2023 Chinese New Year Wish from Tan Sri Lim Hock San

Mannju

on

January 20, 2023

Here’s a special wish from our Executive Chairman, Tan Sri Lim Hock San,

May this CNY Festive bring in your life the goodness of peace and happiness.

Happy Chinese New Year from LBS Bina Group Berhad.

———————————————————————————————–

Facebook: https://bit.ly/LBSBina_Facebook

Instagram: https://bit.ly/InstagramLBSBina

Twitter: https://bit.ly/twitterLBSBina

Linkedin: https://bit.ly/LinkedInLBSBina

Visit our website here: https://bit.ly/WebsiteLBSBina

Vox Pop : It is bad luck to wash hair on CNY Day! [2023 CNY]

Mannju

on

January 20, 2023

Due to Malaysia’s rich and diverse culture, the Lunar New Year is celebrated immediately following Christmas and New Year’s celebrations.

The to-do list includes red packets, spring cleaning, and shopping.

Since the Spring Festival and the new year are just getting started, whatever you do at that time is thought to affect your luck for the upcoming year.

So how well-versed are you with Chinese New Year? Here’s a few fun facts about Chinese New Year that you should definitely know!🎋

———————————————————————————————–

Facebook: https://bit.ly/LBSBina_Facebook

Instagram: https://bit.ly/InstagramLBSBina

Twitter: https://bit.ly/twitterLBSBina

Linkedin: https://bit.ly/LinkedInLBSBina

Visit our website here: https://bit.ly/WebsiteLBSBina

Do drop some comments on your thoughts and maybe some interesting topics we can look into!

Vox Pop Sustainability : How much do you know about Corporate Sustainability?

Mannju

on

January 13, 2023

like ours can create long-term value by operating in an ecological, social, and economic environment.

In Episode 2 of VoxPop Sustainability, Andrea will be bringing us to explore what exactly is The Corporate Perspective of Sustainability!I

Find out more at: https://lbs.com.my/sustainability/

———————————————————————————————–

Facebook: https://bit.ly/LBSBina_Facebook

Instagram: https://bit.ly/InstagramLBSBina

Twitter: https://bit.ly/twitterLBSBina

Linkedin: https://bit.ly/LinkedInLBSBina

Visit our website here: https://bit.ly/WebsiteLBSBina

Do drop some comments on your thoughts and maybe some interesting topics we can look into!

LBS Home Makeover with Goodnite

Mannju

on

January 3, 2023

Moving into a new home can be one of life’s greatest joys, the journey only gets more exciting when it comes to decorating.

We are excited for the special collaboration between LBS & Goodnite on the ‘LBS Home Makeover with Goodnite’ Campaign where LBS homeowners stand an exclusive opportunity to win a Goodnite home makeover!

Win a makeover worth RM150,000 for your LBS property by following these simple steps:

Step 1: Own and stay in LBS Homes

Step 2: Upload photos of either your living room, dining room or bedroom that needs a makeover to http://homemakeover.lbs.com.my

Step 3: Complete this slogan, “I want to win #LBSGoodnite Home Makeover because..”(not more than 300 words)

Step 4: Like and follow LBS Bina’s Facebook and Instagram pages.

The campaign starts from 3 Jan – 30 April 2023.

Visit http://homemakeover.lbs.com.my for more info.

*Terms & Conditions apply.

#LBSHomeMakeOver #LBSxGoodniteHomeMakeOver

Subscribe And Win Contest

Mannju

on

December 6, 2022

Subscribe & Win Giveaway (“Giveaway”)

The Giveaway is organised by LBS Bina Group Berhad (hereinafterbe referred to as “the Organiser”). By participating in the Giveaway, you agree to be bound by the following terms and conditions as stipulated herein (consisting of the General Terms and Conditions and the Specific Terms and Conditions) between you and the Organiser (“Giveaway Terms”). By participating in this Giveaway, you are deemed to have read and agree to the Giveaway Terms herein mentioned. You agree that the Organiser may include additional terms to and/or vary the Giveaway Terms at our sole discretion at any point of time and any additional and/or variation of the terms shall be incorporated by reference immediately at the point of time in which it is implemented. You are advised to visit this page from time to time to be updated of the latest Giveaway Terms.

