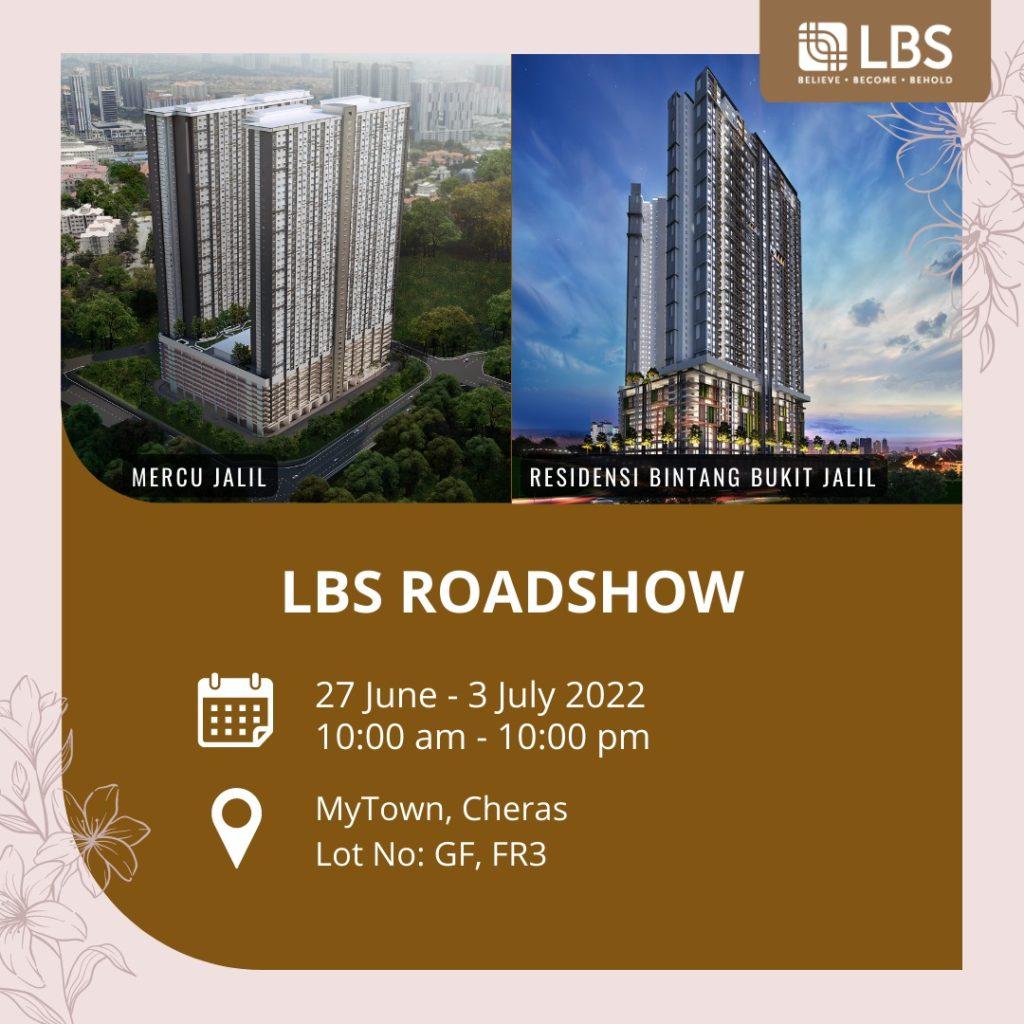

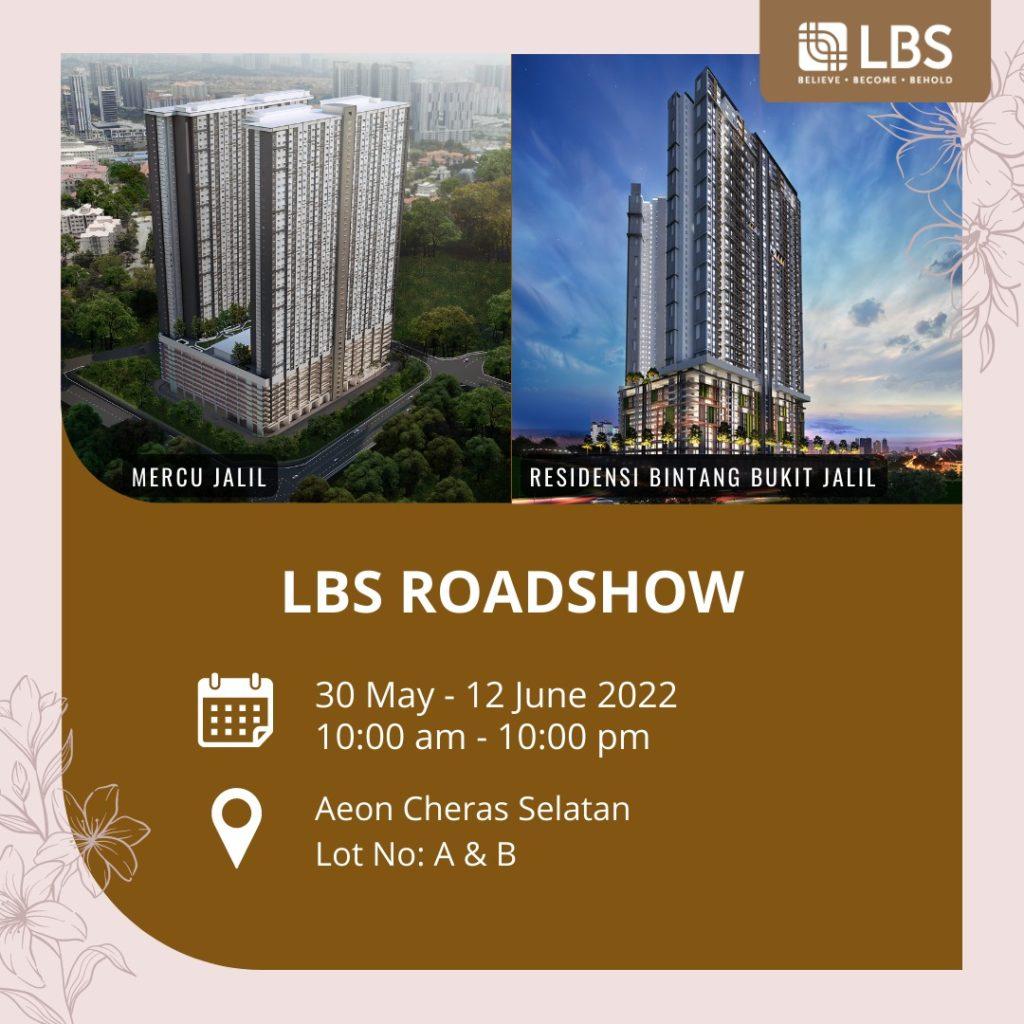

For the six months ended 30 June 2022 (“6MFYE22”), revenue and PATMI surged by 23% and 58% respectively to RM819.4 million and RM65.3 million as compared to the corresponding period in 2021. The increase was largely attributable to the positive take-up rates of the Group’s projects at Bukit Jalil, LBS Alam Perdana, KITA @ Cybersouth and Alam Awana Industrial Park. The Group reported that development projects within the Klang Valley accounted for more than 84% of the 6MFYE22 revenue. LBS’ cash and cash equivalents, as at end June 2022, was RM265.7 million, an increase of 62% compared to 6MFYE21.

The Group announced that as at 21 August 2022, it has recorded property sales of RM1.31 billion, bookings in the pipeline of RM313 million. As at 31 July 2022, the Group has a land bank for future development of 2,674 acres.

Commenting on the results, LBS Executive Chairman Tan Sri Lim Hock San said, “LBS has reported a set of remarkable earnings this quarter. This is part and parcel due to carefully planned launches and the Group’s relentless effort to push forward with innovative marketing strategies. In an environment filled with much uncertainty due to labour shortages, interest rate hikes and raw material price increases, I am glad that we have managed to sustain our earnings. While we are aware that solving these issues would be a gradual process, we hope to keep up our momentum heading into the second half of 2022.

