Perks And Plusses Turns One Celebrating a Year Of Exclusive Rewards and Epic Giveaways!

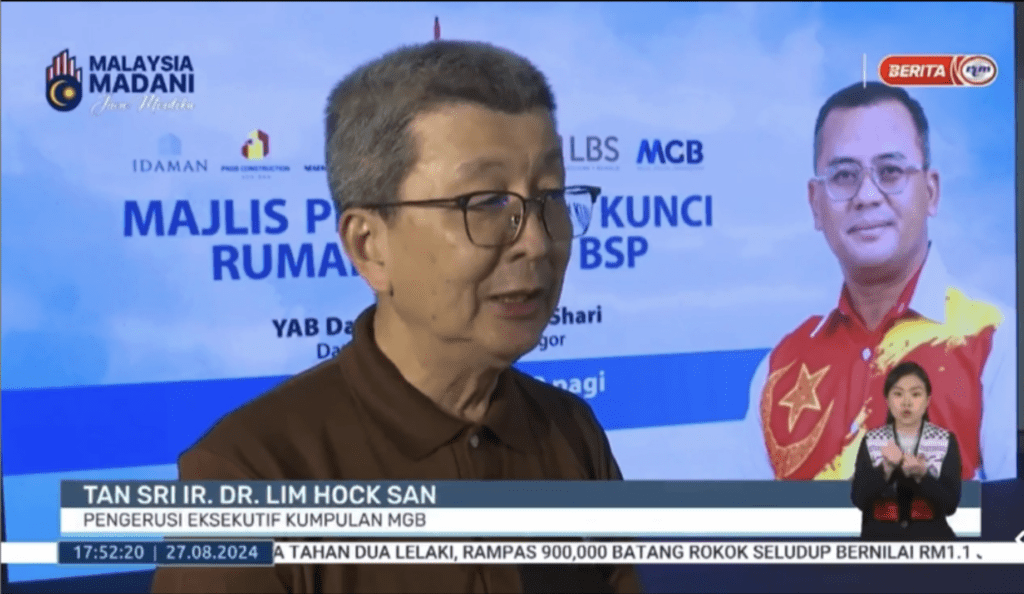

On 27th August 2024, we proudly celebrate the exciting first anniversary of Perks & Plusses, LBS Bina Group Berhad’s groundbreaking loyalty program!

In just one year, Perks & Plusses has revolutionized the way our homeowners experience exclusive rewards and benefits, quickly becoming a favorite among LBS homebuyers. To celebrate this exciting milestone, we’ve lined up an array of thrilling surprises and exclusive giveaways you won’t want to miss!

Since its launch, Perks & Plusses has redefined the home-buying journey, showering our valued members with incredible perks. With every LBS home purchase, new homeowners are automatically enrolled in this dynamic program, unlocking a world of endless rewards. From special discounts to priority access for new launches and community events, the benefits keep growing!

What’s more? By partnering with over 50 prestigious companies across diverse industries—automobiles, food & beverages, healthcare, and more—Perks & Plusses delivers a network of exceptional offers that cater to every lifestyle and interest. It’s the ultimate way to elevate your LBS homeownership experience!

First-Year Highlights:

1LBS Referral Program: Earn referral fees** when you introduce friends or family members who purchase LBS property.

LBS 2nd Home Rebate: Enjoy an additional 2%** rebate for existing homeowners purchasing a second LBS property.

Exciting Partnership Offers: Access exclusive rebates and special deals from our strategic partners, curated just for LBS homeowners.

Personalized Experience: Be the first to hear about new LBS and MGB launches, promotions, and enjoy a special gift waiting just for you!

We are extremely proud of how Perks & Plusses has evolved and the impact it’s made on our members. This anniversary is our way of expressing our gratitude and sharing excitement for the fantastic rewards and opportunities ahead.

Join us in celebrating this milestone and get ready for even more exclusive rewards and surprises! If you’re an LBS homeowner, take part in our first-anniversary spin-and-win contest from 5th September to 31st October 2024. Simply share your valuable feedback via our survey (link below) and spin the wheel for a chance to win amazing prizes—including a Hisense 1HP Non-Inverter Air Conditioner, Skyworth 43″ Full HD Android TV, and much more (Terms & Conditions apply)!

For more details on Perks & Plusses, visit https://rewards.lbs.com.my/ or follow us on social media (Facebook, Instagram, TikTok).

Explore LBS Bina Group Berhad properties at https://lbs.com.my/ or visit any of our sales galleries.

And don’t miss the video below to see how easy it is to step into the LBS homeownership journey!