In the event of any inconsistency between any terms and conditions stipulated in any of the Organiser’s marketing brochures, leaflets, buntings, or otherwise any other platforms and the Giveaway Terms stipulated herein, the latest Giveaway Terms shall prevail.

A. GENERAL TERMS & CONDITIONS

CAPACITY AND REPRESENTATION

- To be eligible to participate in the Giveaway, you must be aged eighteen (18) and above in Malaysia or have attained an age of majority in the jurisdiction in which you are domiciled to enter legally binding contracts.

- You acknowledge and agree that all information provided by you which will be relied upon by the Organiser is true, accurate, and not misleading. The Organiser reserves the right to request for more information from you in the event the information provided by you is deemed insufficient failure by which may result in your disqualification from the Giveaway.

- By participating or entering this Giveaway, you are not violating any constitutive documents, applicable law, policies, regulation, rules, other terms, and conditions, and/or contracts that you have entered, agreed, or bound into with any third parties in any jurisdiction.You further acknowledge that we will rely on any information provided by you and that any false, inaccurate, and/or misleading information may cause losses and damages to us. You agree to hold harmless and indemnify us, our directors, our employees, our agents, our affiliates, and any other third parties facilitating the Giveaway from the losses and damages suffered as a result of the false, inaccurate and/or misleading information provided by you. Additionally, we shall not be liable for any false, inaccurate and/or misleading information provided by you in relation to this Giveaway whatsoever.

- You shall not use the Giveaway as a means or manner to facilitate or promote any illegal, immoral, violence, hate speech, racially disparaging, defamatory and/or fraudulent content (hereinafter be referred to as “Refrained Content”) wherein any evidence of such Refrained Content occurring out of this Giveaway, the Organiser shall not be made responsible whatsoever and you will be subjected to a disqualification by the Organiser

- You will comply with all applicable laws, by-laws, rules, regulations, policies, instructions, directions, orders and/or directives from the Organiser, any governmental organization, and/or relevant authorities.

PRIVACY

- All information provided by you shall be collected, stored, used, and retained by the Organiser in accordance with its Personal Data Protection Act Notice. You are to read, acknowledge and accept the Organiser’s Personal Data Protection Act Notice which is incorporated by reference herein and can be found at https://lbs.com.my

TAX AND DISBURSEMENTS FEES

- You shall bear all expenses including but not limited to transportation, personal expenses, insurance, stamp duties, transfer fees, taxes, any other duties and/or any other costs, fees and/or related expenses incurred pertaining to the Prize (hereinafter defined).

- You shall be solely responsible to declare your Prize winnings with the relevant tax authorities and pay for any levy, duty, charges, and tax that is imposed (if any). The Organiser shall not in any way be held liable to pay any charges, tax, levy, fines and/or duty that are imposed on the winners by the relevant tax authorities for the Prize winnings.

PRIZES

- The Organiser shall not assume any liability and responsibility whatsoever in the event of any mishaps, injuries, damages, death, claims and/or accidents suffered by your participation in the Giveaway and/or from the use of the Prizes.

- You shall hold the Organiser harmless against any liability and claims and agree to indemnify the Organiser completely for any claims, damages, losses, and liability arising from and/or in relation to your use of the Prizes.

- You agree and acknowledge that the Organiser provides no representation or warranty of any kind whatsoever in respect of any defect or other faults in relation to the Prize, and that the Prize displayed in any marketing or promotional materials are for illustration purposes only which may not depict the actual color, material, model, and/or specification of the actual Prize.

- The Organiser shall not be liable to compensate and/or rectify any defect or other faults in the Prizes. You shall contact and refer to the supplier, manufacturer, distributor and/or reseller of the Prizes in the event that you have any queries, concerns, and issues regarding the Prizes.

- You agree that the Prize is non-transferable, non-refundable, non-exchangeable for cash without the Organizer’s express written consent. The Organizer reserves the right to substitute any Prize with that of a similar value without prior notice to you.

INDEMNITY

- You agree to indemnify and keep indemnified the Organiser, its directors, employees, agents, affiliates, and any other third parties facilitating the Giveaway against all liabilities, losses, damages, and expenses which the Organiser may incur or suffer as a result of or in connection with and any breach and violation of Giveaway Terms herein or any representation or warranty given by you.

MISCELLANEOUS

- The Organiser reserves the right at its sole discretion to suspend, modify, extend, delay, or terminate the Giveaway at any time without prior notice to you.

