Terms of Reference of Sustainability Committee

Mannju

on

September 20, 2022

1. Objective

The principal objective of the Sustainability Committee (“Committee”) is to assist the Board of Directors of LBS Bina Group Berhad (“LBS” or “Company”) in fulfilling its oversight responsibilities in relation to the sustainability strategy and initiatives covering economic, environmental, social and governance (ESSG) aspect as well as embedding sustainability practices into the businesses of the Company and its subsidiaries (“Group”).

2. Members

(a) The Sustainability Committee shall be appointed by the Board and shall comprise at least 3 members.

(b) The members of the Committee shall elect a Chairman from among their number.

(c) In the event of any vacancy in the Committee resulting in the number of members being reduced to below 3, the Board shall, within one (1) month fill the vacancy.

(d) The Board shall have the discretion as it deems fit to rescind and/or revoke the appointment of any person(s) in the Committee.

3. Meeting

(a) The quorum for meeting of the Committee shall be three (3).

(b) Meetings shall be held as and when appropriate, but shall not less than once in a calendar year.

(c) Meetings of the Committee shall be summoned by the Secretary of the Committee at the request of any member thereof. Notice of each meeting confirming the venue, time and date together with an agenda of items to be discussed, shall be forwarded to each member of the Committee not less than three (3) working days prior to the date of the meeting.

(d) A resolution in writing signed by a majority of the Committee Members for the time being shall be as valid and effectual as if it had been passed at a Meeting of the Committee duly called and constituted. Any such resolution may consist of several documents in like form each signed by one (1) or more Committee Members. Any such document, may be accepted as sufficiently signed by a Committee Member if transmitted to Company by telex, telegram, cable, facsimile or other electrical or digital written message purporting to include a signature of a Committee Member.

(e) The Company Secretary shall be the Secretary of the Committee.

(f) The Committee is authorised to call any employee to attend at a meeting of the Committee as and when required.

4. Reporting Procedures

(a) The Secretary shall circulate the minutes of meetings of the Committee to all members of the Committee. Minutes of each meeting shall be duly entered in the book provided therefor.

(b) The Chairman shall report the proceedings of each meeting to the Board.

5. Authority

(a) The Committee is authorized by the Board to undertake the specific duties and responsibilities stated below. The Committee is also authorized to obtain external legal or other independent professional advice, as it considers necessary.

(b) The Committee may sub-delegate any of its powers and authority as it thinks fit, including, without limitation the establishment of sub-committees to analyse particular issues or themes and to report back to the Committee.

6. Duties and Responsibilities

The Committee has the overall responsibility for overseeing the requirements for the Group to conduct its business in a responsible manner in relation to its impact to the environment, economic, social and governance aspects:-

(a) To advise the Board and recommending the sustainability strategies and related policies for adoption and the implementation of such strategies and policies;

(b) To monitor the implementation of processes, standards, measures and actions designed in achieving the organisation’s sustainability milestones and goals;

(c) Monitoring the adequacy of resource allocated in achieving compliance with strategies, targets, policies and roadmaps pertaining to sustainability;

(d) Monitoring the overall management of stakeholder engagement and its outcomes, including ensuring mechanisms for sustainability-related grievances are in place;

(e) Assisting the Board members to keep abreast with and understand the sustainability issues relevant to the Group and its business, including but not limited to climate-related risks and opportunities; and

(f) Assessing, reviewing and recommending to the Board for approval the Company’s annual sustainability report/statement.

7. Review

This Terms of Reference has been endorsed by the Board of Directors and is made available for reference on Company’s corporate website and internal computer networking system. It shall be reviewed by the Board of Directors and update whenever necessary to ensure its effective implementation.

Internal Audit Charter

Mannju

on

September 20, 2022

1. Mission

To add value to the overall organisational performance and independently ascertain whether the on-going processes for controlling operations throughout LBS Bina Group Berhad (“LBGB” or “Company”) and its subsidiaries (collectively referred to “Group”) are adequately designed and functioning in an effective manner.

2. Objective

To provide independent and objective assessment and assurance that the Group’s risk management, internal controls and governance processes are operating effectively and efficiently.

3. Role and Scope of Activities

The role of Internal Audit is to assist the Board of Director, Audit Committee and Management to carry out their oversight responsibilities effectively in establishing cost-effective controls, assessing risks, recommending measures to mitigate those risks and assuring proper controls and governance processes. It also assists in the creation of shareholders’ confidence in the Company’s system of internal control.

The Internal Audit Function’s scope of activities is to ascertain, through selective testing, that the processes for controlling, as they have been designed and represented by Management, are adequate and functioning in an effective manner to ensure:

• resources are adequately protected;

• significant financial, managerial and operating information are accurate and reliable; and

• employees’ actions are in compliance with the LBGB’s policies, standards, procedures, and applicable laws and regulations.

4. Accountability

The Internal Audit Function, in the discharge of its duties, shall be accountable to the Audit Committee to:

• provide quarterly an assessment of the adequacy and effectiveness of the Group’s processes for controlling its activities;

• report significant issues related to the processes for controlling the activities of the Group and provide information concerning such issues through resolution; and

• periodically provide information on the status and results of the Internal Audit Plan.

5. Responsibility

The Internal Audit Function has responsibility to:

• develop an Annual Internal Audit Plan, based on significant exposures to loss or failure, and submit that plan to the Audit Committee for approval;

• consider the scope of work of External Auditors and regulatory examiners, as appropriate, for the purpose of providing optimal audit coverage to the Group;

• implement the Internal Audit Plan as approved by the Audit Committee;

• issue periodic reports to the Audit Committee summarising results of audit activities;

• maintain professional Internal Auditors with sufficient knowledge, skills and experience to meet the requirements of this Charter; and

• evaluate and assess controls coincident with the introduction of major changes to systems.

