FAB 2021 | Finale Prize Presentation Ceremony

Erfan Sakib

on

March 28, 2022

Event

- This event is to gather all the winners of The LBS Fabulous 20-21 Grand Finale Lucky Draw to collect the prizes. VVIPs of LBS will be presenting the main prizes such as cars, motorcycles and bicycles.

- During the event, you will be given a redemption letter that will allow you to redeem your LBS FABULOUS 20-21 prizes. All prizes are available for redemption on the spot except for Sharp Refrigerator, Sharp Washing Machine and DELL Notebooks. You will need to collect your redemption letter at this event and arrange collection of these items with our vendors.

- On the event day, we are also giving away 30 AEON cash vouchers worth RM20 to 30 early birds who arrive early & attended the event.

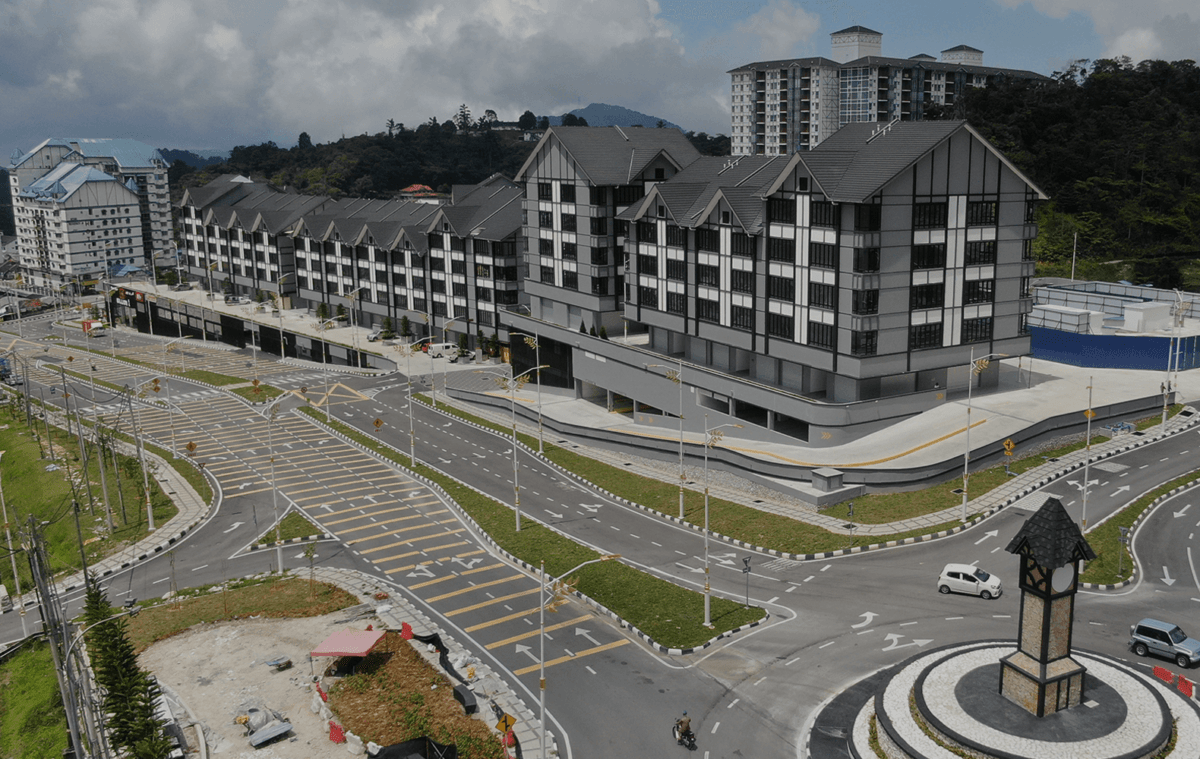

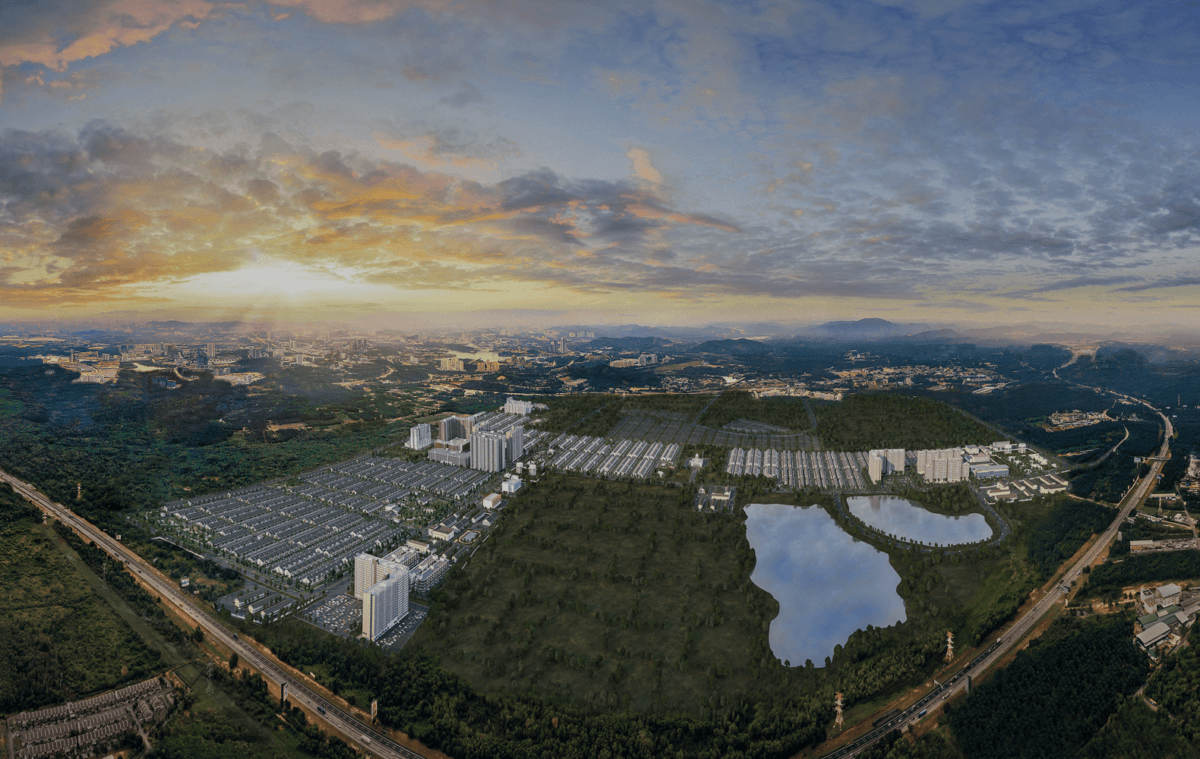

- As for new homebuyers, whoever purchase a house at KITA@Cybersouth on the event day – 2nd April 2022 will also be entitled to get a 42” TV.

- For those who are not able to attend the prize-giving ceremony, we will email you your redemption letter, 1 – 2 weeks after the event. You may liaise with our vendor on arrangements to collect your prize. Please present your redemption letter to the vendor for their verification before they release the prize to you.

- You are allowed to bring your family and friends too. Please RSVP with us and let us know the number of pax you are bringing to the event. F&B will be provided

Eligibility of Winners