- Any decisions taken by the Organiser are final and binding on you and the Organiser shall not be obliged to entertain any queries, claims, requests, or correspondences after the decision of the Organizer has been made.

- The Organiser shall have the absolute right to disqualify any individual that it determines to be tampering with and/or disrupting the operations of the Giveaway, and/or to be acting in breach or potential breach of these Giveaway Terms.

- Any provisions applicable to this Giveaway which is prohibited or unenforceable under any law or regulation shall be ineffective to the extent of such illegality, voidness, prohibition, or unenforceability without invalidating the remaining provisions.

DISCLOSURE

- This Giveaway is in no way sponsored, endorsed, or administered by, or associated with Google Inc. The Organisers expressly excludes any losses, claims, and/or actions arising from any glitch, malfunction, shut down, and/or otherwise use arising specifically from YouTube or any platform (whether derivative) from YouTube.

B. SPECIFIC TERMS AND CONDITIONS

Giveaway Period

The Giveaway period shall commence from 2 December 2022 and ends on 31 December 2022 at11:59 PM (“Giveaway Period”). The Organiser in its sole discretion reserves the right to extend or vary the Giveaway Period. All entries received before or after the Giveaway Period shall be invalid and will not be entertained.

Notwithstanding the above, the Organiser in its sole discretion, may extend the Giveaway Period by providing notice in a platform of their choosing (“Extended Giveaway Period”).

Method of Participation

To participate in the Giveaway,

(1) The participant must have an existing Youtube account that has been created for a duration of three (3) months prior to the commencement of the Giveaway.

(2) The participant must subscribe and remain subscribed to the LBS Bina Group channel on YouTube hyperlinked as follows (https://www.youtube.com/c/LBSBinaGroupOfficial/featured – LBS Bina Group);

(3) The participant must comment on the Giveaway video featured on LBS Bina Group’s YouTube channel (“Channel”) pertaining to the Giveaway and name three (3) other preferred or favourite videos from the Channel including the reasons for such selection.

Only One (1) entry is allowed for each participant.

Giveaway Visual / Posting

Prizes

Watsons e-vouchers (worth RM50.00 each) (“E-Vouchers”)

Announcement of Winners

- Ten (10) participants with the highest number of likes on their comment will win a Watsons e-voucher worth RM50.00 each.

- The winner will be selected by the Organiser on the 12 January 2023 and/or any other date of the Organiser’s choosing after the Giveaway Period ends via a reply to the comment submitted by the participant (“Reply Comment”).

- In the event there is an Extended Giveaway Period, an additional ten (10) participants with the highest number of likes on their comment (excluding the first ten participants aforementioned) will be selected as winners of Watsons e-vouchers worth RM50.00 each.

Prize Redemption Details

- The winner upon being selected, shall provide their contact details including but not limited to their email address as a reply to the Reply Comment for the Organiser to correspond with the winner accordingly wherein the said correspondence(s) may include further instructions for the successful redemption of the Vouchers.

- The Organiser will not be held responsible and reserves the right to forfeit the E-Vouchers or assign the E-Vouchers to another participant should the initial winner(s) fail and/or neglects to provide the required details within stipulated time frame in the Reply Comment and/or to comply with the instructions of the Organizer.

- The E-Vouchers will be emailed to the winners of the Giveaway within 7 working days after the contact details of the winner is provided to the Organiser.

DISQUALIFICATION

The Organizer reserves the right to disqualify;

(a) any submissions as stated above in the event that; the submission of any comment(s), photo(s), screenshot(s) and/or image(s) relevant are manipulated, blur, unclear, and/or containing inappropriate content, including but not limited to vulgarity, obscenity, lewd, pornographic or violent material, or materials which promote violence or which disparages the Organizer or any other person or entity, or contain trademarked or copyrighted material;

(b) Any entry which the Organiser considers to have been made in breach of this Giveaway terms and conditions.

(c) any submissions from any Youtube accounts intended and/or discovered to be proxy accounts from another Youtube account and/or otherwise discovered that it originates from a single participant.