6. Authority

The Internal Auditors are authorised to:

• have unrestricted access to all of the Group’s functions, records, property, and personnel;

• have full and free access to the Audit Committee; and

• allocate resources, set frequencies, select subjects, determine scope of work,

and apply the techniques required to accomplish audit objectives.

The Internal Auditors are not authorised to:

• perform any operational duties for Group; and

• initiate or approve accounting transactions external to the Internal Audit Department.

7. Independence

To provide for the independence of the Internal Auditing Function, the Internal Audit will report to the Audit Committee.

8. Standards of Audit Practice

The Internal Audit Function shall meet the Standards for the Professional Practice of Internal Auditing, as adopted by the Institute of Internal Auditors.

9. Review of Internal Audit Charter

This Charter has been endorsed by the Audit Committee and is made available for reference on Company’s corporate website and internal computer networking system. It shall be reviewed by the Audit Committee and update whenever necessary to ensure its effective implementation. Any subsequent amendments to the Charter should only be approved by the Audit Committee.

External Auditors Policy

Mannju

on

September 20, 2022

1. Introduction

The Audit Committee of LBS BINA GROUP Berhad (“the Company”) is responsible for reviewing, assessing and monitoring the performance, suitability and independence of external auditors. The objective of this External Auditors Policy (“the Policy”) is to outline the guidelines and procedures for the Committee to assess and monitor the external auditors.

2. Scope

This Policy applies to the external auditors of LBS Group.

3. Definitions

“ Board” refers to the Board of Directors of LBS at any one time.

“Committee” refers to the Audit Committee of LBS at any one time.

“Company” refers to LBS Bina Group Berhad (Company No.: 518482-H). “LBS Group” refers LBS Bina Group Berhad and its subsidiaries.

“Policy” refers to this External Auditors Policy including any amendments made or to be made from time to time.

4. Objectives

The objective of this Policy is to outline the guidelines and procedures for the Committee to assess and

monitor the external auditors.

5. Selection & Appointment

Pursuant to Section 273 of the Companies Act 2016, the office of auditors shall cease at the conclusion of each annual general meeting. Accordingly, the members shall appoint or re-appoint the external auditors of the Company, and the external auditors so appointed shall, hold office until the conclusion of the next annual general meeting of the Company. Should the Committee determine a need for a change of external auditors, the Committee will follow the following procedures for selection and appointment of new external auditors:-

a) the Committee to identify the audit firms who meet the criteria for appointment and to request for

their proposals of engagement for consideration;

b) the Committee will assess the proposals received and shortlist the suitable audit firms;

c) the Committee will meet and/or interview the shortlisted candidates;

d) the Committee may delegate or seek the assistance of the Chief Financial Officer/Finance Director to

perform items (a) to (c) above;

e) the Committee will recommend the appropriate audit firm to the Board for appointment as external

auditors; and

f) the Board will endorse, after due consideration, the recommendation and seek shareholders’ approval for the appointment of the new external auditors and/or resignation/removal of the existing external auditors at the general meeting.

6. Selection Criteria

The Committee will evaluate potential audit firm on a number of criteria including, but not limited to:

a) Independency, objectivity and professional scepticism

b) Quality of engagement team

c) Reputation

d) Internal governance process

e) Human Resources and qualification

f) Proven and demonstrated experience in audit of listed companies

g) Cost

h) Clientele (size, spread, etc.)

7. Independence

The external auditor’s independence is a key factor in ensuring that the financial statements of the

Company and its subsidiaries are true and fair, and meet high standards of financial integrity.

The Committee monitors the independence of the external auditor, including any relationship with the

Group or any other person or entity that may impair or compromise, or appear to impair or compromise,

the external auditor’s independence.

Independence may be impaired or compromised by the provision of services of a non-audit nature to

LBS Group, depending on the materiality of those services and the fees charged for them. Therefore,

the external auditors are precluded from providing any services that may impair their independence or

conflict with their role as external auditors.

The Committee shall obtain a written assurance from the external auditors confirming that they are, and

have been, independent throughout the conduct of the audit engagement in accordance with the terms

of all relevant professional and regulatory requirements.

8. Non-Audit Services

The external auditor’s independence is a key factor in ensuring that the financial statements of the Company and its subsidiaries are true and fair, and meet high standards of financial integrity.The external auditors can be engaged to perform non-audit services that are not, and are not perceived to be, in conflict with the role of the external auditors. This excludes audit related work in compliance with statutory requirements.

The prohibition of non-audit services is based on three (3) basic principles as follows:-

a) external auditors cannot function in the role of Management;

b) external auditors cannot audit their own work; and

c) external auditors cannot serve in an advocacy role of LBS Group.

The external auditors shall observe and comply with the By-Laws of the Malaysian Institute of Accountants in relation to the provision of non-audit services, which include the followings:-

i) accounting and book keeping services;

ii) valuation services;

iii) taxation services;

iv) internal audit services;

v) information technology system services;

vi) litigation support services;

vii) recruitment services; and

viii) corporate finance services.

All engagements of the external auditors to provide non-audit services are subject to the approval/endorsement of the Committee.

Management shall obtain confirmation from the external auditors that the independence of the external auditors will not be impaired by the provision of non-audit services.

9. Rotation of Audit Partner

The audit partner responsible for the external audit of LBS Group is subject to rotation at least every five (5) financial years, followed by a two year minimum time out period during which they may not take part in the audit of the Group.

10. Annual Reporting

The external auditors shall issue an annual audit plan for review and discussion with the Committee. The external auditors shall also provide a management letter to the Committee upon completion of the annual audit.

11. Annual Assessment

The Committee shall carry out annual assessment on the performance, suitability and independence

of the external auditors based on the following four (4) key areas:-

i) quality of service;

ii) sufficiency of resources;

iii) communication and interaction; and

iv) independence, objectivity and professional scepticism.