In order to redeem the Prize, you must have fulfilled the terms and conditions below:

1. You must have executed and stamped a valid Sale and Purchase Agreement between 1stJanuary 2020 to 31st December 2021 (“hereinafter referred to as “SPA”) with the Developer;

2. You must have either;

- executed and stamped the Facilities Agreement with a bank/end-financier for the Property (applicable if you have opted to obtain a loan from a bank/end financier to pay for the Purchase Price of the Property); or

- settled at least fifty percent (50%) of the total Purchase Price (excluding any developers rebates offered by us to you) in accordance to the Third Schedule of the SPA (applicable if you have opted to finance the Property in cash).

3. You must not have defaulted or breached any provisions in the SPA and/or the Facilities Agreement.

4. In the event the SPA is terminated and/or cancelled and/or the winner’s defaults on any payment due and payable under the SPA for any reason whatsoever, you will be deemed disqualified from being entitled to the Prize. You shall pay the retail price of the Prize to LBS Bina Holdings Sdn Bhd within Seven (7) days of the demand or request made by LBS Bina Holdings Sdn Bhd. We reserve the right to initiate legal action against you for the retail price of the Prize, in the event you fail, omit and/or neglect to make such payment, including but not limited to the recovery of all costs, expenses, damages, and losses suffered by LBS Bina Holdings Sdn Bhd as a result of your neglect to pay.