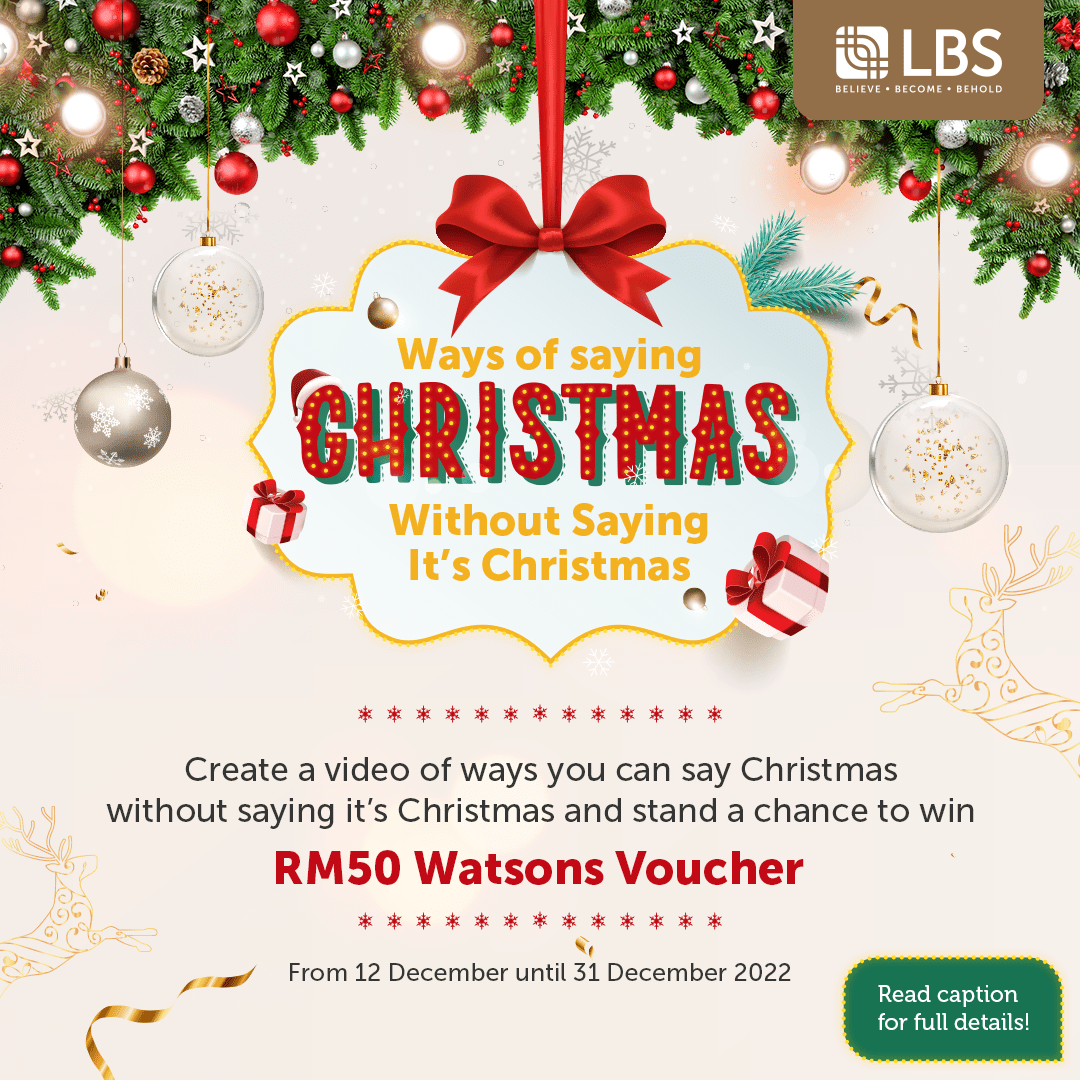

Saying Christmas Without Saying It’s Christmas Contest

Mannju

on

December 6, 2022

Ways of Saying Christmas Without Saying it’s Christmas (“Contest”)

The Contest is organised by LBS Bina Group Berhad (hereinafter known as “the Organiser”). By participating in the Contest, you agree to be bound by the following terms and conditions as stipulated herein (consisting of the General Terms and Conditions and the Specific Terms and Conditions) between you and the Organiser (“Contest Terms”). By participating in this Contest, you are deemed to have read and agree to the Contest Terms herein mentioned. You agree that the Organiser may include additional terms to and/or vary the Contest Terms at our sole discretion at any point of time and any additional and/or variation of the terms shall be incorporated by reference immediately at the point of time in which it is implemented. You are advised to visit this page from time to time to be updated of the latest Contest Terms.