The Committee may also request the Chief Financial Officer/Finance Director to perform the annual assessment of the external auditors.

12. Review of Policy

This Policy has been approved by the Committee and is made available for reference on Company’s corporate website and internal computer networking. It shall be reviewed by the Committee and updated whenever necessary to ensure its effective implementation.

LBS Chairman Appointed as an Adjunct Professor of Leadership by UNITAR International University

Mannju

on

September 1, 2022

Tan Sri Lim Hock San, the Executive Chairman of LBS Bina Group Berhad has been appointed as an Adjunct Professor of Leadership by UNITAR International University in recognition of his exemplary leadership in spearheading LBS Bina Group Berhad and transforming the group into a household brand name and as one of the leading players in the property development industry.

The bestowment of Adjunct Professorship of Leadership to Tan Sri Lim Hock San also recognises his unwavering contribution in society, ranging from education, chamber of commerce to clan-based associations.

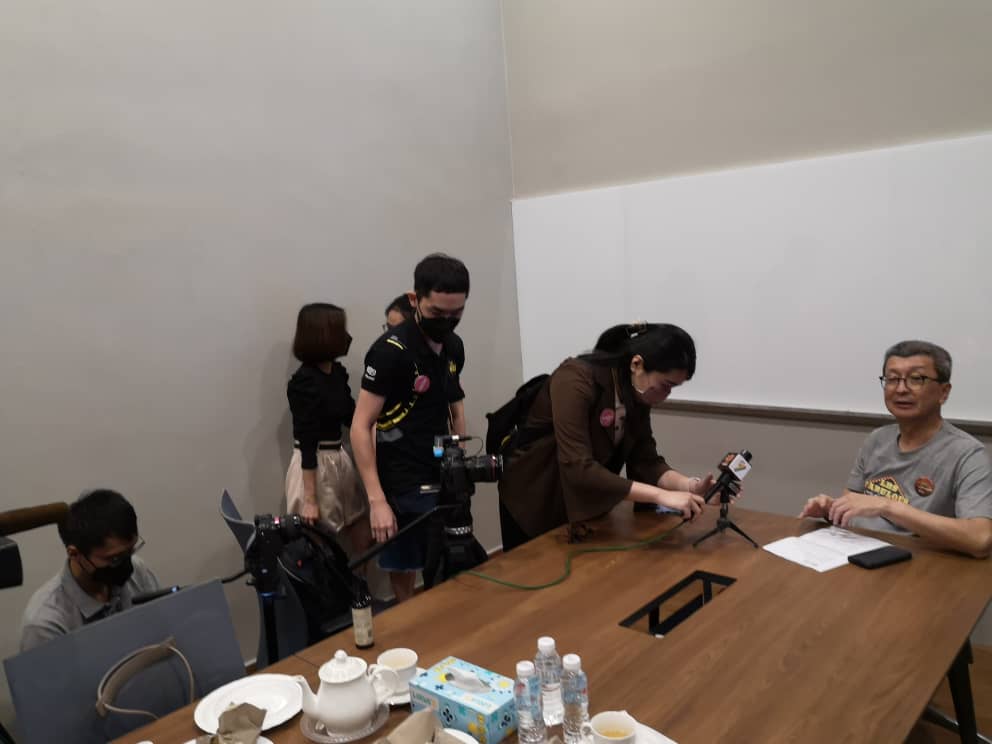