5. You shall furnish your NRIC for verification during or prior to the redemption of the Prize.

6. We shall have the right to withhold or forfeit the Prize from any Lucky Draw Winners if you fail to provide your NRIC upon collection of the Lucky Draw Prize and/or to collect the Lucky Draw Prize within Sixty (60) daysfrom the draw date on 28th March 2022.

7. You shall bear all costs and expenses related to the redemption of the Prize absolutely, and we shall not responsible in any way whatsoever in the event that you fail to claim the Prize due to your own personal circumstances. You shall not authorize any third parties to act as a representative for you to collect any motor vehicle/motor cycle prize except for electronical/gadget/bicycle prize is allowed.

8. You shall bear all duties, taxes, fees, and/or levies relating to the Prize and shall make such payments directly with the regulatory authority in question.

9. You shall duly observe and continue to comply with all relevant terms and conditions stated in the LBS Fabulous Lucky Draw Terms & Conditions.

Notwithstanding the above, if you need more info on your winning and prize, please make yourself available at KITA @ Cybersouth Sales Gallery on 2nd April 2022.

Thank you,

LBS.

LBS Fabulous 20-21 Lucky Draw

Erfan Sakib

on

March 22, 2022

Tick! Tock! Set your calendar guys!

LBS Bina Group will be sharing good fortune again this year through the Grand Finale of LBS Fabulous Lucky Draw 20-21!

To our homebuyers, stand a chance to bring home over 700 prizes in the finale round. Tune in our LIVE @ LBS Bina Group Facebook Page on Mon, 28th March 2022 at 2pm. #LBSFab2021LuckyDraw

For more info, kindly visit www.lbs.com.my/ or call 1700 81 8998

20220321 LBS PARTICIPATES IN THE PROPOSED JOINT VENTURE OF A LIGHT RAIL TRANSPORT SYSTEM

Erfan Sakib

on

March 21, 2022

For Immediate Release

LBS PARTICIPATES IN THE PROPOSED JOINT VENTURE OF A LIGHT RAIL TRANSPORT SYSTEM WITH TRANSIT ORIENTED DEVELOPMENT IN JOHOR BAHRU

___________________________________________________________________________________________________________________________

Petaling Jaya, 21 March 2022 – LBS Bina Group Berhad (“LBS” or the “Group”) today announced that it has entered into a Heads of Agreement (“HOA”) with Nylex (Malaysia) Berhad (“Nylex”), Sinar Bina Infra Sdn. Bhd. (“SBI”), BTS Group Holdings Public Company Limited (BTS) and Ancom Berhad (“Ancom”) to build and operate a light rail transport system (“LRT Project”) with an integrated property development based on the “Transit-Oriented Development” concept in Johor Bahru’s metropolitan region. LBS and SBI have certain strategic land banks in Johor Bahru while BTS is a public listed company in Thailand and the majority shareholder of Bangkok Mass Transit System PCL, the operator of the BTS Skytrain and Bangkok BRT.

Pursuant to the HOA, LBS shall inject its lands at a consideration to be mutually agreed taking into account the valuation to be carried out by an independent valuer. In exchange, LBS will receive Nylex shares priced at RM0.15 per share and LBS or its affiliate shall be the preferred civil and construction contractor for the LRT Project as well as the preferred main contractor for the development of the LBS lands. The HOA is subject to the completion of a feasibility study to be conducted by BTS and professional consultants, the grant of the LRT Project concessions by the state government of Johor to SBI and signing of definitive agreements.

LBS Executive Chairman Tan Sri Lim Hock San said, “This potential collaboration provides us with an opportunity to monetise our lands in Johor and expand our property development and construction expertise beyond our usual housing projects. We expect to generate infrastructure construction income and steady recurring income from this project. The Johor Bahru metropolitan region is up and coming, connectivity is crucial for its growth. Our lands are strategically located. We foresee this project to be a viable development which will ease the transportation and connectivity concerns of the local community.

In addition, we are pleased to be able to work with experienced professionals who have appropriate technical skills and knowledge to see us through this project. We will work towards inking the definitive agreements and share any developments in addition to the final terms and conditions when available.”