In the event of any inconsistency between any terms and conditions stipulated in any of the Organiser’s marketing brochures, leaflets, buntings, or otherwise any other platforms and the Contest Terms stipulated herein, the latest Contest Terms shall prevail.

A. GENERAL TERMS & CONDITIONS

CAPACITY AND REPRESENTATION

● To participate in the Contest, you must be aged eighteen (18) and above in Malaysia or have attained an age of majority in the jurisdiction in which you are domiciled to enter legally binding contracts.

● You acknowledge and agree that all information made by you is true, accurate, and not misleading. We reserve the right to request for more information from you in the event we deem that the information provided by you is insufficient. Kindly note that failure by you to provide us true and accurate information may result in your disqualification from the Contest.

● You further acknowledge that we will rely on any information provided by you and that any false, inaccurate, and/or misleading information may cause losses and damages to us. You agree to hold harmless and indemnify us, our directors, our employees, our agents, our affiliates, and any other third parties facilitating the Contest from the losses and damages suffered as a result of the false, inaccurate and/or misleading information provided by you.

● You shall not use the Contest as a means or manner to facilitate any illegal and/or fraudulent transactions.

● You will not, by participation or entrance of this Contest, violate any other terms and conditions, policies, and guidelines, and/or contracts that you have agreed to.

● You will comply with all applicable laws, by-laws, rules, regulations, policies, instructions, directions, orders and/or directives from us, any governmental organization, and/or relevant authorities.

PRIVACY

● All information provided by you shall be collected, stored, used, and retained by us in accordance with our Personal Data Protection Act Notice. You are to read, acknowledge and accept our Personal Data Protection Act Notice which is incorporated by reference herein and can be found at https://lbs.com.my

TAX AND DISBURSEMENTS FEES

● You shall bear all expenses including but not limited to transportation, personal expenses, insurance, stamp duties, transfer fees, taxes, any other duties and/or any other costs, fees and/or related expenses incurred pertaining to the Prize (hereinafter defined).

● You shall be solely responsible to declare your Prize winnings with the relevant tax authorities and pay for any levy, duty, charges, and tax that is imposed (if any). The Organiser shall not in any way be held liable to pay any charges, tax, levy, fines and/or duty that are imposed on the Winners by the relevant tax authorities for the Prize winnings.

PRIZES

● The Organiser shall not assume any liability and responsibility whatsoever in the event of any mishaps, injuries, damages, death, claims and/or accidents suffered by your participation in the Contest and/or from the use of the Prizes.

You shall not hold the Organiser harmless against any liability and claims and agree to indemnify the Organiser completely for any claims, damages, losses, and liability arising from and/or in relation to your use of the Prizes.

● You agree and acknowledge that the Organiser provides no representation or warranty of any kind whatsoever in respect of any defect or other faults in relation to the Prize, and that the Prize displayed in any marketing or promotional materials are for illustration purposes only which may not depict the actual color, material, model, and/or specification of the actual Prize.

● The Organiser shall not be liable to compensate and/or rectify any defect or other faults in the Prizes. You shall contact and refer to the supplier, manufacturer, distributor and/or reseller of the Prizes in the event that you have any queries, concerns, and issues regarding the Prizes.

● Any decisions taken by the Organiser are final and binding on you. The Organiser shall not be obliged to entertain any queries, claims, requests, or correspondences after the decision of the Organizer has been made.

● You agree that the Prize is non-transferable, non-refundable, non-exchangeable for cash without the Organizer’s express written consent. The Organizer reserves the right to substitute any Prize with that of a similar value without prior notice to you.

INDEMNITY

You agree to hold harmless and indemnify us, our directors, our employees, our agents, our affiliates, and any other third parties facilitating the Contest from any losses and damages suffered by us as a result of your violation or breach of the Contest Terms.

MISCELLANEOUS

1. The Organiser reserves the right at its sole discretion to suspend, modify, extend, delay, or terminate the Contest at any time without prior notice to you.

2. Any decisions taken by the Organiser are final and binding on you and the Organiser shall not be obliged to entertain any queries, claims, requests, or correspondences after the decision of the Organizer has been made.

3. The Organiser shall have the absolute right to disqualify any individual that it determines to be tampering with and/or disrupting the operations of the Contest, and/or to be acting in breach or potential breach of these Contest Terms.