Interview for Official Launch of LBS Fabulous Extraaaa

Mannju

on

September 1, 2022

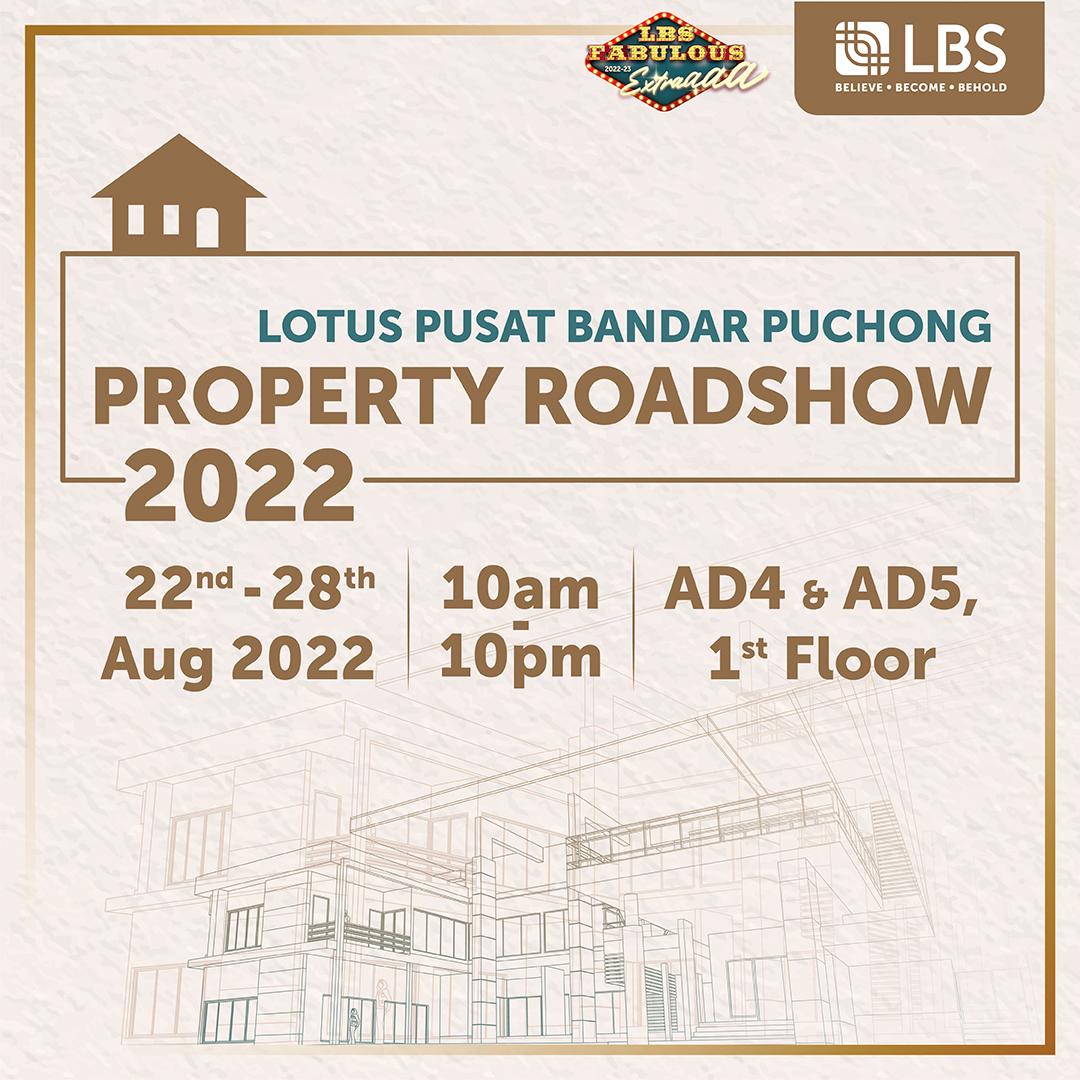

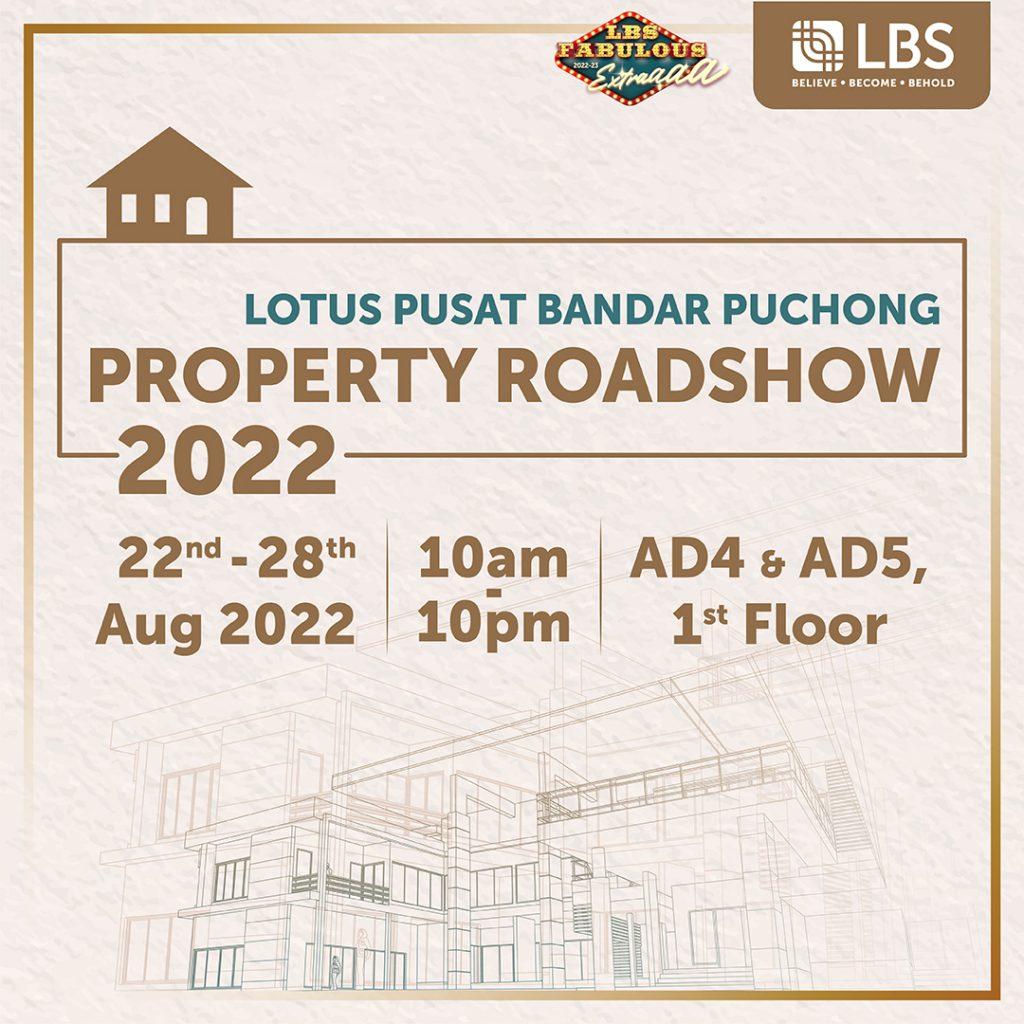

Tan Sri Lim Hock San had an interview with the media from Astro AEC , 8TV and China Press during the Official Launch of LBS Fabulous Extraaaa on 26th August 2022. Tan Sri Lim shared about the LBS campaign and the outlook for the property industry.

Vox Pop : “Are You a True Malaysian?” (Merdeka 2022)

Mannju

on

September 1, 2022

In conjunction with the 65th National Day under the theme of “Keluarga Malaysia, Teguh Bersama”

We welcome Nina on this VoxPop Merdeka edition!

In this episode we decided to do something different, we will ask the public some questions to see “Are You A True Malaysian”?

Happy Merdeka Day!🇲🇾

Housing loan: How to apply as a first-time homebuyer in Malaysia

Mannju

on

August 30, 2022

Looking to apply for a home loan in Malaysia? Here we’ve prepared a comprehensive and step-by-step guide on applying for housing loan in Malaysia. From understanding property and finance jargon, house loan calculator to learning about interest rate and credit score, we’ve compiled it all for you.