We have secured RM1.31 billion in sales, equivalent to 82% of our 2022 sales target. We are pleased that we have continued to receive strong take-up rates for our projects in the second quarter, in particular at our LBS Alam Perdana and KITA @ Cybersouth developments. This indicates that we are building in the right key areas and delivering affordable housing which satisfies the needs of our homebuyers. We continue to remain focused on our growth plans while prioritising our shareholders as we aim to elevate LBS to greater heights.”

-End-

For Immediate Release

LBS DELIVERS IMPRESSIVE EARNINGS IN Q2FYE22

- Revenue increased 54% year-on-year to RM410 million from RM266 million.

- 14 new project launches worth of RM1.77 billion with bookings in the pipeline of RM317 million.

- Strong unbilled sales of RM2.4 billion.

- Total property sales (21 August 2022: RM1.31 billion) – 82% of 2022 sales target.

Petaling Jaya, 22 August 2022 – LBS Bina Group Berhad (“LBS” or the “Group”) today announced its second quarter results for the financial year ending 31 December 2022 (“Q2FYE22”).

For the quarter under review, LBS delivered revenue of RM410.4 million and profit after tax of RM33.2 million, a year-on-year increase of 54% and 71% respectively. Profit after tax and non-controlling interests (“PATMI”) increased by 116%, year-on-year, to RM35.1 million. The Group reported a strong set of financial results despite encountering industry-wide challenges such as labour shortages and rising inflationary pressure.