4. Any provisions applicable to this Contest which is prohibited or unenforceable under any law or regulation shall be ineffective to the extent of such illegality, voidness, prohibition, or unenforceability without invalidating the remaining provisions.

DISCLOSURE

● This Contest is in no way sponsored, endorsed, or administered by, or associated with Meta Inc. The Organisers expressly excludes any losses, claims, and/or actions arising from any glitch, malfunction, shut down, and/or otherwise use arising specifically from YouTube or any platform (whether derivative) from Facebook.

B. SPECIFIC TERMS AND CONDITIONS

5) “Ways of Saying Christmas Without Saying it’s Christmas” Video Contest

Contest Period

The “Ways of Saying Christmas Without Saying it’s Christmas” Video Contest period shall commence from 12 December 2022 – 31 December 2022, 11:59 PM (“Contest Period”). The Organiser reserves the absolute right to extend or vary the Contest Period in its sole discretion. All entries received before or after the Contest Period shall be invalid and will not be entertained.

“Ways of Saying Christmas Without Saying it’s Christmas” Video Contest

To participate in the Contest, participants shall have their personal Facebook or Instagram account and shall perform the following;

(1) Participants must follow and remain as a follower to the LBS Bina Group Facebook & Instagram throughout the Contest Period.

(https://www.facebook.com/LBSBinaGroup – Facebook

https://www.instagram.com/lbsbinagroup/ – Instagram)

(2) Participants must create a ‘reel’ (video) using Facebook or Instagram (“Video”). The participants shall showcase that the theme of the Video is in relation to the Christmas festive celebration creatively.

(3) The duration of the Video shall be from 15 seconds to 45 seconds and the participants are encouraged to creatively edit the Video. For the avoidance of doubt, the participants shall not include any element of religious artefacts, innuendos, and/or themes in their Video.

(4) The Video shall be shared on their personal and active Facebook OR Instagram handle and shall Include the following Hashtags;

i) #SayChristmasWithLBS; and

ii) #LBSBina

(5) The Participants shall tag LBS Bina Group’s Instagram or Facebook handles as described above in their Video submission.

(6) The participants may only include one (1) Video submission for the purposes of this Contest.

Contest Visual / Posting

Prizes

The top 5 participants with highest views and ‘likes’ on their Video will win a Watsons Voucher worth RM50 each. (“E-Vouchers”).

Prize Redemption Details

The winners of the contest will be contacted by the Organiser and/or representative of the Organiser through the ‘direct message’ function on Facebook or Instagram, wherein the winners will be required to provide personal details to the Organiser and/or representative of the Organiser for the purposes of the provision of the E-Vouchers. Subject to the foregoing, the E-Vouchers will be emailed to the winners of the “Ways of Saying Christmas Without Saying it’s Christmas” Video Contest within 7 working days after the winners have been announced.

DISQUALIFICATION

The Organizer reserves the right to disqualify any submissions in the above mentioned terms and conditions in the event that; the submission of any photo(s), screenshot(s) and/or image(s) relevant are manipulated, blur, unclear, and/or containing inappropriate content, including but not limited to vulgarity, obscenity, lewd, pornographic or violent material, or materials which promote violence or which disparages the Organizer or any other person or entity, or contain trademarked or copyrighted material.

Vox Pop : LBS Jejak Jaguh 2022 (Official Video)

Mannju

on

December 1, 2022

Fire up your football fever and get to know our LBS Star within our communities. ⚽

Huffing A Breath Of Newness Into Brinchang, Cameron Highlands

Mannju

on

December 1, 2022

Planning a weekend getaway with your loved ones? Or just to relax while sipping on your favourite cup of latte, simply enjoying the cold breeze on the top of the hillside, with a twist of modernity? Start your engine and let’s go!

Located at approximately 5,000 feet above sea level, Cameron Highlands, Pahang is a highly-visited holiday spot where tourists from all around the world come to experience a serene and peaceful get-away from the hustle and bustle of the city. Over the years, famous tourist attractions include tea plantations, fresh fruits and vegetables farmlands, gardens and nurseries, and of course hotels and resorts. Cameron Highlands is easily accessible by car via two routes – Simpang Pulai and the original road through Tapah. The Tapah road is great for travellers who want to enjoy the great view of scenery where you can take a quick stop at the Lata Iskandar Waterfall for a picture or two.