Dreaming of a place you can call your own? Surely you’ve compiled Pinterest boards on how your future home will look like, the colour of its walls, and the choices of interior design? But before all that, how do you even secure a mortgage for your dream home?

Let’s face it, dreams don’t come cheap. Unless you’re a millionaire or have a trust fund, chances are you’re going to need a home loan. Applying for your first one may seem daunting, but don’t worry. We’re here to guide you with a comprehensive guide on how to apply for housing loan in Malaysia and turn your dreams into reality.

This guide will be categorised into four parts: Before Applying, Actually Applying for it, After Applying, and some extras tips to help you secure your loan.

First things first, if you’ve already found your dream home, you’ll want to know the maximum amount you can borrow based on your income and existing debts. If you haven’t chosen a place yet, it’s a good idea to first figure out a mortgage range with monthly repayments you can afford.

Our house loan calculator will be able to do these for you.

How much you can borrow is basically known as the Loan-to-Value (LTV) ratio or the margin of finance. In Malaysia, it’s quite common to get around a 90% LTV for residential mortgage or home loans. There’s even a “Malaysia My First Home Scheme” (Malaysia Rumah Pertamaku) that gives qualifying first-time homebuyers a 100% LTV, meaning they can get a full loan.

Keep in mind that your LTV is affected by several criteria, like whether you are buying for investment, if you have more than one existing house loan, and so on. Aside from financing the property, it’s good to keep in mind that banks also sometimes allow up to 5% of additional margin of finance on the loan to finance things like valuation costs by the borrower, i.e. you.

The mortgage you take from a bank is the total amount you’ve received to finance your home (also known as the principal amount) plus the total interest payable. Each month, part of your monthly payment will go towards paying off the principal, while the other goes towards interest on the loan. Interest is what the bank charges for lending you money.

That’s right, there are multiple types of property loans. Each home financing package or plan is different and has different benefits. You’ll want to pick one that best fits your unique financial needs.

1. Basic Term Loan:

A simple and basic that isn’t as flexible as other loans. This basically means you won’t be able to reduce the loan period, thus the loan interest, by making advance payments.

2. Semi-Flexi Loan:

As its name suggests, this loan is more flexible if you want to save money in the long run. If, for example, you came into some extra cash and wanted to pay more in a certain month (thus reducing your loan period and your loan interest).

3. Full-Flexi Loan:

Similar in nature to Semi-Flexi Loans, but with the added benefit of being able to withdraw any advance payments at any time with no extra charges. This flexibility is known as an overdraft facility which is definitely worth looking into as it has its pros and cons.

4. Islamic Home Loan:

Looking for Shariah-compliant financing? There are a few types, but unlike the above three conventional loans, an Islamic home loan works on the basis of interest-free transactions, following the Murabahah concept under Shariah Principles.

5. Fixed Rate Loan:

As its name suggests, this one has a fixed interest rate throughout the whole loan tenure. If you’re worried about floating rates, then this is a good option for you.

Get more details on all these types of home loans here.

Most loans have variable interest rates and the interest rate is tied to the Base Rate (BR) of banks. The lower the interest rate, the better it is for you. Some packages offer fixed interest rates that don’t depend on the BR (see Fixed Rate Loan above).

Base Rates or BR is basically an internally-derived interest rate that the bank refers to before deciding on the interest rate to apply to your home loan amount. It’s conceived based on how much it will cost the bank to lend you the money.

With Islamic Loans, instead of interest rates (Riba), there are profit rates. The bank buys something on the borrower’s behalf and sells it back to the borrower at a profit. The idea behind this is financial justice, with the aim of creating a balance for the net a profit or loss between the lender and the beneficiary.

Read more: What to know about Base Rate (BR), Base Lending Rate (BLR) & Spread Rate when selecting a home loan?

- A copy of the purchaser’s identity card

- A copy of the title

- A copy of the SPA

- The latest assessment receipt

- The quit rent receipt

- The assessment receipt

- Other relevant documents

What’s an OPR? The Overnight Policy Rate is the rate a borrower bank has to pay to a lending bank for the funds borrowed. This can affect the BR.

Bank Negara Malaysia (BNM) cut the OPR in January 2020 from 3% to 2.75%, and more recently to 1.75% due to COVID-19 outbreak. This is good news for borrowers because the lower cost of borrowing for banks lead to cheaper home loans for consumers. In short, borrowers will benefit from either lower monthly instalment payments or shorter loan tenure.

So what are the new lending rates in 2020? Major banks like Maybank, Public Bank Bhd, RHB Bank Bhd, CIMB Bank Bhd and OCBC Bank has reduced their BLR and BR by 50 basis point in May 2020.

If you want to find out more about how OPR affect your home loan, click on this to read more.

*Update: As of 6 July 2022, Bank Negara Malaysia (BNM) had increased the Overnight Policy Rate (OPR) by 25 basis points to 2.25 per cent from 2.00 per cent (11 May 2022).

You’ve probably heard of this term, but what exactly is it? To put it simply, a credit score is what banks use to appraise the credibility of your loan application, including home loans and credit cards. The higher your score, the better your chance of getting a loan. But how do you calculate credit score? Unfortunately, there’s no fixed formula to this as different credit agencies have their own ways to assess every individual’s credit score. However, there are a few factors that these credit companies look into:

- payment history

- credit mix and loan amounts owed

- length of credit history

- new credit applications in the past 12 months

- legal track record

In order for your credit to be scored, you need to build a credit history — a record of your debt payment. When applying for loans, banks want to be able to see that you are responsible when it comes to paying back your debt and one easy way of building a credit history is by having a credit card. Your credit history will then be compiled into a credit report and these reports will define your financial health, which helps banks to decide if you’re good at managing your finances and if they should approve or reject your loan application.