For the six months ended 30 June 2022 (“6MFYE22”), revenue and PATMI surged by 23% and 58% respectively to RM819.4 million and RM65.3 million as compared to the corresponding period in 2021. The increase was largely attributable to the positive take-up rates of the Group’s projects at Bukit Jalil, LBS Alam Perdana, KITA @ Cybersouth and Alam Awana Industrial Park. The Group reported that development projects within the Klang Valley accounted for more than 84% of the 6MFYE22 revenue. LBS’ cash and cash equivalents, as at end June 2022, was RM265.7 million, an increase of 62% compared to 6MFYE21.

The Group announced that as at 21 August 2022, it has recorded property sales of RM1.31 billion, bookings in the pipeline of RM313 million. As at 31 July 2022, the Group has a land bank for future development of 2,674 acres.

Commenting on the results, LBS Executive Chairman Tan Sri Lim Hock San said, “LBS has reported a set of remarkable earnings this quarter. This is part and parcel due to carefully planned launches and the Group’s relentless effort to push forward with innovative marketing strategies. In an environment filled with much uncertainty due to labour shortages, interest rate hikes and raw material price increases, I am glad that we have managed to sustain our earnings. While we are aware that solving these issues would be a gradual process, we hope to keep up our momentum heading into the second half of 2022.

We have secured RM1.31 billion in sales, equivalent to 82% of our 2022 sales target. We are pleased that we have continued to receive strong take-up rates for our projects in the second quarter, in particular at our LBS Alam Perdana and KITA @ Cybersouth developments. This indicates that we are building in the right key areas and delivering affordable housing which satisfies the needs of our homebuyers. We continue to remain focused on our growth plans while prioritising our shareholders as we aim to elevate LBS to greater heights.”

-End-

About LBS Bina Group Berhad

LBS Bina Group Berhad (“LBS”), an internationally recognized developer with a vision for building and inspiring delightful spaces, is a renowned township developer that has amassed numerous awards through their various developments. By placing people at the heart of their approach, LBS has been building and shaping the nation’s landscape for over 30 years while continuing to meet the market demands for quality and affordable homes.

The continued success of LBS is attributed to the leadership of Executive Chairman, Tan Sri Lim Hock San. In recognition of his leadership, Tan Sri Lim was named as the Property Man of the Year by Malaysia Property Award (formerly known as FIABCI Malaysia Property Awards of Distinction or FIABCI Malaysia Awards of Distinction) in 2018, which is the gold standard for developers in the real estate industry. Further recognition received was the “Oscar Award” in the property fraternity. The award was in recognition of Tan Sri Lim’s perseverance and resilience over time within the industry, excellent demonstration of strong leadership, deep industry knowledge and impeccable values of integrity and responsibility.

To date, LBS with vast land banks spread across Malaysia, will continue to grow in stature and strength, through replicating successful townships such as Bandar Saujana Putra to other parts of Selangor including KITA @ Cybersouth in Dengkil, LBS Alam Perdana in Bandar Puncak

Alam and so on. Beyond property development, LBS is also venturing into retail management, hospitality and tourism.

For more information, visit https://lbs.com.my/

For media inquiries, please contact:

1. Ng Shu Wain

Email: [email protected]

2. Corporate Communication, Media & Digital, LBS

Email: [email protected]

For Immediate Release

林木生集团2022财年次季盈利亮眼

● 营业额从2亿6600万令吉,按年上扬54%至4亿1040万令吉

● 14项总值17亿7000万令吉新发展项目,预定额达3亿1700万令吉 ● 强劲24亿令吉未进账销售

● 截至2022年8月21日总房地产销售额13亿1000万令吉,已达全年销 售额目标82%

(八打灵再也22日讯)林木生集团(LBS)今日宣布截至12月31日2022 财年次季业绩。

林木生集团2022财年次季取得4亿1040万令吉营业额和3320万令吉税后盈 利,分别年增54%和71%。税后盈利与非控制权益(PATMI)年起116%至 3510万令吉。尽管面临劳工短缺和通胀压力等全行业挑战,该集团仍交出 亮眼业绩表现。

截至2022年6月30日首6个月,营业额按年扬升23%至8亿1940万令吉;税 后盈利与非控制权益达6530万令吉,年增幅为58%。成长主要归功于旗下 武吉加里尔发展项目、LBS Alam Perdana城镇、KITA @ Cybersouth城 镇、以及Alam Awana Industrial Park的良好认购率。该集团巴生谷发展 项目贡献了超过84%营业额。截至2022年6月底,该集团的现金及现金等 值为2亿6570万令吉,比去年同期高62%。

