Stamp duty and legal fees calculation for SPA when buying a house in Malaysia

Despite what many people think, the cost involved when buying a house is not limited to the 10% down payment. Find out the 7 other costs homebuyers need to consider when owning a house including stamp duty fees, legal fees for the SPA and loan agreement as well as property valuation fees.

Hunting for a dream home is an experience that a first-time home buyer is not likely to forget. However, you might overlook certain critical elements in calculating the total expenditure of acquiring your home as many buyers are likely to focus only on the biggest expenditure involved – the property’s 10% down payment or deposit. You might be further enticed by promotions, discounts and rebates by developers.

However, there are other important costs in the home purchasing process that you need to factor in, especially towards the end of the transaction. These are variable, third-party fees that are often referred to as closing costs. Ignore them and you may risk financial setbacks and disappointment in realising your dreams of owning a home.

Below are a few significant closing costs that you need to include in your property budget planning:

1. Stamp duty fees

An unavoidable cost in real estate purchases, stamp duty is the tax placed on your property documents during the sale or transfer of the property – as specified under the First Schedule of Stamp Duty Act 1949. The sale or transfer of properties in Malaysia which are chargeable with stamp duty must be stamped within 30 days from the date of the execution (property transaction). The tax includes:

- stamp duty on the Sale and Purchase Agreements (SPA) of your property – this costs only RM10

- stamp duty on the instruments of transfer – Memorandum of Transfer (MOT) or Deed of Assignment (DOA). The stamp duty is calculated based on a tiered system as shown in the table below.

- stamp duty on your loan agreement – a flat rate of 0.5% of the total loan.

Latest stamp duty fees on the MOT or DOA

| Price Tier | Stamp Duty (% of property price) |

| First RM100,000 | 1% |

| Next RM400,000 (RM101,000 – RM500,000) | 2% |

| The following amount up to RM1 million (RM500,001 – RM 1 million) | 3% |

| Thereafter (> RM1 million) | 4% |

How is stamp duty calculated in Malaysia?

For instance, when purchasing a property which costs RM750,000, you will have to pay a total of:

{(First RM100,000 X 1%) + (Next RM400,000 X 2%) + (Remaining RM250,000 X 3%) } + 0.5% of loan amount (90% of RM750,000) + RM10 for stamp duty on SPA

= {RM1,000 + RM8,000 + RM7,500} + 0.5% X (RM675,000) + RM10

= RM16,500 + RM3,375 + RM10

=RM19,885

Payment of stamp duty for MOT

The Memorandum of Transfer or MOT has to be signed by a new property owner (strata or individual ownership) to transfer ownership of the property from the developer or old owner, for secondary or subsale properties. For an MOT to be valid, the document must be stamped and adjudicated at the Inland Revenue Board and stamp duty paid accordingly. This stamp duty will usually be paid by a law firm appointed by the homebuyer.

Payment of stamp duty can be now done online on the LHDN official website through the Stamp Assessment And Payment System or STAMPS.

Stamp Duty Exemptions in 2024

1) Stamp duty exemption for first time homebuyers

During the recent tabling of Budget 2024, the government announced that it first-homebuyers who purchase residential properties worth between RM500,001 to RM 1 million will enjoy a 75% stamp duty exemption up to 31 December 2023. This stamp duty holiday was increased from the 50% exemption announced in July 2022, under the Keluarga Malaysia Home Ownership Initiative or i-MILIKI.

Besides that, it was announced in end of 2020 that a full stamp duty exemption will be given to both instruments of transfer and loan agreement for the purchase of a first home worth not more than RM500,000 – the home can either be a new-launch or a subsale property:

To receive this exemption, the following criteria must be met:

- This exemption will be for a SPA that is completed between 1 January 2021 to 31 December 2025.

- It is only applicable to residential properties, excluding SOHO/SOFO/SOVO types, as well as serviced residences built for commercial use.

- First-time homebuyers must be Malaysian citizens.

- The buyer must not already own a residential property; if he/she has inherited a property or was given one (no matter if it’s an individual or joint ownership), then he/she is no longer eligible.

- The exemption is given at 2 stages of transfer, i.e. from the property developer to a qualifying financial institution/bank, and from the bank to the Malaysian citizen.

2) Stamp duty exemption for property transfer between family members

For the transfer of property by way of love and affection between parents and children, grandparents and grandchildren – Stamp duty on the instruments of transfer of property will be fully exempted, limited to the first RM1 million of the property’s value.

The remaining balance of the property’s value is subject to the existing stamp duty tier and a 50% remission is provided on the stamp duty imposed. This exemption applies for instruments of transfers executed from 1 April 2023 and is only applicable for Malaysian citizens.

3) Stamp duty exemption on abandoned housing projects

A stamp duty exemption also applies to instruments executed by a rescuing contractor or property developer on or after 1 January 2013 but not later than 31 December 2025. This is described as a contractor or a developer who is appointed or approved by the Minister of Housing and Local Government to carry on rehabilitation works for an abandoned project.