-End-

LBS Participates In The Proposed Joint Venture Of A Light Rail Transport System

Erfan Sakib

on

March 21, 2022

21 March 2022

Untuk Siaran Segera

LBS SERTAI CADANGAN KERJASAMA PEMBANGUNAN

SISTEM TRANSIT ALIRAN RINGAN DI JOHOR BAHRU

Petaling Jaya, 21 Mac 2022 – LBS Bina Group Berhad (“LBS” atau “Kumpulan”) hari ini mengumumkan kerjasama melalui perjanjian utama (“HOA”) yang dimeterai dengan Nylex (Malaysia) Berhad (“Nylex”), pemegang saham Sinar Bina Infra Sdn. Bhd. (“SBI”) iaitu, BTS Group Holdings Public Company Limited (BTS) dan Ancom Berhad (“Ancom”) untuk membina dan mengendalikan sistem transit aliran ringan (“Projek LRT”) dengan pembangunan hartanah bersepadu berdasarkan konsep “Pembangunan Berorientasikan Transit” di wilayah metropolitan Johor Bahru. LBS dan SBI mempunyai bank tanah strategik di kawasan tertentu di Johor Bahru manakala BTS ialah syarikat tersenarai awam di Thailand dan pemegang saham majoriti bagi Bangkok Mass Transit System PCL, iaitu pengendali BTS Skytrain dan Bangkok BRT.

Menurut HOA, LBS akan menyediakan hartanah di kawasan tersebut berdasarkan pertimbangan yang dipersetujui bersama dengan mengambil kira penilaian yang bakal dilakukan oleh penilai bebas, bagi tujuan Projek LRT. Sebagai pertukaran, LBS akan menerima saham Nylex pada harga RM0.15 sesaham dan LBS atau mana-mana anak syarikatnya akan menjadi kontraktor utama bagi pembangunan berkaitan. HOA tertakluk kepada keputusan kajian yang akan dijalankan oleh BTS dan perunding profesional, pemberian konsesi Projek LRT oleh kerajaan negeri Johor kepada SBI serta menandatangani perjanjian muktamad bagi projek tersebut.

Pengerusi Eksekutif LBS Tan Sri Lim Hock San berkata, “Kerjasama yang berpotensi ini memberi peluang untuk kami memberi nilai tambah yang sewajarnya ke atas tanah-tanah kami di Johor di samping meningkatkan kepakaran pembangunan hartanah dan pembinaan sertai mengatasi projek perumahan yang biasa dibangunkan. Kami menjangka untuk menjana pendapatan melalui pembinaan infrastruktur dan pendapatan berulang yang stabil melalui projek ini. Wilayah metropolitan Johor Bahru semakin membangun dan, kesinambungan merupakan elemen yang penting bagi pertumbuhannya. Tambahan pula, tanah-tanah kami ini terletak di lokasi yang strategik. Kami menjangkakan projek ini akan menjadi pembangunan yang berdaya maju di samping melancarkan pengangkutan dan akses di kalangan masyarakat setempat.

Selain dari itu, kami gembira dapat bekerjasama dengan golongan profesional yang berpengalaman dan berkemahiran teknikal serta berpengetahuan luas untuk membantu kami di dalam projek ini. Kami akan berusaha untuk memuktamadkan perjanjian ini dan berkongsi sebarang maklumat sebagai tambahan kepada terma dan syarat perjanjian tersebut.”

-Tamat-

Untuk Siaran Segera

LBS SERTAI CADANGAN KERJASAMA PEMBANGUNAN

SISTEM TRANSIT ALIRAN RINGAN DI JOHOR BAHRU

Petaling Jaya, 21 Mac 2022 – LBS Bina Group Berhad (“LBS” atau “Kumpulan”) hari ini mengumumkan kerjasama melalui perjanjian utama (“HOA”) yang dimeterai dengan Nylex (Malaysia) Berhad (“Nylex”), pemegang saham Sinar Bina Infra Sdn. Bhd. (“SBI”) iaitu, BTS Group Holdings Public Company Limited (BTS) dan Ancom Berhad (“Ancom”) untuk membina dan mengendalikan sistem transit aliran ringan (“Projek LRT”) dengan pembangunan hartanah bersepadu berdasarkan konsep “Pembangunan Berorientasikan Transit” di wilayah metropolitan Johor Bahru. LBS dan SBI mempunyai bank tanah strategik di kawasan tertentu di Johor Bahru manakala BTS ialah syarikat tersenarai awam di Thailand dan pemegang saham majoriti bagi Bangkok Mass Transit System PCL, iaitu pengendali BTS Skytrain dan Bangkok BRT.