截至2022年8月21日,该集团取得13亿1000万令吉房地产销售额,预定额 为3亿1300万令吉。该集团截至2022年7月31日手持2674英亩地库。

林木生集团执行主席丹斯里林福山针对业绩指出:“本集团次季获利强劲 ,是基于精心策划的发展项目,以及集团不懈努力推进创新营销策略。在 劳工短缺、升息、以及原材料价格上涨等充满不确定性的环境下,开心我 们能够维持获利。虽然我们知道解决这些问题将是个渐进的过程,但我们 希望在2022下半年继续保持势头。”

丹斯里林福山补充:“我们年初至今取得13亿1000万令吉房地产销售额 ,已占全年目标的82%。我们的发展项目在次季仍取得可观的认购率,尤 其LBS Alam Perdana和KITA @ Cybersouth 两个城镇。这表明我们在正 确的关键区域建设,并提供满足购屋者需求的可负担房屋。我们将继续专 注于我们的增长计划,同时优先考虑我们的股东,因为我们的目标是将本 集团迈向更高一层楼。”

For Immediate Release

林木生集团2022财年次季盈利亮眼

● 营业额从2亿6600万令吉,按年上扬54%至4亿1040万令吉

● 14项总值17亿7000万令吉新发展项目,预定额达3亿1700万令吉 ● 强劲24亿令吉未进账销售

● 截至2022年8月21日总房地产销售额13亿1000万令吉,已达全年销 售额目标82%

(八打灵再也22日讯)林木生集团(LBS)今日宣布截至12月31日2022 财年次季业绩。

林木生集团2022财年次季取得4亿1040万令吉营业额和3320万令吉税后盈 利,分别年增54%和71%。税后盈利与非控制权益(PATMI)年起116%至 3510万令吉。尽管面临劳工短缺和通胀压力等全行业挑战,该集团仍交出 亮眼业绩表现。

截至2022年6月30日首6个月,营业额按年扬升23%至8亿1940万令吉;税 后盈利与非控制权益达6530万令吉,年增幅为58%。成长主要归功于旗下 武吉加里尔发展项目、LBS Alam Perdana城镇、KITA @ Cybersouth城 镇、以及Alam Awana Industrial Park的良好认购率。该集团巴生谷发展 项目贡献了超过84%营业额。截至2022年6月底,该集团的现金及现金等 值为2亿6570万令吉,比去年同期高62%。

截至2022年8月21日,该集团取得13亿1000万令吉房地产销售额,预定额 为3亿1300万令吉。该集团截至2022年7月31日手持2674英亩地库。

林木生集团执行主席丹斯里林福山针对业绩指出:“本集团次季获利强劲 ,是基于精心策划的发展项目,以及集团不懈努力推进创新营销策略。在 劳工短缺、升息、以及原材料价格上涨等充满不确定性的环境下,开心我 们能够维持获利。虽然我们知道解决这些问题将是个渐进的过程,但我们 希望在2022下半年继续保持势头。”

丹斯里林福山补充:“我们年初至今取得13亿1000万令吉房地产销售额 ,已占全年目标的82%。我们的发展项目在次季仍取得可观的认购率,尤 其LBS Alam Perdana和KITA @ Cybersouth 两个城镇。这表明我们在正 确的关键区域建设,并提供满足购屋者需求的可负担房屋。我们将继续专 注于我们的增长计划,同时优先考虑我们的股东,因为我们的目标是将本 集团迈向更高一层楼。”

关于林木生集团

屡获大奖的城镇发展商林木生集团(LBS)以打造和创建空间而声名卓著,享誉国际。在30 多年来, LBS秉持着以人为本的核心宗旨,积极建立和塑造国家实景,同时不断满足市场对 优质可负担房屋的需求。

如今,该集团的地库坐落马来西亚黄金地段。LBS以成功建造的太子城(Bandar Saujana Putra)城镇为例,继续在雪兰莪州及其他地区大展蓝图,如建造位于本查阿南的LBS Alam Perdana以及龙溪KITA @ Cybersouth城镇等。林木生集团的地位和实力也因而蓬勃增长, 除了开发房地产,也涉足零售管理、酒店和旅游业。

林木生集团的茁壮成长,归功于集团执行主席丹斯里林福山的卓越领导。丹斯里林福山曾获 多项表彰领导才能的奖项,包括在2018年荣获“世界不动产联盟大马分会(FIABCI Malaysia)颁发至高殊荣的产业风云人物奖,此荣誉也被堪称产业界“奥斯卡金像奖”。丹 斯里林福山出色和强而有力的领导才能、丰富的业界知识、诚信、价值观及责任感,而荣获 此项大奖。

Imej Jiwa Communications私人有限公司代表林木生集团发新闻稿

Ng Shu Wain

E-mail: [email protected]

林木生集团企业通讯、媒体与数码部

E-mail: [email protected]