The instruments are loan agreements approved by the approved financier and instruments of transfer for the purpose of transferring a revived residential property in relation to the abandoned project.

2. Legal fees

Unless you have a legal background and possess some of the required expertise and knowledge, you are most likely to engage in legal assistance for your real estate purchase. Your appointed solicitor will prepare all the necessary documents and contracts to facilitate the transfer of the property.

The legal fees for preparation of the Sale and Purchase Agreement are calculated as a percentage of the purchase price, varying from 0.25% up to 1% depending on the value of the homes.

How are legal fees calculated in Malaysia?

The legal fee rates in Malaysia are as below:

| PRICE TIER | LEGAL FEE (% of property price) |

| First RM500,000 | 1% |

| Next 500,000 (RM500,001 – RM 1 million) | 0.8% |

| Following RM2,000,000 (RM1,000,001 – RM 3 million) | 0.7% |

| Next RM2,000,000 (RM3,000,001 – RM 5 million) | 0.6% |

| Thereafter (> RM 5 million) | 0.5% |

Say for instance you are purchasing a residential property which costs RM750,000, you will have to pay a total of:

(First RM500,000 X 1%) + (Next RM250,000 X 0.8%)

= RM5,000 + RM2,000

= RM7,000

Note that some developers may absorb the legal fees but you will always need to pay the stamp duty yourself as a buyer. Find out what a lawyer can do for you when buying a house in Malaysia.

3. Real Property Gains Tax (RPGT)

Beyond owning your own residential property, a first-time homebuyer should also look ahead to the possibility of eventually selling the property in the future.

This might be for a number of reasons – you might want to upgrade, leave the area for a new job, find a home better suited to your preference or just sell it to profit from capital growth when the market is booming. Regardless, disposing your home to a new buyer will entail paying real property gains tax (RPGT). RPGT is a form of Capital Gains Tax in Malaysia levied by the Inland Revenue (LHDN) and is chargeable upon profit made from the sale of your land or real property.

Having some knowledge of RPGT could help you sell your property at the right time and save you a lot of money!

RPGT exemption in 2022 and 2023

Under the recent Budget 2022, Finance Minister Tengku Zafrul announced that the government will no longer impose Real Property Gains Tax or RPGT for residential property disposals by individuals comprising Malaysian citizens and permanent residents starting from the sixth year. This means that the RPGT rate for property disposals in the 6th year and subsequent years of property ownership is to be reduced to 0%, effective from 1 Jan 2022.

RPGT rates effective from January 1, 2022

| RPGT Rates | Individuals (Citizens & PRs) | Individuals (Non- Citizens & Foreigners) | Companies |

| Disposal in 1st year | 30% | 30% | 30% |

| Disposal in 2nd year | 30% | 30% | 30% |

| Disposal in 3rd year | 30% | 30% | 30% |

| Disposal in 4th year | 20% | 30% | 20% |

| Disposal in 5th year | 15% | 30% | 15% |

| Disposal in 6th year & beyond | 0% (Reduced from 5%) | 10% | 10% |

Those who dispose of their home after less than 3 years will be still charged 30% RPGT; 20% in year 4 and 15% in year 5.

Bear in mind that there are other RPGT exemptions for the following conditions:

- An exemption of 10% of profits or RM10,000 per transaction for Malaysian citizens and permanent residents (whichever is higher) for these 2 scenarios:

1. If an asset is transferred as a gift by a donor who is a Malaysian citizen and the acquirers are either husband and wife, parent and children or grandparents and grandchildren. This exemption is not applicable for transfers between siblings.

2. Once-in-a-lifetime exemption on the chargeable gain on disposal of 1 private residence by a Malaysian citizen or Permanent Resident (PR).

- Homeowners who own low or medium-cost housing priced below RM200,000 are exempted from RPGT when disposing of their property.

4. Property agent fees

If you engage property or real estate agents, especially in securing residential property in the secondary market, their fees will be an additional cost on top of the price you pay for your home. Although most buyers nowadays are aware of this, there are some who do not factor agent fees into the total cost. This could be a setback, especially if you are on a tight budget.

The maximum fee chargeable on services provided by agents on the sale of any land and building is normally 3%, although many brokers and agents charge less than that on a case-to-case basis.

As a buyer, make sure that you negotiate and confirm your estate agent fees before officially engaging them to represent you in any property transactions. This will help when calculating your total cost in advance.

5. Property valuation fees

Unless you’re paying for the property in cash, you’re likely to be looking for a housing loan from banks to fund the purchase. Financial institutions will usually require a valuation of the property before approving the loan amount, and most banks will charge a fee for these valuations.

How are valuation fees calculated?

Similar to the legal fees, the valuation fee for real estate is usually borne by the buyer and is calculated as a percentage of the purchase price.