In Malaysia, most financial institutions will refer to both the Bank Negara’s Central Credit Reference Information System (CCRIS) and the CTOS Data Systems Sdn Bhd (CTOS). Central Credit Reference Information System (CCRIS) under Bank Negara records your personal credit rating based on your credit history, that is, your outstanding loan/financing amounts in the past 12 months. This means making sure all your loan repayments (personal loans, car loans, credit card payments, etc.) are always on time, up to date, and within the right amounts. And then there’s CTOS, a privately-owned agency that archives a person’s or company’s entire credit history (unlike CCRIS which reports your credit score over a 12-month duration). Check in on your CTOS credit score every once in a while as it has the added benefit of alerting you in case of fraud or any errors in payment.

WANT TO LEARN MORE ABOUT CREDIT SCORE?

If you’re wondering how you’re supposed to know this, we’ve got you covered. Simply calculate your Debt Service Ratio (DSR). DSR basically shows you your repayment capability based on your income and is a key factor that banks use to determine your borrowing power. Your DSR is calculated like this:

Total monthly commitment ÷ Net monthly income × 100 = DSR

For example, if your total monthly commitments (loan/financing and credit card debts) is RM2,300 and your nett income after deducting from EPF, SOCSO, and taxes is RM3,500, your DSR is RM2300 ÷ RM3500 = 0.657 or 65.7%.

Different banks have different thresholds for DSR. Generally, if you go over a certain percentage like 70%, this means you have too many commitments and the income criteria for the bank to give you a loan cannot be met because they believe you won’t be able to keep up with all your monthly repayments.

You’ve got the basics down and ensured that you have a good credit history. You also roughly know how much you’re eligible to borrow. Now all that’s left is to choose a bank.

While it would be great if you could walk into any bank and get exactly what you needed on the spot, it’s just not possible. When it comes to banks, it’s not a “one size fits all” situation.

The bank you choose is dependent on the type of loan you feel is best for you. And “the best” is subjective; look at the different rates, packages, terms and conditions. This is a long-term commitment, so you’ll want to look into who gives you the best service.

One advice we can give is don’t be afraid to shop around. Research the different loan packages. Make appointments and speak with different mortgage bankers or loan officers. Find one you’re comfortable with and one who is experienced and takes the time to understand your unique financial needs.

Then, together, you can confirm the type of loan you want and submit your documents as part of your application.

The last thing you want is to walk into the bank empty-handed. When applying for a property loan, there are a few documents that you need to prepare prior to your meeting:

- The property booking form

- Identification documents (copy of your IC/Passport)

- Salary slips (up to 6 months)

- Bank and EPF statements

- Income tax receipt/tax form

Read more about these steps here and here where we detail the main scenarios that often lead to a loan rejection.

Now what? Easy. If your loan has been approved, celebrate! But not too much and not too expensive, because you’re now in debt. But you’ve secured your property and that’s definitely a cause for celebration.

There, there. It’s not the end of the world. Oftentimes, it’s not you — it’s the bank. Perhaps your DSR was higher than that specific bank’s maximum allowable DSR. It could also be that something went wrong with your documentation.

Nevertheless, not getting that bank loan approval can set you back approximately three to six months from applying for another. If you’ve calculated your DSR (see above) and gotten a low enough value, you should be fine. However, different banks have different thresholds so that calculation is just an estimate.

But not to worry — we’ve got four handy tips to help you out with your next application.

If you want to go in with an increased chance of a home loan approval and without doubts or worry, check out our home loan eligibility calculator to increase your chances of getting your mortgage approved.

In the meantime, check your home loan eligibility using LoanCare and find out if you be able to secure a mortgage from up to 17 banks across Malaysia.

We’re loving the proactiveness here. It’s great that you’re thinking of this. Having less monthly instalments is a compelling goal, but sometimes, it’s not the best financial decision. An example is if your bank imposes penalties for settling your mortgage before your lock-in-period expires. Another reason would be if you’re covered under a mortgage insurance and want to retain this financial buffer.

So, when is it a good idea? When you’ve done the math and you’re sure that you’ll be saving on your loan interest payments. An early settlement a few years before your loan tenure of 35 years could result in thousands saved!

We’re glad you asked. There are a few ways you can do so:

- Refinancing to a shorter-term loan.

- Make a few small, additional payments throughout the year.

- Make a large capital repayment.

Each way has its pros and cons. Get more advice on each one, as well as further explanation on whether you should pay off your home loan early here.

Before we send you off on your merry way to start your home loan application, here are a few handpicked tips that we feel could be quite helpful depending on your predicament or needs.

Thinking of getting a home with a significant other? An attractive prospect! This means you’d be able to get a larger loan (equating to a dream home on the higher, grander end). You can do this with two or more people and all the joint loaners will need to be between the ages of 18 and 60 while applying.

However, there are some stumbling blocks and pitfalls awaiting this path. Read through our list of four things to consider before applying for a joint loan – there are even tips on how to bolster one’s borrowing profile if your spouse, friend, or relative is self-employed.

Malaysia is a melting pot of people from all over the world! It’s no surprise that we have expatriates looking to buy property here, whether to retire or embark on a new journey. Foreigners can legally buy property in Malaysia, but there are some criteria regarding the types of property you can buy. This is just the country’s way of ensuring expat buyers don’t buy up the cheaper real estate meant for locals. Each state sets a minimum price; for example in Kuala Lumpur, the minimum price threshold is RM1 million. Overhang properties (properties in the market where supply outstrips demand, usually new projects like luxury condos) are set at RM600,000.

Now, how easy it is to get a loan in Malaysia will largely depend on your personal situation. Many foreigners are here as part of the Malaysia My Second Home (MM2H) programme*. If you have this, there shouldn’t be any problems with applying for the various loans mentioned in this guide as the programme is well established and government-backed.