Menurut HOA, LBS akan menyediakan hartanah di kawasan tersebut berdasarkan pertimbangan yang dipersetujui bersama dengan mengambil kira penilaian yang bakal dilakukan oleh penilai bebas, bagi tujuan Projek LRT. Sebagai pertukaran, LBS akan menerima saham Nylex pada harga RM0.15 sesaham dan LBS atau mana-mana anak syarikatnya akan menjadi kontraktor utama bagi pembangunan berkaitan. HOA tertakluk kepada keputusan kajian yang akan dijalankan oleh BTS dan perunding profesional, pemberian konsesi Projek LRT oleh kerajaan negeri Johor kepada SBI serta menandatangani perjanjian muktamad bagi projek tersebut.

Pengerusi Eksekutif LBS Tan Sri Lim Hock San berkata, “Kerjasama yang berpotensi ini memberi peluang untuk kami memberi nilai tambah yang sewajarnya ke atas tanah-tanah kami di Johor di samping meningkatkan kepakaran pembangunan hartanah dan pembinaan sertai mengatasi projek perumahan yang biasa dibangunkan. Kami menjangka untuk menjana pendapatan melalui pembinaan infrastruktur dan pendapatan berulang yang stabil melalui projek ini. Wilayah metropolitan Johor Bahru semakin membangun dan, kesinambungan merupakan elemen yang penting bagi pertumbuhannya. Tambahan pula, tanah-tanah kami ini terletak di lokasi yang strategik. Kami menjangkakan projek ini akan menjadi pembangunan yang berdaya maju di samping melancarkan pengangkutan dan akses di kalangan masyarakat setempat.

Selain dari itu, kami gembira dapat bekerjasama dengan golongan profesional yang berpengalaman dan berkemahiran teknikal serta berpengetahuan luas untuk membantu kami di dalam projek ini. Kami akan berusaha untuk memuktamadkan perjanjian ini dan berkongsi sebarang maklumat sebagai tambahan kepada terma dan syarat perjanjian tersebut.”

-Tamat-

For Immediate Release

LBS PARTICIPATES IN THE PROPOSED JOINT VENTURE OF A LIGHT RAIL TRANSPORT SYSTEM WITH TRANSIT ORIENTED DEVELOPMENT IN JOHOR BAHRU

Petaling Jaya, 21 March 2022 – LBS Bina Group Berhad (“LBS” or the “Group”) today announced that it has entered into a Heads of Agreement (“HOA”) with Nylex (Malaysia) Berhad (“Nylex”), Sinar Bina Infra Sdn. Bhd. (“SBI”), BTS Group Holdings Public Company Limited (BTS) and Ancom Berhad (“Ancom”) to build and operate a light rail transport system (“LRT Project”) with an integrated property development based on the “Transit-Oriented Development” concept in Johor Bahru’s metropolitan region. LBS and SBI have certain strategic land banks in Johor Bahru while BTS is a public listed company in Thailand and the majority shareholder of Bangkok Mass Transit System PCL, the operator of the BTS Skytrain and Bangkok BRT.

Pursuant to the HOA, LBS shall inject its lands at a consideration to be mutually agreed taking into account the valuation to be carried out by an independent valuer. In exchange, LBS will receive Nylex shares priced at RM0.15 per share and LBS or its affiliate shall be the preferred civil and construction contractor for the LRT Project as well as the preferred main contractor for the development of the LBS lands. The HOA is subject to the completion of a feasibility study to be conducted by BTS and professional consultants, the grant of the LRT Project concessions by the state government of Johor to SBI and signing of definitive agreements.

LBS Executive Chairman Tan Sri Lim Hock San said, “This potential collaboration provides us with an opportunity to monetise our lands in Johor and expand our property development and construction expertise beyond our usual housing projects. We expect to generate infrastructure construction income and steady recurring income from this project. The Johor Bahru metropolitan region is up and coming, connectivity is crucial for its growth. Our lands are strategically located. We foresee this project to be a viable development which will ease the transportation and connectivity concerns of the local community.

In addition, we are pleased to be able to work with experienced professionals who have appropriate technical skills and knowledge to see us through this project. We will work towards inking the definitive agreements and share any developments in addition to the final terms and conditions when available.”