For first RM100,000.00 =0.25%

Next residue up to RM2 million = 0.2%

Next residue up to RM7 million = 0.167%

Next residue up to RM15 million = 0.125%

Next residue up to RM50 million = 0.10%

Factors which determine your property valuation

Understanding the factors which make a property more (or less) valuable will help to assist purchasing/investment decisions. Usually, a residential property’s valuation is impacted by the following:

Location

The value of a property is generally higher the nearer it is to the city centre. On the flip side, if the home is within the vicinity of something undesirable such as a cemetery, power stations or a waste disposal area – that could bring down the property’s value.

Accessibility and amenities

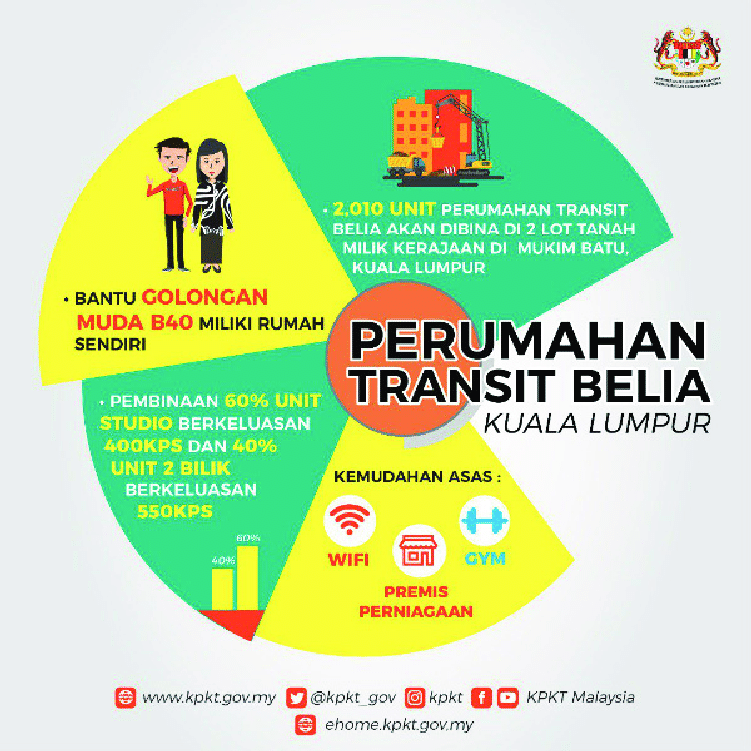

The value of a property is generally increased if it is near major highways, public transit nodes such as the MRT and LRT, and conveniences such as clinics and private hospitals, educational institutions, banks and shopping malls, as well as international or private schools.

Maintenance and renovations

This would apply for subsale properties – Valuers will take into account maintenance and renovation works done which enhance the livability and aesthetic value of the property.

Quality of construction

A building that is made of high-quality materials might hold together longer before having any issues, thus these will be valued higher. Homes that were constructed over a decade ago can still fetch a premium price due to the quality of the building materials, workmanship and structural design.

MORE: Is buying a home near the MRT3 circle line a smart move?

6. Home insurance

Most banks will require buyers to purchase insurance on their homes as part of the housing loan package to protect the value of the property. The common option includes:

Mortgage Reducing Term Assurance (MRTA)

MRTA is the most popular and economical option for property loan borrowers and is usually packaged as an option when applying for a home loan at a bank. It is a single premium group term life insurance that pays your outstanding home loan in event of your death or total permanent disability (TPD).

The costs of MRTA are dependent on the age of the borrower (usually the older the borrower, the higher the MRTA) and the total mortgage on the property (usually estimated at 3% to 5% of the total mortgage).

Mortgage Level Term Assurance (MLTA)

MLTA offers repayment of your outstanding home loan as well as a guaranteed cash value back at the end of the scheme. This cash benefit will help keep your family afloat in the event of your death or total permanent disability (TPD). Unlike the MRTA, anyone can be a beneficiary for an MLTA, the policy-holder can nominate any family member to receive the pay-out should something happen to him or her.

An MLTA’s sum assured remains constant or level throughout the policy’s tenure period. The most important thing about this mortgage insurance is that the insurance proceeds are credit-proof and will not be frozen.

Term Life insurance

This is the oldest and most common life insurance which offers your family (beneficiary) a lump sum payment (sum assured) in event of your death or TDP during your policy tenure (similar to MLTA).

However, the premium structure is akin to the MRTA but is more flexible as you and your loved ones will be protected as long as you pay the premium and it can be terminated at any point in time. Policy-holders can also extend the coverage by adding critical illness into the condition in return for a slightly higher premium.

READ: MLTA vs MRTA: Which mortgage life insurance to pick

7. Home renovations

For example, after you have completed the purchase of the house, you might want to change wall colours, doors, floorings, windows, fences, roofing, rooms and other elements of the house to suit your preferences. These could easily add up to your total costs, depending on whether the renovations involved are major or minor.

Here’s a tip: Most experts recommend not spending more than 10% of your home value on renovations. Check out our simple guide on how much does a home renovation cost in Malaysia?

Low credit score?

Low credit score?

Aside from home loan, you can

Aside from home loan, you can There are a few important

There are a few important  What is home loan refinancing?

What is home loan refinancing?