If you’re not under the MM2H programme, then your ability to get a loan from a Malaysian institution will depend on what type of property you want, your current financial situation, as well as how much of a deposit you are able to give. A good real estate agent will be able to help you out as well as Mortgage Officers in banks.

*Do note though that the MM2H programme has been temporarily suspended to allow the Ministry of Tourism, Arts and Culture (MOTAC) and related agencies to “comprehensively review and re-evaluate the MM2H program since its inception in 2002. The suspension is in line with the Government’s decision not to allow foreigners to enter Malaysia following the outbreak of COVID-19” – but we hope to welcome you soon.

With the economic impact of the pandemic and the various movement control orders (MCO), Bank Negara Malaysia (BNM) has made quite a few changes. From moratoriums on home financing repayments to reductions in base rates (BR) and new lending rates by Malaysian banks, read all about it here.

Seeing how Malaysia banks have started tightening their lending policy, it might be a bit more difficult to secure a housing loan in the future. Don’t worry though, if you have a strong credit rating, your chances of getting one is still high.

To make things easier for you during this unprecedented time, consider getting an experienced banker when submitting loans. He or she will be able to give you the best advice and increase your chances for loan approval.

Our parting advice is, if you’re at a loss or if you need more guidance – fret not. A good real estate agent will be a reliable source of help. Most times, these are professionals who understand that not everyone speaks that property lingo. Remember, there are no dumb questions, so ask away. In the meantime, build up your credit score, learn about the different types of property loan, research on the current housing loan interest rate and check your home loan eligibility using house loan calculator to increase your chances of securing a loan.

DID YOU KNOW…

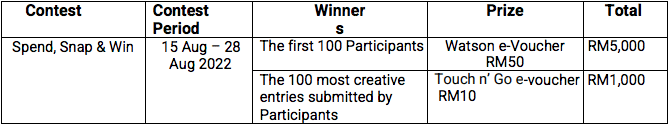

Spend, Snap & Win (“Contest”)

Mannju

on

August 15, 2022

The Contest is organised by LBS Bina Group Berhad (hereinafter known as “the Organiser”). By participating in the Contest, you agree to be bound by the following terms and conditions (consisting of the General Terms and Conditions and the Specific Terms and Conditions) between you and the Organiser (“Contest Terms”). You agree that the Organiser may include additional terms to and/or vary the Contest Terms at our sole discretion at any point of time and any additional and/or variation of the terms shall be incorporated by reference immediately at the point of time in which it is implemented. You are advised to visit this page from time to time to be updated of the latest Contest Terms.

In the event of any inconsistency between any terms and conditions stipulated in any of our marketing brochures, leaflets, buntings, or otherwise any other platforms and the Contest Terms stipulated herein, the latest Contest Terms shall prevail.

1. CAPACITY AND REPRESENTATION

1.1. To participate in the Contest, you must be aged eighteen (18) and above in Malaysia or have attained an age of majority in the jurisdiction in which you are domiciled to enter into legally binding contracts.

1.2. You acknowledge and agree that all information made by you are true, accurate, and not misleading. We reserve the right to request more information from you in the event we deem that the information provided by you is insufficient. Kindly note that failure by you to provide us with true and accurate information may result in your disqualification from the Contest.

1.3. You shall be responsible to update us immediately in the event that you discover that any information made by you is erroneous, outdated, or insufficient. Kindly note that failure by you to provide the necessary information to us may result in your disqualification from the Contest.

1.4. You further acknowledge that we will rely on any information provided by you and that any false, inaccurate, and/or misleading information may cause losses and damage to us. You agree to hold harmless and indemnify us, our directors, our employees, our agents, our affiliates, and any other third parties facilitating the Contest from the losses and damage suffered as a result of the false, inaccurate and/or misleading information provided by you.

1.5. You shall not use the Contest as a means or manner to facilitate any illegal and/or fraudulent transactions.

1.6. You will not, by participation or entrance of the Contest, violate any other terms and conditions, policies, and guidelines, and/or contracts that you have agreed to.

1.7. You will comply with all applicable laws, by-laws, rules, regulations, policies, instructions, directions, orders and/or directives from us, any governmental organization, and/or relevant authorities.

2. PRIVACY

2.1. All information provided by you shall be collected, stored, used and retained by us in accordance with our Personal Data Protection Act Notice. You are to read, acknowledge and accept our Personal Data Protection Act Notice which is

incorporated by reference herein and can be found at https://lbs.com.my

3. TAX AND DISBURSEMENTS FEE

3.1. You shall bear all transportation, personal expenses, insurance, stamp duties, transfer fees, taxes, any other duties and/or any other costs, fees and/or related expenses incurred pertaining to the Prize.

3.2. You shall be solely responsible to declare your Prize winnings with the relevant tax authorities and paying for any levy, duty, charges and tax that is imposed (if any). The Organiser shall not in any way be held liable to pay any charges, tax, levy, fines and/or duty that are imposed on the Winners by the relevant tax authorities for the Prize winnings.

4. PRIZES

4.1. The Organiser shall not assume any liability and responsibility whatsoever in the event of any mishaps, injuries, damages, death, claims and/or accidents suffered by your participation in the Contest and from the use of the Prizes.

4.2. You shall hold the Organiser harmless against any liability and claims and agree to indemnify the Organiser completely for any claims, damages, losses and liability arising from and/or in relation to your use of the Prizes.

4.3. You agree and acknowledge the Organiser provides no representation or warranty of any kind whatsoever in respect of any defect or other faults in relation to the Prize, and that the Prize displayed in any marketing or promotional materials are for illustration purposes only which may not depict the actual color, material, model, and/or specification of the actual Prize.