To give Cameron Highlands a breath of newness, the latest attraction, Cameron Centrum is brought here to offer a whole new commercial experience to the locals as well as tourists. The new English Tudor-style development suited to the cool climate in Cameron Highlands of 22 to 25 degree Celsius during the day and 15 to 22 degree Celsius at night is also very promising to give its customers a feeling of being abroad. Cameron Centrum is located close to many famous tourist sites and attractions in Cameron Highlands, making it very accessible and convenient for its tourists. It is an establishment that currently consists of shoplots, with hotels and residential buildings in the near future. This is definitely a haven for shopping and sightseeing with breathtaking views of the natural surroundings. Another most recent tourist attraction in Cameron Highlands is a new floral park that has recently opened in November. Located in Kea Farm, Cameron Flora Park, is a visual treat for the eyes, and is definitely a picturesque spot that is perfect for those who love to take pictures for their Instagram. Walking into the Cameron Flora Park is like walking into a paradise of all kinds of colourful flowers featured in every corner of the garden. This is also a great spot for picnics – an all-girls’ picnic trip, family and friends’ picnic – you’ll find yourselves surrounded by the beauty of the floral garden, not to mention the floral scent that you’ll be sniffing throughout! Be sure to stop by Cameron Flora Park the next time you make a trip to Cameron Highlands.

In the past, tourists came to Cameron Highlands for a more laid-back environment with mostly natural surroundings, but recently, since the inception of Cameron Centrum, tourists can now enjoy nature with a modern twist. Major brand names can now be found at the property, such as Family Mart, MarryBrown, McDonald’s, Starbucks, Billion Shopping Centre, The Coffee Bean & Tea Leaf and Baskin-Robbins, just to name a few. A giant clock tower is located in the center of the shoplots, kind of giving the Big Ben feels for its visitors. If Big Ben sounds unfamiliar to you guys, Google up okay? For those who love taking photos for Instagram, Cameron Centrum is definitely voted for being Instagrammable! The Centrum is developed in a way that much of its Highlands’ character remains unchanged, where most of the English charms from its colonial past are still seen in the buildings. This is made so to preserve the historical value of the town, where it is almost like bringing their visitors to the nostalgic olden colonial days in a more modern setting. The vibrant lights, cool weather and English architecture of the building will give local tourists the little European atmosphere with a touch of magic right here at Cameron Centrum.

Visitors and locals can now enjoy an upgrade in nightlife actions at Cameron Centrum. On its own, Cameron Highlands is not a hotspot for tourists if they are looking for a wild nightlife, though there are spots that cater to night drinking like pubs and bars. More business establishments are coming to the Centrum, and this is a new opportunity opening up for locals, visitors, as well as business operators. Really, what can beat a night of sipping a cup of hot chocolate with your loved ones with the cold breeze slightly blowing in your face, with your hands against the cup to find warmth, while you savour each sip of your favourite drink? After all, life is to be celebrated!

Cameron Centrum is going to be very hard to miss in the town of Brinchang. With an open boulevard concept, Cameron Centrum is set to be a benchmark for style, elegance and urban modernity in the town. The development is created to cater to these modern-day requirements, master-planned to attract both local and foreign tourists for a contemporary, modern and trendy destination for work, play, food and drinks, retail and more. It will be an all-in-one establishment – trendy stays at hotels and residential areas, shops, while open spaces and nature complement the other, carefully and mindfully built to attract and retain tourists. For a weekend getaway with friends and family, Cameron Centrum is the perfect place and it does not matter if you are in Cameron Highlands for a breath of nature or for an Insta-worthy holiday treat.

As the year 2022 is coming to an end with the Christmas season near, a short holiday trip to Cameron Highlands sounds like the perfect plan for a family and friends gathering. The year end season also means that sales are in full swing, so now is the time for all of you to splurge and pamper yourselves with a little of something good this year (Everyone deserves a treat for themselves every now and then!) Taking a holiday in Cameron Highlands is actually quite affordable compared to other holiday spots in the country. Cheap and good food is easily accessible in Brinchang Town, and in an end-of-the-year rainy season, hot pot steamboat dinner is highly sought after by tourists. If you do go to Cameron Highlands, please remember to treat yourselves to a hot pot steamboat dinner to mark your holiday. If you’re feeling a bit expensive and are looking for something grander and more exquisite, go to Cameron Centrum for a fancy treat.