-End-

For Immediate Release

LBS PARTICIPATES IN THE PROPOSED JOINT VENTURE OF A LIGHT RAIL TRANSPORT SYSTEM WITH TRANSIT ORIENTED DEVELOPMENT IN JOHOR BAHRU

Petaling Jaya, 21 March 2022 – LBS Bina Group Berhad (“LBS” or the “Group”) today announced that it has entered into a Heads of Agreement (“HOA”) with Nylex (Malaysia) Berhad (“Nylex”), Sinar Bina Infra Sdn. Bhd. (“SBI”), BTS Group Holdings Public Company Limited (BTS) and Ancom Berhad (“Ancom”) to build and operate a light rail transport system (“LRT Project”) with an integrated property development based on the “Transit-Oriented Development” concept in Johor Bahru’s metropolitan region. LBS and SBI have certain strategic land banks in Johor Bahru while BTS is a public listed company in Thailand and the majority shareholder of Bangkok Mass Transit System PCL, the operator of the BTS Skytrain and Bangkok BRT.

Pursuant to the HOA, LBS shall inject its lands at a consideration to be mutually agreed taking into account the valuation to be carried out by an independent valuer. In exchange, LBS will receive Nylex shares priced at RM0.15 per share and LBS or its affiliate shall be the preferred civil and construction contractor for the LRT Project as well as the preferred main contractor for the development of the LBS lands. The HOA is subject to the completion of a feasibility study to be conducted by BTS and professional consultants, the grant of the LRT Project concessions by the state government of Johor to SBI and signing of definitive agreements.

LBS Executive Chairman Tan Sri Lim Hock San said, “This potential collaboration provides us with an opportunity to monetise our lands in Johor and expand our property development and construction expertise beyond our usual housing projects. We expect to generate infrastructure construction income and steady recurring income from this project. The Johor Bahru metropolitan region is up and coming, connectivity is crucial for its growth. Our lands are strategically located. We foresee this project to be a viable development which will ease the transportation and connectivity concerns of the local community.

In addition, we are pleased to be able to work with experienced professionals who have appropriate technical skills and knowledge to see us through this project. We will work towards inking the definitive agreements and share any developments in addition to the final terms and conditions when available.”

-End-

即时发布

林木生集团将参与新山轻快铁合资企業發展

(八打灵再也21日讯)林木生集团(LBS)今日宣布,与耐力斯(NYLEX,4944,主板工业产品服务股)、安康(ANCOM,4758,主板工业产品服务股)、以及Sinar Bina Infra私人有限公司(SBI),即BTS集团控股(BTS Group Holdings Public Company Limited)签署前期协议(HOA),在柔佛新山市区建设和营运轻快铁(LRT)系统。此轻快铁计划是一项“以公共交通为导向的发展”概念的综合房地产开发。

林木生集团与SBI皆在新山策略地点持有地库,而泰国上市公司BTS ,是曼谷铁路系统公司(Bangkok Mass Transit System PCL)的大股东;曼谷铁路系统公司是BTS轻轨和快捷公车BRT的运营商。

根据前期协议,在双方同意的情况下,以及考量由独立估价师针对轻快铁项目进行的估值,林木生集团将注入土地。作为交换,林木生集团将以每股15仙,获得耐力斯股;同时,林木生集团或其关联公司,将成为该轻快铁项目的首选土木和建筑承包商,以及林木生集团土地发展的主要承包商。前期协议将取决于BTS集团控股和专业顾问完成的可行性研究、柔佛州政府向SBI授予的轻快铁项目特许权,以及签署最终协议。

林木生集团执行主席丹斯里林福山指出:“这潜在的合作为我们提供机会,适当地资本化我们在柔佛的土地,并将我们的房地产发展与建筑专业知识,扩展到房屋项目之外。我们预计该项目将带来基础设施建设的收入,以及稳定的经常收入。新山大都市区正在崛起,链接与便利对其发展至关重要。我们的土地地理位置优越。相信这项目是个可行的发展,将改善当地社区的交通和连通问题。我们很高兴能与具有技术和知识,且经验丰富的专业人士合作。 我们将致力于前进,以签署最终协议,并分享最终条款与进展。”

~完~

即时发布

林木生集团将参与新山轻快铁合资企業發展

(八打灵再也21日讯)林木生集团(LBS)今日宣布,与耐力斯(NYLEX,4944,主板工业产品服务股)、安康(ANCOM,4758,主板工业产品服务股)、以及Sinar Bina Infra私人有限公司(SBI),即BTS集团控股(BTS Group Holdings Public Company Limited)签署前期协议(HOA),在柔佛新山市区建设和营运轻快铁(LRT)系统。此轻快铁计划是一项“以公共交通为导向的发展”概念的综合房地产开发。