4.4. The Organiser shall not be liable to compensate and/or rectify any defect or other faults in the Prizes. You shall contact and refer to the supplier, manufacturer, distributor and/or reseller of the Prizes in the event that you have any queries, concerns, and issues regarding the Prizes.

4.5. Any decisions taken by the Organiser are final and binding on you. The Organiser shall not be obliged to entertain any queries, claims, requests or correspondences after the decision of the Organizer has been made.

4.6. You agree that the Prize is non-transferable, non-refundable, and nonexchangeable for cash without the Organizer’s express written consent. The Organizer reserves the right to substitute any Prize with that of a similar value by notifying you of the same.

5. INDEMNITY

5.1. You agree to hold harmless and indemnify us, our directors, our employees, our agents, our affiliates, and any other third parties facilitating the Contest from any losses and damages suffered by us as a result of your violation or breach of the Contest Terms.

6. PROMOTIONAL MATERIALS

6.1. You agree that the Organiser shall have the right to interview you, take photographs, and videos as well as use your personal details which shall include your name(s) for our marketing campaign materials for the purposes of advertising, trade and/or publicity in accordance to the Privacy clause above. You acknowledge that any interview results, photographs and videos shall be solely owned by us.

7. MISCELLANEOUS

7.1. Any representation of the Prizes shown in any advertisement and promotional materials are solely for illustration purpose and may defer from the actual prizes.

7.2. The Organiser reserves the right at its sole discretion to suspend, modify, extend, delay or terminate the Contest at any time without prior notice to you.

7.3. Any decisions taken by the Organiser are final and binding on you and the Organiser shall not be obliged to entertain any queries, claims, requests or correspondences after the decision of the Organizer has been made.

7.4. The Organiser shall have the absolute right to disqualify any individual that it determines to be tampering with and/or disrupting the operations of the Contest, and/or to be acting in breach or potential breach of this Contest Terms.

7.5. Any provisions applicable to the Contest which is prohibited or unenforceable under any law or regulation shall be ineffective to the extent of such illegality, voidness, prohibition or unenforceability without invalidating the remaining provisions.

8. DISCLOSURE

8.1. This Contest is in no way sponsored, endorsed or administered by, or associated with Meta Platforms, Inc (formerly known as Facebook Inc). The Organiser expressly excludes any losses, claims, and/or actions arising from any glitch, malfunction, shut down, and/or otherwise use arising specifically from Facebook, Instagram or any platform (whether or not derivative) from MetaPlatforms Inc.

B. SPECIFIC TERMS AND CONDITIONS THE CONTEST

The Contest Period The period shall commence from 15 August 2022 – 28 August 2022, 12:00 am (“The Contest Period”). The Organiser reserves the absolute right to extend or vary the Contest Period at its sole discretion. All entries received before and after the Contest Period shall be invalid and will not be entertained by the Organiser.

Eligibility & Participation

A) Any person who has fulfilled the criteria below and has abided by the steps in the contest mechanism below shall be eligible to participate in this Contest (“Participants”);

Criteria

I. The Participant shall be a resident of Malaysia; II. The Participant shall be aged 18 years and above; and The Participant’s Facebook and/or Instagram account shall be set as ‘Public’ wherein the Organizer and/or its appointed third parties is able to view the entries submitted by the Participant during The Contest Period.

B) Participants are allowed to submit multiple entries in accordance to the contest mechanism below. Notwithstanding the above, the Participants acknowledge and agree that are only eligible to win any of the Prizes (as defined below), once.

Contest Mechanism

i. The Participant shall visit and purchase any goods at any Watsons physical stores nationwide during The Contest Period;

ii. The Participant shall have created and submitted a creative photograph on its own Facebook and Instagram profile as a ‘post’ which shall include the Participant as a subject in the said photograph [Selfie or Wefie] with the Organizer’s “LBS SkyLake Residence” standee, wherein the standee shall be fully and clearly visible in the said photograph;

iii. The Participant shall submit the invoice/receipt unique number of its purchase of goods stated in (i) above in the provided google form (https://bit.ly/3bpxff6) which shall be made available to the Participant on the Organizer’s Facebook profile (“Submission Form”);

iv. The Participant shall or shall have “like”-d and “follow”-ed the Organiser’s Facebook (@LBSBinaGroup) and Instagram (@lbsbinagroup) social media platforms respectively and shall maintain the same throughout The Contest Period; and

v. The Participant shall tag three (3) unique profiles that they are connected to on Facebook/Instagram in the caption of the Participant’s entry as stated in item (ii) above, include the hashtags [#LBSBinaGroup; #LBSBinaContest; #WatsonsXLBS #Watsonsclub12 ] in the said entry, and comment “I’M DONE” in the comment section of the Organizer’s Facebook and Instagram posting.

vi. The Organizer shall designate two hundred (200) entries submitted by the Participants as the winners of the Prizes as further detailed in the Prizes section below.

Prizes

I. The prizes shall consist of;

The Organizer shall announce the winners of the Contest on 1 September 2022 or any other date as notified by the Organizer to the general public (“Winner Announcement Date”).

Prizes Redemption Details

(1) The Prizes will be emailed to the winners within fourteen(14) business days from the “Winner Announcement Date” to the email provided by the winners in the Submission Form and the winners shall acknowledge the email sent by the Organizer accepting the Prizes.

(2) Prizes must be acknowledged by the Participants within 30 days after receiving the email from the Organizer or it will be forfeited.

DISQUALIFICATION

The Organizer reserves the right to disqualify any submissions in the abovementioned terms and conditions in the event that; the submission of any photograph(s) are blur, unclear, and/or containing inappropriate content, including but not limited to vulgarity, obscenity, lewd, pornographic or violent material, or materials which promote violence or which disparages the Organizer or any other person or entity, or contain trademarked or copyrighted material.