林木生集团与SBI皆在新山策略地点持有地库,而泰国上市公司BTS ,是曼谷铁路系统公司(Bangkok Mass Transit System PCL)的大股东;曼谷铁路系统公司是BTS轻轨和快捷公车BRT的运营商。

根据前期协议,在双方同意的情况下,以及考量由独立估价师针对轻快铁项目进行的估值,林木生集团将注入土地。作为交换,林木生集团将以每股15仙,获得耐力斯股;同时,林木生集团或其关联公司,将成为该轻快铁项目的首选土木和建筑承包商,以及林木生集团土地发展的主要承包商。前期协议将取决于BTS集团控股和专业顾问完成的可行性研究、柔佛州政府向SBI授予的轻快铁项目特许权,以及签署最终协议。

林木生集团执行主席丹斯里林福山指出:“这潜在的合作为我们提供机会,适当地资本化我们在柔佛的土地,并将我们的房地产发展与建筑专业知识,扩展到房屋项目之外。我们预计该项目将带来基础设施建设的收入,以及稳定的经常收入。新山大都市区正在崛起,链接与便利对其发展至关重要。我们的土地地理位置优越。相信这项目是个可行的发展,将改善当地社区的交通和连通问题。我们很高兴能与具有技术和知识,且经验丰富的专业人士合作。 我们将致力于前进,以签署最终协议,并分享最终条款与进展。”

~完~

Build your own house or buy a ready-to-move-in house? Which one is better?

Erfan Sakib

on

March 16, 2022

Next, do you own land or not? If you already own one or want to build a house on your parents’ land, there is an assistance scheme that can be utilised, namely the SPNB Skim Rumah Mesra Rakyat (RMR). What is interesting regarding this programme is, successful applicants will get a construction subsidy of RM20,000. For those who are eligible, it is a relatively large amount and can be fully utilised. The Rumah Mesra Rakyat application can be made on the official website of Syarikat Perumahan Negara Berhad (SPNB), RMR Online System.

For those who are not eligible to apply for the SPNB RMR Scheme, you can hire contractors to build your house. Yet you need to be wary of irresponsible house contractors who may cause your home construction project abandoned and overdue for a long time. In fact, make sure that the house that has been completed has a warranty or guarantee to ensure that if there is any damage to the house due to unsatisfactory quality of work, you can still claim your rights.

To ensure that the process of building a house on your land runs smoothly, make sure you make a valid written agreement with the contractor. Make sure every item is clearly stated such as house price as well as construction period.

Many companies offer home building packages for landowners. You just need to do a compare and contrast, and research to determine which company is recognised and fits your budget.

Also, if you own a piece of land, this does not mean you can freely build a house on the site. This is because each land has its land status. For example, if you want to build a house on agricultural land, you may need to change the status of the ‘agricultural’ to ‘building’ first, subject to the approval of the District Council.

In fact, some bank policies require the status of agricultural land to be converted to building land for them to approve loans. Even if the District Council in your area has already approved a building plan on agricultural land, it does not mean that your loan will be approved by the bank. Therefore, make sure you know the status of the land on which you want to build a house, do not build it yet as you have to demolish it if you do not get the approval of the Local Authority.

- If you own a piece of land and you’re planning to build a house but it is very remote and isolated, you need to be willing to incur extra costs to get supplies such as electricity and water (additional costs will apply for electricity poles and pipes).

- If it is too far and isolated, do consider the safety aspect especially if you have a family in case there’s a medical emergency or crime. Travel distances between public facilities such as hospitals and police stations should also be taken into account. However, if the area itself is already within proximity to any of these public facilities, you can already start the project in peace.

- One of the undeniable advantages of buying a ready-to-move-in home is the strategic location. As a tactic to attract buyers, the housing developer will offer public facilities that are already available and close to the construction project.

- Some of the construction projects that have been built are within a short distance from job opportunities. Not just that, facilities such as public transport can also be one of the attractions to buying a ready-to-move-in house. So, as a homeowner, you just have to make a choice of which location you want.

Attractive young woman and her handsome husband looking at each other while calculating family expenses, interior of spacious living room on background

It is not a 100% complete decision if you don’t make a cost calculation. Here are some important things to consider before making calculations for each of these options.

To build a house, two parties will usually provide house building loans, namely government loans for civil servants and bank loans. For Government Housing Loans/ Lembaga Pembiayaan Perumahan Sektor Awam (LPPSA), the government offers two types of loans for the construction of houses on your land with several conditions:

- House construction can only begin after the loan is approved

- The building plan is approved by the local authority and the approval period is still in force

- The house must be built according to the plan during the loan approval

- Fees will be paid based on the development of the stage of the house being built.

For bank loans, the approval conditions and loan policy depend on the bank itself. For a home-building loan with a bank, you need to ask your bank officer about the conditions that have been set.

If you want to build your own house, here are the advantages:

- A home design can be set according to your taste

- You can build a house with a budget as low as RM100/per sq. ft up to as expensive as RM300/ sq.ft

- Those who plan to expand the size of the house in the future may plan from scratch. For example, in the future, you want to add a fish pond at home and you already have a budget. During the early stages of house construction, you can already allocate the land area for the desired fish pond.

At the same time, you must also take into account the disadvantages of building a house on your land.

- To save costs, you need to have your land

- You need to have a basic knowledge of the whole process of building a house to prevent you from being cheated by parties trying to manipulate you

- There may be additional costs from the original calculation. Construction prices may go up or you have to hire other construction workers

- Usually to build a house yourself need to make two loans, namely a loan to buy land (if you do not own a piece of land) and a loan to build a house

- Housing loan payments should start as soon as the money is received. Therefore, while the house is being completed, you may have to pay off the loan (and maybe rent too) while waiting for your house to be ready

- If you are not careful when choosing a home contractor services, you may face the risk of being scammed by the contractor.

Buying a ready-to-move-in house also has its advantages. You can choose to buy a house in the primary market or a sub-sale house.

- You do need to know about the technical aspects of construction and construction costs, you just need to know the process of buying a house

- The risk of going over a set budget is lower because most cost estimates will not exceed a set rate

- There is no risk of being cheated by the contractor

- Completed houses are usually complete with other facilities such as shops, schools, etc

- For those who need loans, more housing loan assistance schemes are being offered to buy ready-to-move-in houses.

Now, let’s see the downside of buying a house.

- An auction or sub-sale house can be at risk of being damaged and requiring additional repair costs

- For the undercon housing market, irresponsible developers can risk the project being abandoned

- There are no options for home design.

No matter whether you choose to build your own house or buy a ready-to-move-in house, each of these options has its advantages and disadvantages. What’s important, check your financial stability before making the choice that best suits you. Think wisely and consider all options before making a final decision. If you have experience in building your own house, share it with us. Whatever your choice is, good luck!

Presented by LBS Bina on 17 Mac 2022

Published at: https://www.iproperty.com.my/guides/build-house-vs-buy-house-which-one-is-better/

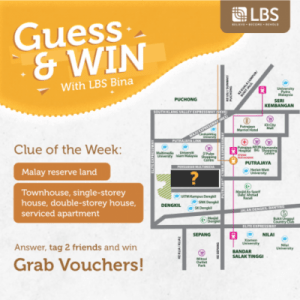

Guess & Win With LBS Contest

Erfan Sakib

on

March 4, 2022

The Contest is organised by LBS Bina Group Berhad (hereinafter known as “the Organiser”). By participating in the Contest, you agree to be bound by the terms and conditions contained herein (consisting of the General Terms and Conditions and the Specific Terms and Conditions) between you and the Organiser (“Contest Terms”). You agree that the Organiser may include additional terms to and/or vary the Contest Terms at our sole discretion at any point of time and any additional and/or variation of the terms shall be incorporated by reference immediately at the point of time in which it is implemented. You are advised to visit this page from time to time to be updated of the latest Contest Terms.

In the event of any inconsistency between any terms and conditions stipulated in any of our marketing brochures, leaflets, buntings, or otherwise any other platforms and the Contest Terms stipulated herein, the latest Contest Terms shall prevail.

MGB Interview with The Edge

Erfan Sakib

on

February 28, 2022

Tan Sri Lim Hock San joined an interview with The Edge. The interview comprised of insights about MGB Berhad profile and updates. Also discussed were the development of IBS as well as large-scale projects jointly cooperated by MGB and the Selangor State Government known as Rumah Selangorku Idaman MBI (Idaman).

The interview was published on the 16th and 17th of February 2022